Bitcoin Price Prediction – March 13

Stable processions of price increases have continually been generated in the market activities of Bitcoin versus the valuation of the US Dollar, given that the trade is mooning, nurturing the momentum in a positive direction.

The current trade affairs have confirmed that the crypto economy is still headed for higher positions, so it would be a smart technical concept for long-position traders to try and identify optimal rising forces to leverage their means of entry. In the vein of keeping that sentiment alive, buyers should also be cautious about buying against an aggressive pull-down-moving force that may surface.

BTC/USD Market

Key Levels:

Resistance levels: $75,000, $77,500, $80,000

Support levels: $65,000, $62,500, $60,000

BTC/USD – Daily Chart

The BTC/USD daily chart showcases that the market is mooning steadily, nurturing the momentum through some higher points above the previous all-time high.

The upper Bollinger Band indicator has continued to move highly above the other trend lines. As it is, the middle Bollinger Band indicator has been seen to be the crucial support trade line against the validation of either regaining or losing more values in the event of a massive correctional pattern. The stochastic oscillators have moved southerly to get a re-cross positional posture to a crypto signal to the upside.

When will the US coin tendencies begin their views against Bitcoin, given that it is currently in a positive running cycle?

The American currency may be tending to re-affirm its valuation against the market-pushing forces of Bitcoin only when several rejections set up to garner at a given higher spot, given that the BTC/USD market is mooning presently, nurturing the momentum.

As the condition of the market is good, long-position placers should be cautious about making entries without spotting active price actions. Investors are believed to still find ways to increase points afterward.

It has been demonstrated that to get an ideal time for a decent shorting position order, a touch of price around the upper Bollinger Band trend line has to materialize with a reasonable reversal mode of price action before launching a short order position.

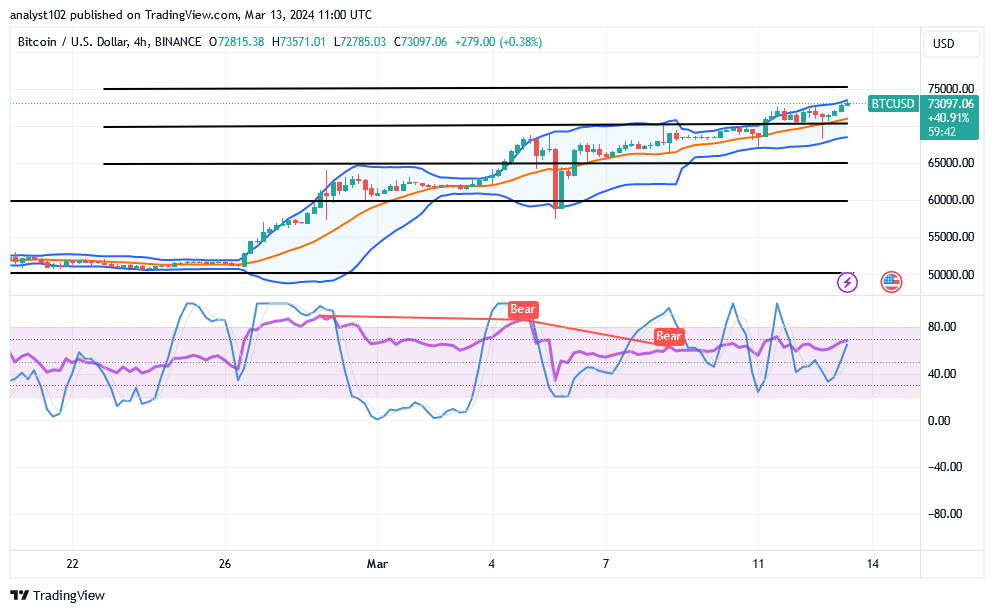

BTC/USD 4-hour Chart

The BTC/USD 4-hour chart showcases that the crypto trade is mooning, nurturing the momentum.

There have been moments when the stochastic oscillators have swerved erratically about variant points, producing an indecisive signal. The Bollinger Band trend lines have been able to extend somewhat to the north, emphasizing the area between the $70,000 and $75,000 marks. As a result, a sudden change in those values, either up or down, will signal future changes in either direction.

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK