Free Crypto Signals Channel

Best Ethereum Trading Signals 2024 – Ultimate Guide

If you are currently looking at becoming more successful at trading Ethereum, but unsure how to navigate or outperform the market – then signals might be exactly what you are looking for.

To break it down a little further, Ethereum signals are trading tips that can help you learn what orders are best to place with your chosen broker and when is the best time to place them.

Throughout this guide, we will explain how you can utilize our Ethereum signals to gain profit and success in the cryptocurrency trading market, without needing to perform any technical analysis.

What are Ethereum Trading Signals?

Ethereum signals can be best explained as trading suggestions that our in-house analysts will send you when a profitable opportunity may have been found. Our team will use their knowledge of technical analysis, which has been acquired over many years to make sure you have all the important information needed to execute a successful trade.

At cryptosignals.org, each signal should include five key data points, including a required limit price, take profit order price, and a stop-loss order price.

Here is an example of what you can expect of our signals when you sign up with us:

- Ethereum Pair: ETH/USD

- Long or Short Order: Long

- Limit Price: $1200

- Stop-Loss: $1000

- Take-Profit: $1500

What this example is showing us is that our analysts believe that the Ethereum pair ETH/USD (Ethereum/US dollar) will increase in the very near future. This would now suggest that you would go on to place a buy order with your broker.

It also shows us the recommended limit, stop-loss, and take-profit order price. This will be covered more in-depth further in this guide. After you have received your signal, it is then about heading over to your online broker and placing an order with all the figures and information that has been given by our experts.

What are the Benefits of Quality Ethereum Trading Signals?

There are various beneficial factors to take into account when signing up our quality Ethereum trading signals. All of which can offer you support on your long-term trading and investing journey.

Here is what we think a few of the core benefits are:

Expert Analysts

Our team of expert analysts and seasoned traders here at cryptosignals.org have spent years honing the craft of technical analysis. We do this by using a wide range of technical indicators (for example, the RSI, Moving Averages, MACD, and many more.)

This means we can perform fundamental research into cryptocurrency pricing and market trends. Simply put, by joining our quality Ethereum trading signals, you can have peace of mind that our experts are using their skill-set to research the market on your behalf.

Great for Inexperienced Traders

One of the largest benefits we like to offer at cryptosignals.org is a space where both experienced and non-experienced traders can fully explore all the advantages that our Ethereum trading signals have to offer.

One of the essential factors in gaining profit in the cryptocurrency trading market is the ability to perform technical analysis, on top of being able to read the necessary pricing charts.

These are skills that can take years to achieve, which is why signing up to cryptosignals.org is ideal for inexperienced traders. You have the ability to trade Ethereum in real-time without any prior knowledge of technical analysis or the cryptocurrency trading market.

Have Clear Entry and Exit Goals

Entry and exit strategies are a vital part of trading Ethereum (or any trading sector, for that matter). That is why when cryptosignals.org provides you with one of our Ethereum trading signals, it will always include a suitable entry and exit target.

This means there is no guesswork when it comes down to entering the market. Further information about how these are crucial to cryptosignals.org will be covered in more detail below.

In addition to entry and exit targets, we also provide what is known as a ‘take-profit’ and ‘stop-loss’ order price. These are strategies that ensure that your trade closes automatically when a price target is hit, or the position goes against us by a certain amount.

When you have placed your entry and exit orders with your chosen broker, there is nothing more to be done at this point.

Trade Within Your Budget

Establishing a budget to grow your trading capital can be crucial when learning and researching the market. This is why when our in-house team at cryptosignals.org sends you a new Ethereum trading signal, you can decide how much you would like to execute.

However, we will typically suggest risking no more than 1% of your total trading account. For example, if your trading account holds $1000 – the idea would be to allocate $10 (1%) to our signal. Likewise, if the account balance is $20,000 the suggested trade would be $200 (1%).

Naturally, the balance of your account will rise and fall throughout each month. In turn, the value of your trade will vary when based on the 1% percent rule. By using proper risk management, it can ensure you are steadily growing your trading capital.

How do our Ethereum Trading Signals Work?

The main premise of Ethereum trading signals (or any crypto signal) is that they are trading recommendations or tips. At CryptoSignal.org we believe the most reliable trading signals contain five important data points.

To give a clearer understanding of how our crypto signals work, we will break down each data point below.

Ethereum pair

The first key data point included in our Ethereum trading signals is the pair you need to trade. To further clarify, a “trading pair” or a “cryptocurrency pair” can be best defined as assets that can be traded for each other in exchange.

For example, if you were to trade Ethereum against Bitcoin – this would show as ETH/BTC. This is known as a crypto-cross pair as the pair contains two competing digital currencies. Or another example is a crypto-to-fiat pair like ETH/USD (Ethereum/ US dollars)

There are various popular digital assets that our in-house traders and analysts will research, including Ethereum, Bitcoin, Litecoin, and many more. By knowing which cryptocurrencies are best traded, this gives our team a firm grasp of which markets to target.

Something to keep in mind is that when signing up with your online broker it is best to choose a company that offers a wide range of markets.

We offer a few examples at cryptosignals.org.

Buy or Sell Position

Now that you know which Ethereum pair you should trade, you need to know what action to take regarding buying or selling. Our team’s main objective is to make a profit whether it be from rising or falling markets.

In our Ethereum trading signals, we will suggest going ‘long’ or ‘short’ on the pair in question. For example, If the signal tells you to go long, our analysts may think the Ethereum pair will increase over time.

We would then instruct you to place a ‘buy’ order with your chosen broker. Likewise, if we thought the Ethereum pair would decrease over time, we would instruct you to opt for a sell order. This would show on your Ethereum trading signal as a short-sell.

By receiving this key information, you do not need to guess which direction to move in the market.

Limit Price

The next three key data points go hand in hand when succeeding in online trading. Firstly, a limit price is an order that instructs your broker at which price you would like to enter the market.

Some key information regarding limit order is that a buy limit order can only be carried out at the suggested limit price or lower. An example of this could be, you may place a buy order on ETH/USD at $1,100.

Regardless of what the price the pair may be at, it will only be implemented by your chosen broker when $1,100 is matched by the current markets. Similar to the buy limit order, the sell limit order can only be carried out at the chosen limit price or higher.

All you have to do then is take our suggested entry price from our Ethereum trading signal, select your limit order and place your trade with your chosen broker.

Take-Profit Price

Our Ethereum trading signals always come with a suggested take-profit price to include when placing your trade. Put simply, a take-profit price is a type of order that will automatically close the open position when the specific price has been reached, this helps to maximize profits.

As we have mentioned above, here at cryptosignals.org, we set a clear and thorough RRR (the risk-reward ratio) with every Ethereum trading signal.

We aim for a 1:3 ratio which means for every $10 we would look for a profit of $30. This along with everything we have covered so far will assist in minimizing the risk of staking too much per trade, which in turn will help drive up the chances of higher profits.

Stop-Loss Price

The stop-loss price is the last key data point and potentially, one of the most important. When setting up a take-profit price order to help maximize profits, we also need to establish a stop-loss order to help limit losses on a position. Usually, our suggested stop-loss price amounts to a loss of no more than 1%.

Over the last 8 years, our in-house team of expert analysts has a long-standing record of creating consistent gains. It goes without saying that losses can happen within the cryptocurrency trading world, or for that matter any investing sector. That is why we always strive to send out a well-researched and practical stop-loss price.

Ethereum Signals Telegram Group

As the cryptocurrency market can be extremely fast-paced, it only made sense that we upgraded to a real-time and instant way of delivering your Ethereum trading signals. In previous years we sent our signals via email but it proved to be slow and had the potential of missing key trade opportunities.

On the contrary, Telegram ensures we have the opportunity to provide our members with Ethereum trading signals in real-time. This means that as soon as the trading signal is sent, it comes straight to you.

Telegram has a user-friendly interface, which means you can view the new signal notification with ease. In many cases, you can also see a chart or graph we have included to help you better understand the thought processes made by our in-house team.

Free Ethereum Trading Signals

After reading through all the information that we have given so far, we can imagine some of it may be daunting. This is why cryptosignals.org also offers free Ethereum trading signals.

We send out 3 free signals a week via our Telegram group mentioned above. The signals contain the same key data points that we give our premium plan members. For example, the stop-loss or take-profit price orders.

We want our potential subscribers to get a clear idea of how we work before committing financially. When you have a better feel of what Ethereum trading signals involve and are more confident in your abilities, you might then decide you want to take it up a level. That is where our premium plans may benefit you further.

Premium Ethereum Trading Signals

Allow us to break down exactly what our premium memberships involve, and why our existing members continue to subscribe to our Telegram group month after month. You will receive 3-5 Ethereum trading signals daily (Monday to Friday).

Additionally, you’ll receive our suggested limit, take-profit, and stop-loss price orders that our experts have analyzed for you. And, as mentioned above, most of our signals come with an explainer surrounding the technical analysis – so you learn while you trade.

Below we have included what our prices look like when billed monthly, quarterly, bi-annually, and annually:

If you are still wondering if the premium plan that cryptosignals.org offers is right for you, then our section below about how to implement a risk-free strategy might help you make your decision.

Ethereum Trading Signals – Risk-Free Strategy

Our risk-free money-back guarantee is a service we offer to all of our new subscribers. This is a 30-day time period to test our Ethereum trading signals along with our service. We often suggest running our signals through a brokerage demo account, to begin with. As a result, you can place our trading signals in a risk-free manner.

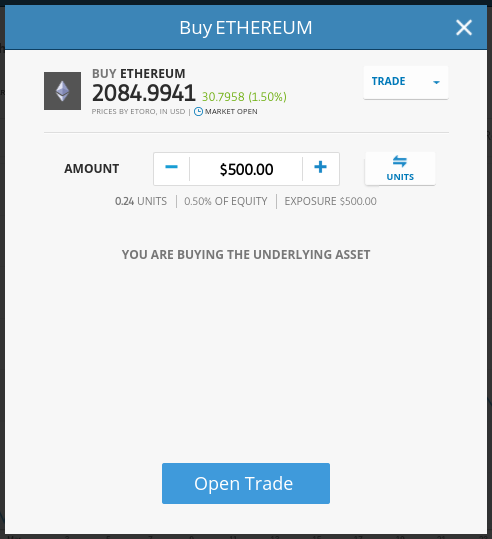

Here is a step by step guide to show you what you need to do:

- Choose an online broker that has a wide range of cryptocurrency markets.

- Once you have done this, you can open a demo account.

- Subscribe to a premium plan membership with cryptosignals.org

- Join our VIP Telegram group.

- When you receive your signal – go ahead and place our suggested orders with your chosen brokerage demo account.

- 2/3 weeks later, have a look at your results and see how much profit you have made.

If we have met your expectations and you would be happy to upgrade, we may suggest one of our longer plans to help get the best out of our monthly fees. On the other hand, you may want to enforce our money-back guarantee.

In this case, you would need to let us know within the 30-days of signing up and we will refund your subscription price in full. We do this to show our potential members that we are fully confident in the service we offer!

Choosing a Crypto Broker for the Best Ethereum Trading Signals

As mentioned earlier in the guide, choosing the correct crypto broker is crucial when it comes to taking full advantage of our Ethereum trading signals, After all, your chosen broker will be the one that places and executes all your orders for you – giving you in-depth knowledge and access to the Ethereum trading universe.

Fees and Commissions

There’s a variety of different fees and commissions involved in cryptocurrency trading. Crypto brokers can make money by charging any of these fees and commissions.

For example, you have Coinbase that charges 1.49% on each position you place.

This makes the online broker and our Ethereum trading signals well-suited for one another. As previously stated, our signals aim to target small gains, therefore you won’t need to worry about your profits being flattened by expensive trading fees.

One detail you will need to factor in is what is known as the ‘spread’. This refers to the difference between the buy and sell prices of the crypto pair you are trading. The spread can differ with each asset, product, or service but can be found on most brokerage sites.

Safety and Trust

Something to take into consideration when looking at brokers is if it is regulated and by which body. A great example of this is 8cap – as it is regulated by three financial bodies. These are as stated the Australian Securities and Investment Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA).

Some may already know that a large portion of cryptocurrency exchanges are unregulated which means anyone can open an account and trade actively without registering their personal information. This is not ideal, as making sure your money is safe should be a top priority. This is why we openly encourage researching regulations before making a deposit.

Supported Crypto Markets

As we previously mentioned within the guide, there are various markets our Ethereum trading signals may target. For example, one signal may focus on a crypto-to-fiat pair, such as ETH/USD. Alternatively, the next signal could include a crypto-cross pair such as ETH/BTC.

Therefore, ensuring that your online crypto broker covers all manners of cryptocurrency markets is key. For instance, with our premium plan, you will be receiving 3-5 signals per day. As such, by choosing a reliable crypto broker – this guarantees you can trade confidently and effortlessly with one single site.

Deposits, Withdrawals, and Payments.

The last thing to take into account is how you can deposit, withdraw and ultimately make payments. The majority of unregulated exchanges will only accept cryptocurrency payments, which is another reason why we recommend using a regulated and established broker.

By using a regulated broker, you can deposit funds immediately using a debit or credit card, This includes Visa, Maestro, and Mastercard. If you prefer using an online e-wallet, this can also be done with the likes of Paypal, Skrill, and Neteller.

As a bonus, depending on where you are in the world, you may be able to benefit from bank transfers being processed instantly.

Get Started With the Best Ethereum Trading Signals Today

If you feel like you would like to go ahead and get started with our Ethereum trading signals, then follow this step-by-step guide on how easy it is to sign up with cryptosignals.org.

Step 1: Join cryptosignals.org

First things first – you will need to open an account with us. This should only take a matter of minutes.

Remember you can begin with our free signals via the Telegram app, which will give you 3 suggestions per week. Or, you can opt for the premium plan which gives a huge advantage of 3-5 signals per day.

Step 2: Join our Crypto Trading Signal Group

When you have signed up at cryptosignals.org, we will send you an email on how to join the VIP Telegram group.

A tip we like to give our new members is to set a custom notification sound on the Telegram app to ensure you can identify when a new Ethereum trading signal has reached. Thus, giving you plenty of time to act on our suggestions.

Step 3: Place Ethereum Trading Signal Orders

Once you receive an Ethereum trading signal, is it then time to take our suggestions over to your chosen crypto broker and place your order.

To remind you, the order will include which crypto pair it is, whether to go ‘long’ (buy) or ‘short’ (sell), and the limit, take-profit, and stop-loss prices.

The Bottom Line

To summarize, our Ethereum trading signals give you the power to not only access but learn the ways of the cryptocurrency trading markets – all from the comfort of your own devices. And as a bonus, you have seasoned traders doing all the research and technical analysis for you!

If you are ready to get started with our Ethereum trading signals, then choose a plan that best suits your needs. Crucially, keep in mind all our new subscribers are offered the no-questions-asked 30-day money-back guarantee!

FAQs:

What Are Ethereum Trading Signals?

Ethereum trading signals provide key information, like the trading pair guiding traders on buying, selling, or portfolio adjustments.

How Do Trading Signals Work?

Trading signals guide asset buying, selling, and portfolio adjustments, aiding decisions across sectors like bonds.

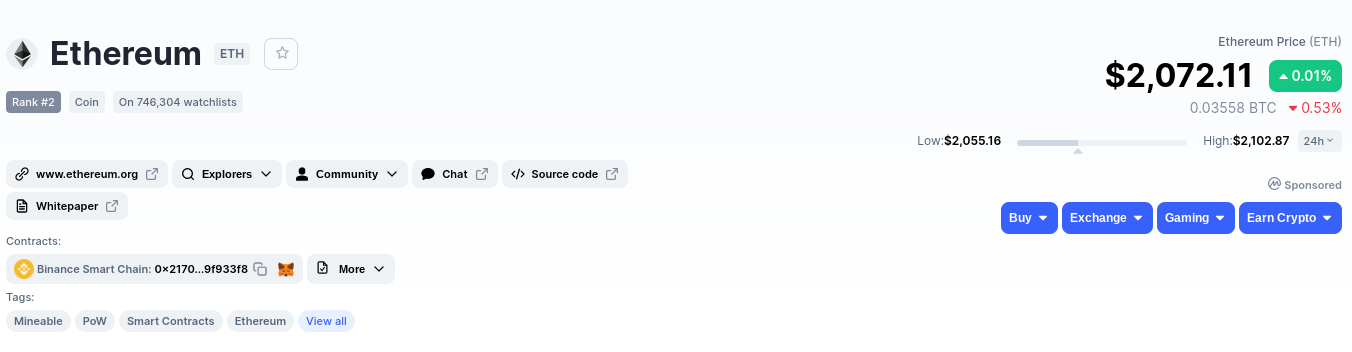

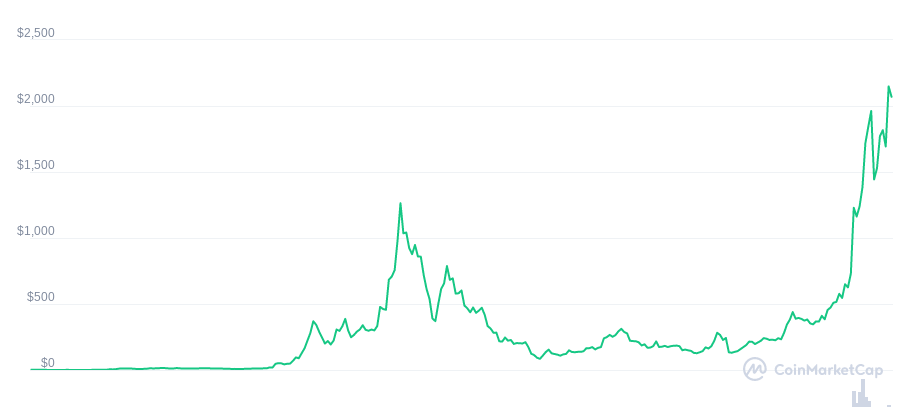

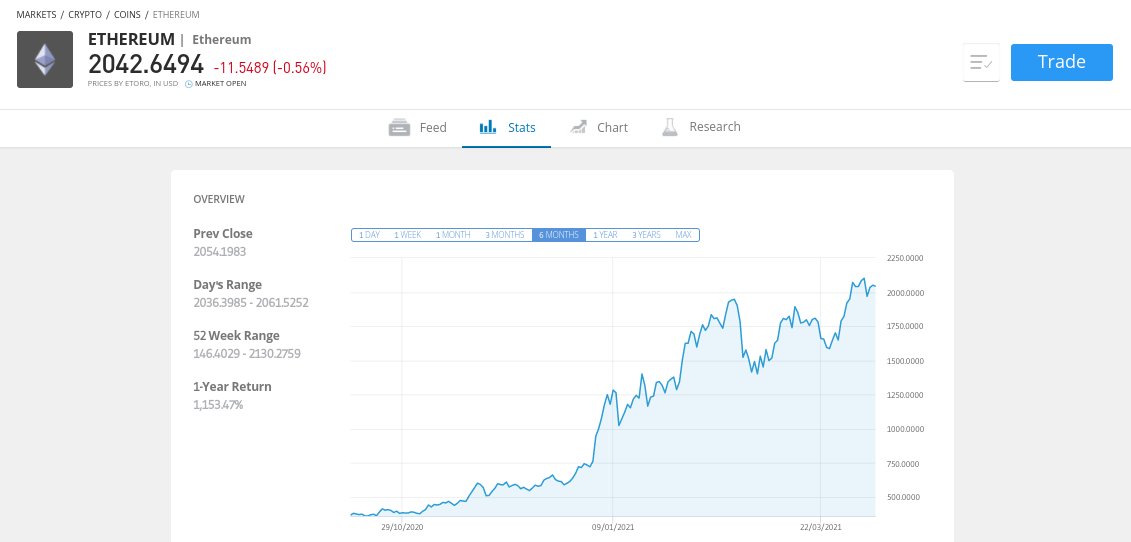

Is Ethereum (ETH) a Good Investment?

Ethereum is the second popular cryptocurrency, offers trading opportunities due to its volatility and market capitalization.

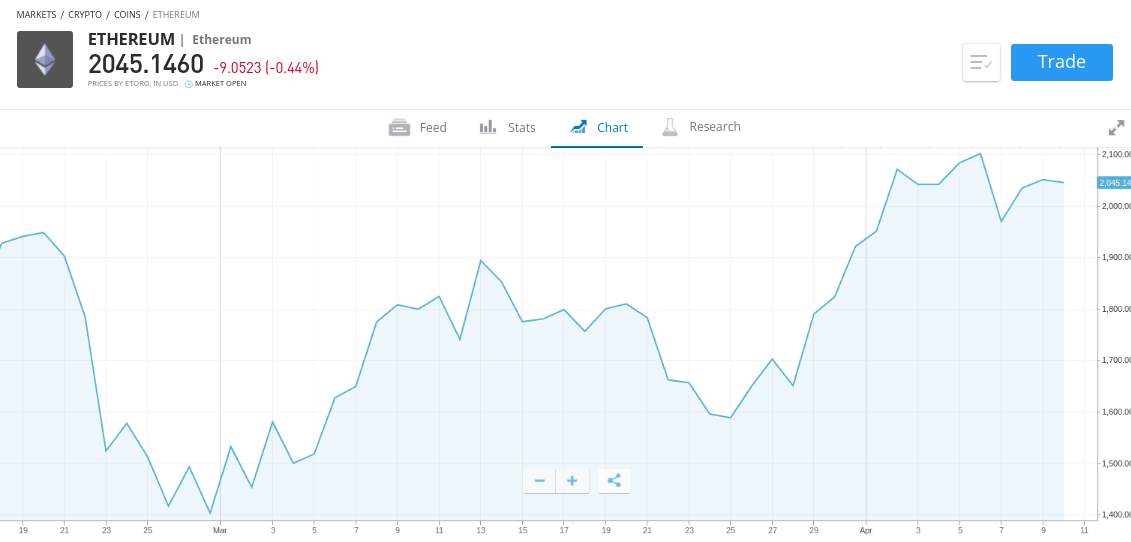

Is Ethereum on a Downtrend in 2022?

Ethereum experienced a downtrend in 2022, marked by a crypto market crash and bearish equities market.