Bitcoin Investors Wait in Anticipation Ahead of CPI and Fed Rate Decision

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The newest events in the macroeconomic landscape and the cryptocurrency market will have a significant impact on Bitcoin (BTC) investors’ sentiment this week. The Federal Reserve’s rate hike tomorrow and today’s US Consumer Price Index (CPI) data will determine the direction of the market for the ensuing weeks.

Bitcoin on the Rise Ahead of Data Release

Ahead of the November CPI inflation figures later today, Bitcoin’s price increased by over 2%, pushing the price above $17,000. The increase is supported by a bigger Monday gain in the US stock market.

Due to the FTX liquidity crisis, the October CPI reading of 7.7% instead of the anticipated 8% on November 10 had little impact on the price of cryptocurrencies. FTX and more than 130 affiliated companies, including Alameda Research, filed for Chapter 11 bankruptcy on November 11.

The November US CPI figures will be made public by the US Bureau of Labor Statistics. For the fifth consecutive month, the inflation rate is projected to decline to 7.3% in November from 7.7% in October, its lowest point since December 2021. Meanwhile, the Core CPI is predicted to decrease slightly from 6.3% in October to 6.1% in November.

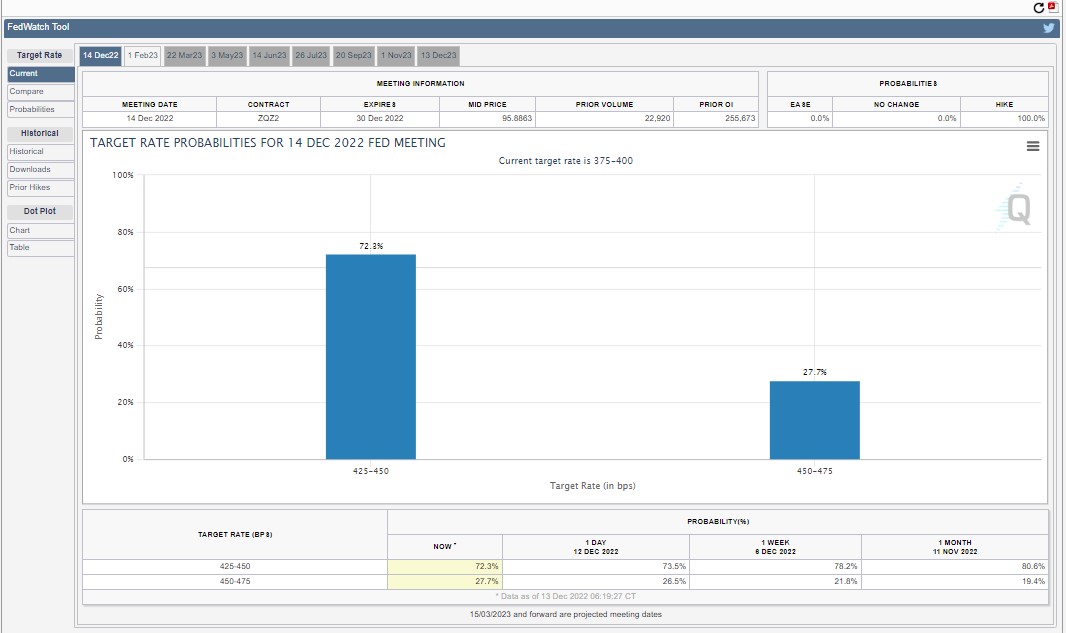

The Fed will announce its decision on a rate hike on December 14 following the FOMC meeting on December 13–14. The FOMC will also present its economic forecasts for the upcoming months. Previously, Fed Chair Jerome Powell suggested that rate increases in December and the following months would be more gradual than before.

At press time, the likelihood of a rate increase of 50 basis points is 72.3%, according to the CME FedWatch Tool. Wall Street anticipates the Fed to maintain its 50 basis point rate increase in November.

Finally, the CPI will influence the Fed’s decision to raise rates, and a rate hike of 75 basis points may also be considered. JPMorgan anticipates a CPI result between 7.2 and 7.4%, although a CPI reading below 6.9% YoY can signal the bottom of a bear market.

You can purchase Lucky Block here. Buy LBLOCK