Free Crypto Signals Channel

What are Crypto Pips in Forex Trading and What Is Their Value?

“Pip” stands for percentage in point or price interest point. In the world of forex trading, it’s the tiniest price move an exchange rate can make, following the conventions of the forex market.

Most currency pairs have prices written to four decimal places. A single pip is the smallest unit of change in the fourth decimal place (like 1/10,000th). For instance, the USD/CAD currency pair’s smallest possible move is $0.0001, equal to one pip.

Pips in forex trading are not the same as bps (basis points) used in interest rates markets. Bps signify 1/100th of 1% (like 0.01%), a different concept altogether.

When you’re trading crypto, you need to understand the movement of exchange rates. Two of the essential things you need to know in this respect are “spreads” and “pips.” This is crucial, as both of these terms will dictate how much you are paying to trade your chosen crypto pair, and thus – they will directly impact your ability to make a profit.

In this guide, we’ll cover the ins and outs of ‘What are Crypto Pips?‘ so that you can enter this marketplace with your eyes wide open.

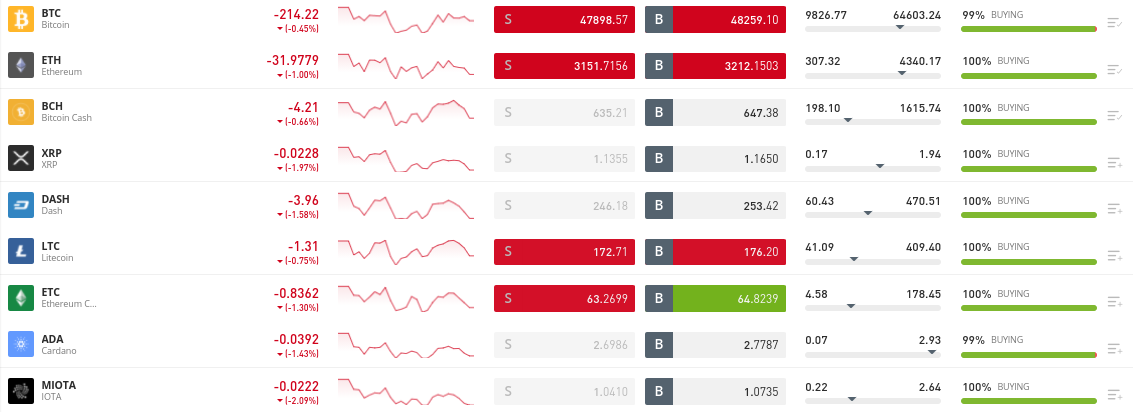

Best Brokers With Low-Pip Crypto Spreads – Quick Overview

Although there are many brokers in the market with which you can trade, not all of them have the best services for you. This is why you need to consider the brokers with the best crypto spreads before you start trading. After all, in the crypto trading space, the spread is often calculated in pips.

Here, we have highlighted the best trading platforms with the tightest crypto spreads.

- ByBit – Best Low-cost broker with the Tightest Crypto Spreads

- AvaTrade – Most Analytical Broker with Super Tight Crypto Spreads

67% of retail investor accounts lose money when trading CFDs with this provider.

What are Crypto Pips and Spreads?

Taking your time to understand “pips” will make your cryptocurrency trading journey more seamless. In a nutshell, the term pip will either refer to “percentage in point” or “price interest point.” But in recent times, cryptocurrency traders have referred to this term as “pipettes,” “points,” and “lots.”

A pip will be equivalent to the last decimal place in a quotation. For instance, if the crypto pair BTC/USD increases from $48,000.00 to $48,000.01, this will amount to one pip. Pips remain an essential factor taken into consideration by every cryptocurrency broker.

The importance of this concept is tied to its nature as a standardized measuring unit in crypto trading. After all, it would be a chaotic scene if traders did not have a common unit by which they can communicate terms of buy and sell positions.

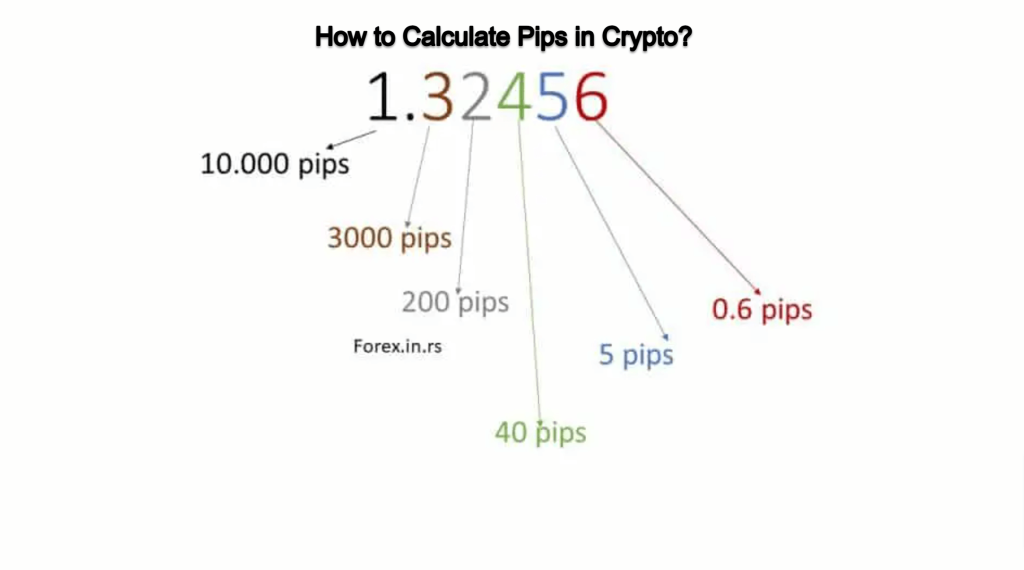

How to Calculate Pips in Cryptocurrency?

How to count pips using a crypto pip calculator? Every pip has its individual value. This means that for every cryptocurrency pair, the value of each pip must be specifically calculated. Now, you don’t really need to learn how to calculate pips crypto using a crypto pip calculator because the best crypto brokers will automatically show you the value of your trade-in percentage terms.

This makes trading more convenient and swift. However, learning how to calculate the pip value by yourself boosts your crypto trading knowledge. More importantly, it helps you to hedge your risks and maximize your trading strategies.

If you also understand how to calculate the value of a pip, you can likely predict your potential gains or losses. Also how to count pips.

- Suppose you want to trade the cryptocurrency pair BTC/USD.

- If you buy one lot of BTC/USD, a pip value will be $0.01.

- This means that your potential gain or loss for this cryptocurrency pair will be calculated at $0.01 for each pip.

It’s crucial to note that the pip value will be based on the lot you’re buying. In that case, let’s consider how it works with BTC/USD:

- For one lot, a pip value is equivalent to $0.01.

- For one mini lot, a pip value will be equivalent to $0.001.

- For one micro lot, a pip value will be equivalent to $0.0001.

Now, let’s put that in context.

Let’s assume one lot is 1,000 units of the cryptocurrency pair. Suppose the price of BTC/USD moves from $48,000.00 to $48,000.01 and you trade one lot. That would be equal to $10 potential gain or loss.

The calculation above represents the basic things you need to know about pip calculation. However, remember you don’t have to worry about any of this as you will find your pip value on the trading platform you’re using. Every time the price shifts, the pip value will be recalculated in real-time.

Ultimately, pips are important in this investment scene, not least because they are essential elements in determining the outcome of your crypto trades – in terms of profit and loss.

Hedging Your Risks When Trading on a Pip-Based Strategy

When you’re trading cryptocurrency pairs, it’s important to note the “ask” and “bid” prices. This is why it’s crucial for you to understand pips once you enter the cryptocurrency trading scene.

Suppose your trading strategy requires you to make above 25 pips to secure a profit. At the same time, you cannot afford to incur a loss beyond 10 pips.

You can do this in two ways:

- You can sum up your open value and that of your take-profit. Then deduct the value of your stop-loss. This will allow you to balance between securing your profit and not reaching your stop-loss point.

- On the other hand, you can deduct the spread from your stop-loss and take-profit. In this case, you stand an equal chance to attain both your take-profit and stop-loss.

Therefore, it’s important to always assess the spreads on your trades. Most importantly, you should choose brokers with tight spreads, as that makes your trades more profitable.

What are Crypto Pips? Understanding the Spread

While we have explained what crypto pips are, it’s also important that you understand the spread and how it impacts your trades. In simple terms, the spread refers to the difference between the ask and bid price of each cryptocurrency pair.

Pips are the way to measure the spread when trading a crypto pair, and this is why the two concepts are interrelated. When you open a position, you’ll automatically run at a loss. This loss refers to the spread, which is essentially the fee you pay to the broker for the trading services you’re offered.

Therefore, you must ensure that you make a profit that covers the spread. In doing so, you’ll get to maximize the returns that you make from a crypto trade.

Here is an example to offer you more insights into how the spread works.

- Suppose you’re trading a crypto pair BTC/USD.

- If your bid price is 48,000.00 and your ask price is 48,000.04, then the spread here is the difference between the two values.

- In this example, the spread amounts to 4 pips.

Therefore, your knowledge of pips and the spread will be relevant for both your short and long-term trades. Furthermore, there are different types of spreads used by crypto brokers.

Here are the common ones you should know about:

- Fixed: Here, the spread charged by the broker remains consistent irrespective of the market conditions. This means that you’ll always have an idea of the spread to expect when you’re about to trade a cryptocurrency pair.

- Variable: For this kind of spread, it shifts based on market conditions. Also referred to as “floating,” the variable spread will likely be minimal when the market is active. However, once the market becomes active, the spread equally decreases.

- Partially Fixed: Concerning this spread type, a part of it is fixed while the market maker decides the rest. This means that the market maker can always add more to the spread based on current trading conditions.

It is worthy of note that when you open a position on a cryptocurrency pair with a significant stake, you’ll likely incur losses at the beginning of your trade. However, if the trade goes in your favor, you’ll quickly recover the losses. For example, if the spread amounts to 4 pips, you need to make gains of over 4 pips crypto to make a profit.

Ultimately, when you understand how the spread works, you can know the things to look out for when evaluating the best brokers to trade cryptocurrency pairs. We have highlighted the best crypto trading platforms with the tightest spreads in the sections below.

Best Brokers for Tightest Crypto Pips

Using the best brokers for your trades is a way to maximize your returns. With these brokers, you get super tight spreads and don’t incur as many fees as you would with some other trading platforms.

1. AvaTrade – Most Analytical Broker with Super Tight Crypto Spreads

AvaTrade is a prominent cryptocurrency broker in the market with its unique selling point being the provision of technical analysis tools. This is a major advantage to you as a cryptocurrency trader and helps you to maximize your trades. With technical analysis, you gain more insights into the market and get a better understanding of factors such as pips and spreads.

AvaTrade offers heaps of technical indicators and chart drawing tools - which is invaluable for this purpose. Furthermore, the platform deals with CFD instruments. This means that when you trade cryptocurrency pairs, you do so without storing the tokens. Once again, this means that you can attempt to profit from both rising and falling markets. Additionally, the platform is licensed in more than seven jurisdictions.

AvaTrade supports a good selection of digital tokens, most of which are large-cap projects like Bitcoin, XRP, and Ethereum. In terms of getting started, you can deposit funds into your AvaTrade account using debit/credit cards and e-wallets like Paypal and Apple Pay. The minimum deposit amounts to just $100. When it comes to fees, you won't pay anything to add or withdraw funds.

Furthermore, and perhaps most importantly, AvaTrade is a 0% commission broker. This is because you will be trading on a spread-only basis. Essentially, once you make a profit that covers the difference between the ask and bid price, you’re good to go. This broker also allows you to practice crypto trading before entering the markets with real money. This is great for newbies, as you will be trading risk-free with paper funds.

- Lots of technical indicators and trading tools

- Free demo account to practice crypto trading

- No commissions and heavily regulated

- Perhaps more suited to experienced traders

What are Crypto Pips? Choosing the Best Broker

In your search to understand “what are crypto pips?“, you need to know how to choose the right broker. This is because the best crypto brokers offer you low-pip spreads, making it possible to adequately secure your profits.

In this section, we provide you with all the things you need to know to choose the right broker.

Regulation

When a broker is regulated, it has more credibility. This is why brokers stand out in the market. As a regulated broker, this platform is audited by top financial institutions that operate to ensure fairness and transparency in the market.

Regulated brokers often have a scope of operation by which they operate. This includes performing KYC checks on new customers and keeping client money in segregated bank accounts. The three crypto brokers that we discussed above – AvaTrade – are all heavily regulated by reputable financial bodies.

Fees and Commissions

You can make an impressive profit on your trades and still lose a bulk of it to fees and commissions. This is why you should consider brokers with tight spreads and a low-fee structure before you choose a trading platform. The fee structure of the platform you choose will determine your experience while trading.

Support for Many Markets

You should consider whether the broker you’ve chosen has a long list of supported cryptocurrencies. This is important, especially if you’re looking to trade a minor project.

For this reason, you might consider a broker that provides you with hundreds of cryptocurrency markets. This includes fiat-to-crypto pairs, crypto-cross pairs, and many Defi tokens.

Payment Methods

There are various ways to make payments on a crypto trading platform. But you’ll want to consider a broker that supports many payment methods such as debit/credit cards and e-wallets.

Analysis Tools Options

Aside from direct trading services, some brokers like AvaTrade also provide you with technical analysis tools. This is an important factor for cryptocurrency traders. Brokers of this nature often allow you to learn and gain more insights while you’re trading, too. This is an effective way to maximize your trades.

How to Get Started on the Best Brokers for Tightest Crypto Pips: Step-by-step Walkthrough

Now that you’ve learned what crypto pips are and how to choose the right broker, you should equally understand the process to get started.

Once you choose a broker with super tight spreads, the first thing to do is open an account.

Step 1: Open an Account

ByBit takes the lead as the best broker to trade cryptocurrency pairs. This is owing to the platform’s regulatory standing and low-fee structure, allowing you to trade crypto pairs in a cost-effective manner. Therefore, the first thing you need to do is to visit ByBit and open an account.

This should only take you a couple of minutes, as you simply need to provide some basic personal information alongside your contact details.

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Complete KYC Process

As a regulated broker, you cannot trade cryptocurrency without submitting some details and uploading a valid ID which can be a passport/driver’s license. Following the submission of these documents, it will validate your identity and allow you to proceed.

Step 3: Make a Deposit

After you’re done with the KYC process, you can now use your debit/credit card on ByBit. Simply input your card details and proceed to make a deposit. Note that the minimum deposit you can make here is $200. However, you can trade crypto from as little as $25.

Step 4: Search for Crypto Market

Locate the search box and enter the name of the crypto asset you intend to trade. As in the example below, we are looking to trade Algo.

If you want to see what digital asset markets are available, click on the ‘Open Markets’ button followed by ‘Crypto’.

Step 5: Trade Crypto

The last stage in the process is to place a buy or sell order for the cryptocurrency you selected. These orders are how you instruct the broker to place a trade on your behalf.

What are Crypto Pips? Conclusion

In this What Are Crypto Pips? Guide, we have discussed extensively all you need to know about the subject. We established that pips crypto are important to trading cryptocurrency pairs and knowing how they work will help you understand this investment scene better.

We also discussed how you can choose the best brokers with the tightest spreads. We concluded that ByBit is the best broker with which you can get the most competitive low-pips spreads in this arena. All you need to do is to create an account with the platform and you can start trading from as little as $25.

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What are crypto pips?

Pips crypto represents the shifts in the exchange rates of cryptocurrency pairs. It’s crucial to understand how they work if you want to consistently get the best experience from trading crypto assets.

What’s an example of a pip?

Suppose BTC/USD moves from $48,000.00 to $48,00.01. This shift is equivalent to 1 pip.

How to choose the best brokers with the tightest spreads?

There are certain things you need to consider when assessing different brokers. Generally, regulated brokers are credible and often cost-effective. More precisely, consider brokers with a low-fee structure, particularly those that allow you to trade on a spread-only basis. For this purpose, the best brokers are ByBit and AvaTrade.

What’s one pip value of BTC/USD?

If you buy one lot of BTC/USD, a pip value will be $0.01. For a mini lot of the same pair, one pip value will be $0.001.

What’s the spread in crypto?

This refers to the gap between the “ask” and “bid” price, which essentially is a fee charged by the broker. Therefore, to make a profit from your trades, you have to make a profit that surpasses the spread.

What is a Pip in Cryptocurrency Trading?

The symbol pips denotes a percentage point. Traders use this method to gauge changes in any asset or currency pair. The point is a movement that is smaller than the pip.

How do pips work in crypto?

Pips, which refer to a one-digit fluctuation in the price at a particular level, are the units used to measure movement in the price of a cryptocurrency. Typically, the “dollar” level is where valuable cryptocurrencies are exchanged, hence a price change from $190.00 to $191.

How much is 1 pip in crypto?

It would help if you kept in mind that one pip in the world of cryptocurrency equals a 0.01 difference in price.

Does crypto have pip?

A unit of measurement used in trading currencies, cryptocurrencies, and other financial products is called a pip or percentage in point.

What is 1 pip on Ethereum?

Today’s PIP to ETH exchange rate is 0.0001341 ETH, down 4.10% from the previous day.

Is 1 pip 10 dollars?

Most currency pairings are priced to four decimal places, with one pip (i.e., 1/10,000th) in the fourth position. For instance, the lowest whole unit movement allowed for the USD/CAD currency pair is $0.0001, or one pip.

How much is $1 in pips?

For a mini lot, one pip is equivalent to $1; if you purchase 10,000 units or a mini lot of US dollars, one pip change in the price quote equates to $1. If you trade a tiny lot of US dollars, $1 is equivalent to one pip.

How many pips is $10?

$1 is the pip value. You would make a profit of 10 pip, or $10 if you bought 10,000 euros against the dollar at 1.0801 and sold them at 1.0811.

How many pips in one rupee?

PKR 67.50 are in 1 pip.

What is 100 pips equal to?

Regarding the pip value of the US dollar, 100 pips are equivalent to 1 cent, and 10,000 pips equal $1. This regulation does not apply to the Japanese yen.

How much is 20 pips in gold?

Add the pip value to the number of pip gains or losses in the deal to get the value of gold pips. For instance, if you made a deal and acquired 20 pip, and gold has a pip value of 0, your profit would be $2 (20 x 0,01 = 0.20).

Is 30 pips good?

The ratio between the stop loss (15–20 pip) and take profit (30–40 pip) is one to two. The traders must compare this to the available equity and the risk-management strategy used. In conclusion, we can state that trading 30-pip increments every day is an engaging and aggressive approach that will yield high profits on each deal.

What is the 20 pips rule?

The “20 pips per day” forex scalping method enables a trader to make 20 pips daily or at least 400 pips weekly. The specified currency pair must move aggressively throughout the day and be as volatile as feasible to follow this method.

What do pips mean in trading?

The abbreviation “Pip” stands for price interest point or percentage in point. According to customs in the forex market, a pip is the smallest unit price adjustment an exchange rate may make. Most currency pairings are priced to four decimal places, with one pip (i.e., 1/10,000th) in the fourth position.

How much is 50 pips worth?

The value of 50 pips for a typical lot (100,000 units) would be $500 ($0.10 x 100,000 x 50). The price of 50 pips for a small lot (10000 units) would be $50 ($0.10 x 10,000 x 50). The price of 50 pips if you were trading a micro lot (1,000 units) would be $5 ($0.10 x 1,000 x 50).