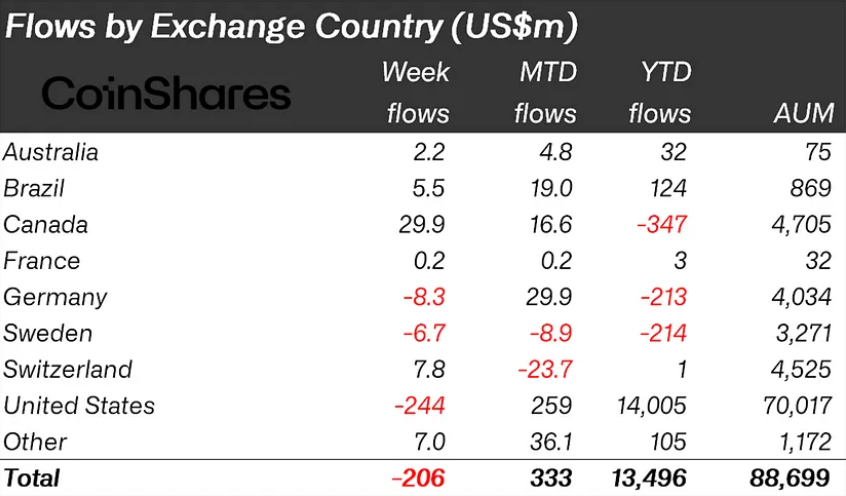

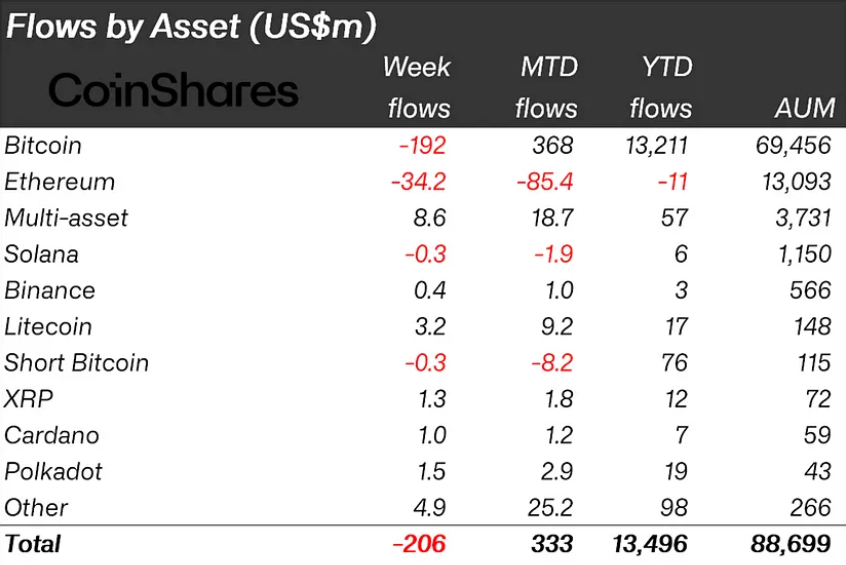

Crypto investment products have witnessed a second consecutive week of crypto outflows totaling $206 million, as reported by CoinShares. This decline coincides with a slight decrease in trading volumes of Exchange-Traded Products (ETPs), now スタンディング at $18 billion. Interestingly, these figures represent only 28% of total Bitcoin trading volumes, contrasting sharply with the 55% recorded just a month earlier.

Analysts attribute this waning interest among ETP and Exchange-Traded Fund (ETF) investors to the Federal リザーブ indication of maintaining current high-interest rates for an extended period.

US Records Notable Crypto Outflows: $244 Million Trickle Out of Bitcoin ETFs

In the United States, sentiment remains predominantly negative, with ETFs experiencing outflows of 244万ドル. Established ETFs have 殴られた hardest, while newly issued ETFs continue to attract capital, albeit at a slower pace compared to previous weeks. In contrast, Canada and Switzerland have seen inflows of $30 million and $8 million, respectively. Germany, however, reported minor outflows totaling $8 million.

ビットコイン、 主要な暗号通貨, も見た outflows, 総額は192億XNUMX万ドルに達します。 Surprisingly, this has not led to a significant increase in short-Bitcoin positions, with only a $0.3 million outflow from such positions. エテリアム、 on the other hand, has continued its six-week streak of outflows, 総額34億XNUMX万ドル。

There has been renewed interest in the altcoin sector, with inflows of $9 million last week. Litecoin & チェーンリンク have seen particularly significant inflows, with $3.2 million and $1.7 million, respectively.

Blockchain equities have faced pressure as well, marking their 11th consecutive week of outflows totaling $9 million. Concerns regarding the impact of the upcoming halving event on mining companies have contributed to investor apprehension.

Standard Chartered Maintains $150,000 Bitcoin Price 予想

Despite these challenges, Geoff Kendrick, head of digital assets research at Standard Chartered, remains optimistic about Bitcoin's prospects. He reaffirms the 銀行の ambitious price target of $150,000 for Bitcoin by year-end, citing the influx of capital into U.S. Bitcoin ETFs as a キー 要因。

U.S. Bitcoin ETFs have attracted approximately $12 billion in net inflows since their inception in early 2024. Speaking to BNN Bloomberg, Kendrick said:

“The ETF inflows in the U.S. have really dominated the demand-supply metrics so far in 2024. This is significant in terms of the ETFs’ performance to date.”

This report highlights the intricate relationship between investor sentiment, regulatory expectations, and market dynamics in the ever-evolving landscape of cryptocurrency investments.

暗号通貨市場を取引するとき、必ずしもそうする必要はありません "当たりハズレ。" 当社のプレミアムと同様に、実際に結果をもたらす取引でポートフォリオを保護します 暗号信号 電報で

暗号通貨のデイトレードの方法を学ぶことに興味がありますか? 必要な情報はすべてここで入手できます

MANAUSD experienced a significant drop in mid-April 2024, causing the price to slightly breach the $0.4250 demand level and taking out existing liquidity below. Following the liquidity being taken, the price formed a failed low, indicating a decrease in selling pressure, which could potentially lead to a rise in price.

MANAUSD experienced a significant drop in mid-April 2024, causing the price to slightly breach the $0.4250 demand level and taking out existing liquidity below. Following the liquidity being taken, the price formed a failed low, indicating a decrease in selling pressure, which could potentially lead to a rise in price.