D'Uniswap Foundation, d'Team hannert dem renomméierten dezentraliséierten Austausch (DEX) Uniswap, huet eng Propositioun enthüllt fir seng Gouvernance a Fraisekader ze verbesseren.

dëst Propositioun ass orientéiert fir méi aktiv an informéiert Participatioun vun UNI Tokenhalter ze encouragéieren, déi d'Autoritéit hunn fir iwwer d'Zukunft vum Projet ze stëmmen.

Ënnert der Propositioun sinn UNI-Halter, déi hir Tokens un e Wahlvertrieder delegéieren, berechtegt op en Undeel vun de Protokollfraisen, déi vun der DEX generéiert ginn. Dëst ass virgesinn fir UNI Inhaber ze stimuléieren fir Delegéiert ze wielen déi mat de beschten Interesse vum Protokoll a senge Benotzer ausgeriicht sinn.

Ausserdeem proposéiert d'Propositioun d'Reduktioun vum Quorum an d'Propositiounsschwellen, wat de Prozess fir d'Gemeinschaft rationaliséieren fir Gouvernance-Stëmmen ze initiéieren an ze passéieren. Dës Ännerungen, wéi et an der Propositioun steet, sollen "Gouvernance stimuléieren" a förderen e méi engagéierten an diversen Ökosystem.

Geplangt fir e Snapshot Vote den 1. Mäerz, gefollegt vun engem On-Chain Vote den 8. Mäerz, wäert d'Propositioun, wann guttgeheescht, an déi nächst Versioun vum Uniswap Protokoll integréiert ginn, v4, virgesinn fir am drëtten Trimester vun 2024 ze starten.

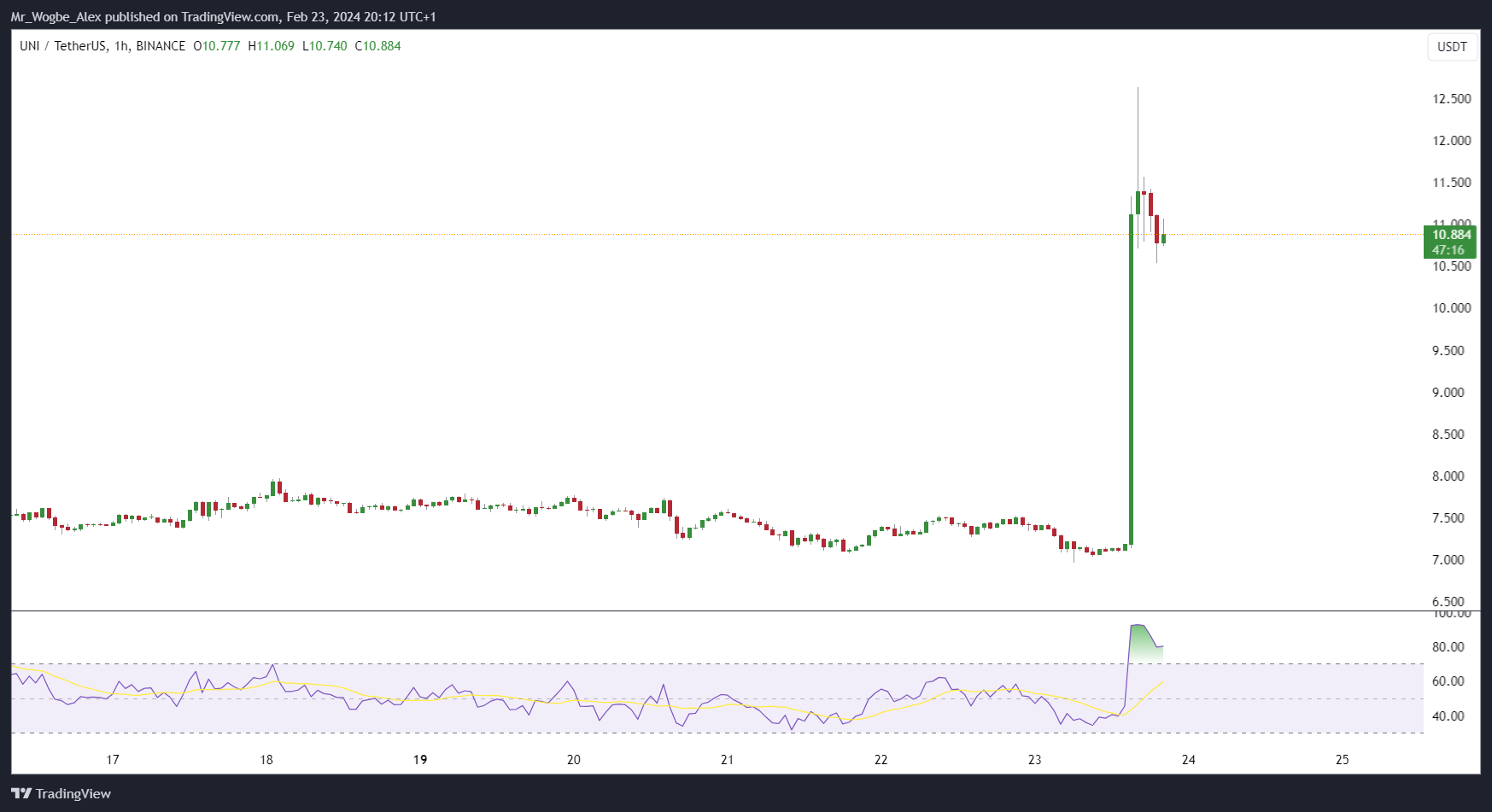

Uniswap spréngt ëm 70%, Records New Local High

Gläichzäiteg mat der Ukënnegung vun der Propositioun war e bemierkenswäerte Präisschlag fir UNI, den gebiertege Token vun uniswap, déi vun iwwer 70% vun $7.35 op $12.63 den 23. Februar geklommen ass, wat säin héchste Punkt zënter Januar 2022 markéiert.

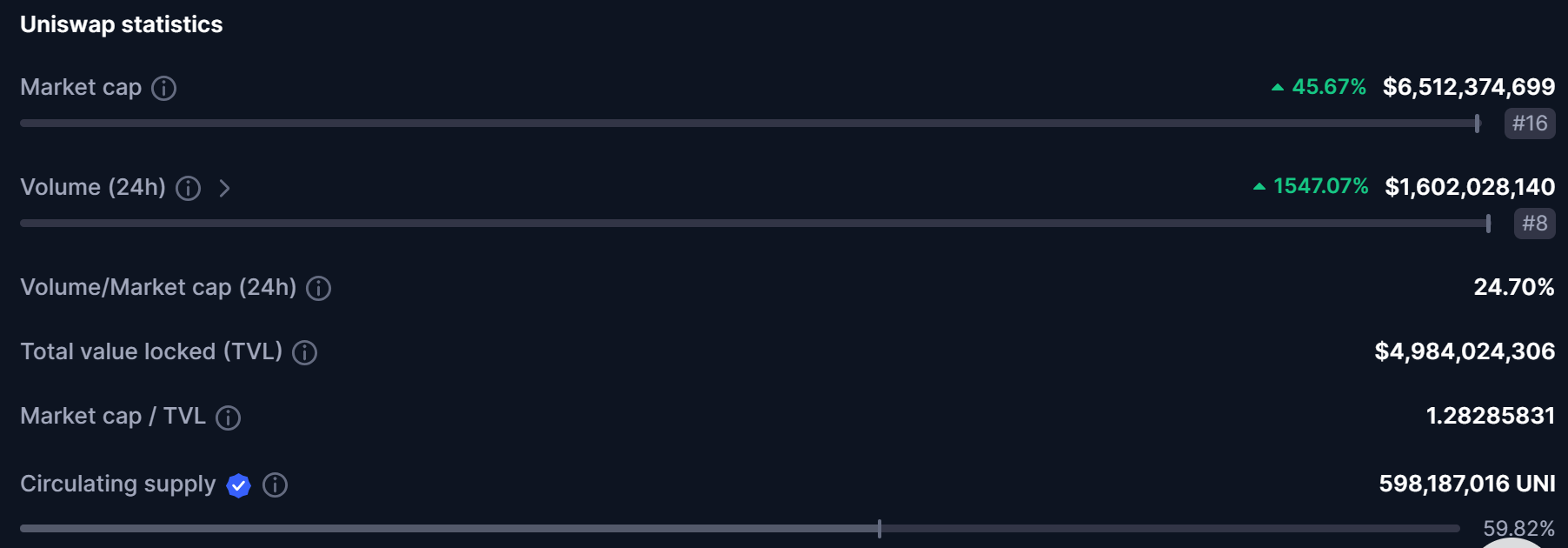

Trotz engem spéideren mëllen Réckgang, mam Krypto-Währungshandel ëm 50% an de leschten 24 Stonnen zum Zäitpunkt vun dësem Bericht, huet d'UN déi meescht vu senge Kollegen iwwerpréift.

Uniswap steet als de féierende DEX am Krypto-Domain, mat iwwer $4.9 Milliarden am Gesamtwäert gespaart (TVL) an iwwer 1.5 Milliarden Dollar am deegleche Handelsvolumen. D'Plattform erlaabt d'Benotzer all ERC-20 Token ouni Intermédiairen auszetauschen, andeems d'Liquiditéitspools vun de Benotzer selwer finanzéiert ginn.

Uniswap v3, déi aktuell Iteratioun vum Protokoll, huet d'Konzept vun der konzentréierter Liquiditéit agefouert, wat d'Liquiditéitsanbieter erlaabt méi héich Fraisen ze verdéngen andeems se Präisbereich fir hir Poole spezifizéieren.

Déi zukünfteg Uniswap v4 hänkt vun der erfollegräicher Implementatioun vun der Ethereum's Dencun haart Gabel, geplangt fir Mäerz. Den Dencun ass agestallt fir e puer Verbesserungen am Ethereum Netz aféieren, dorënner méi niddereg Gasfraisen, méi séier Transaktiounen a verstäerkte Sécherheet.

Elo datt de Start vun Dencun op Mainnet fir Mäerz 2024 geplangt ass, si mir opgereegt en Update fir d'Gemeinschaft ze bidden! 🎉

De Start vun Uniswap v4 ass virleefeg fir Q3 2024 gesat.

Vu Gemeinschaft gebaute Hooks (https://t.co/WyaGr1Ti1t), op Eventer, op Twitter Spaces, den ...

— Uniswap Foundation (@UniswapFND) Februar 15, 2024

Virun sengem Start wäert Uniswap v4 e ëmfaassende Sécherheetsaudit ënnerhuelen, fir d'Sécherheet an d'Zouverlässegkeet vum Protokoll ze garantéieren.

Interesséiert fir ze léieren wéi een Dag Krypto handelt? Kritt all Informatioun déi Dir braucht hei