Free Crypto Signals Channel

Cryptocurrency trading has become popular in the global marketplace. Many cryptocurrency enthusiasts now read up on different tokens in an attempt to understand their price movements. This is because the volatility of cryptocurrencies is highly suitable for short-term trading.

Day trading cryptocurrency means that you enter and exit numerous positions within 24 hours. To do this, you must have some experience with digital tokens and learn how to day trade crypto like a pro. As such, when day trading digital assets, you need to have a research-based strategy and stay updated with the market.

This will ensure you know when to enter and exit trades. In this guide, we will walk you through all you need to know to effectively learn how to day trade crypto from the comforts of home. We will also discuss the relevant considerations you have to make when trading cryptocurrency on a short-term basis.

Learn How to Day Trade Crypto: Quickfire Walkthrough to Day Trade Crypto Under 10 Minutes

Day trading is an effective way to make impressive returns in the cryptocurrency market. You can get started in under 10 minutes if you follow this quickfire walkthrough.

- Step 1: Choose a Trading Site: For you to day trade cryptocurrency, you’ll need to get an efficient broker. As such, you should consider the credibility of the broker before getting started. A broker like ByBit is a great option owing to the fact that it’s regulated and has a low-fee structure.

- Step 2: Open An Account: The first step is to choose a broker. Following that, you’ll need to open an account so you can day trade crypto with the broker. You’ll have to go through a Know Your Customer (KYC) process after which you’ll be granted access to the crypto markets.

- Step 3: Add Funds To Your Account: Before you can trade, you need to have the capital in your account. On ByBit, with $200, you can make the minimum required deposit and get started. You can do this using your debit/credit card, bank account, or Paypal.

- Step 4: Choose a Market: After adding funds to your account, you’ll need to choose a trading pair for your desired crypto token. Here, you simply need to locate the token through the search tab.

- Step 5: Place Your Trade: Once you get to the token’s page, decide the order you intend to use to enter the market. This could be a buy or sell order. Additionally, you’ll have to indicate the amount you intend to stake. Once done, complete your trade to enter the crypto market.

There you have it. You have simply entered your chosen market with the above steps. Since you’re day trading, this means you’d be executing your trades based on favorable price movements.

Due to the frequency of this, you might also consider day trading CFDs. We will explain this soon enough, but before then, let’s consider the best brokers you can use to day trade crypto online.

67% of retail investor accounts lose money when trading CFDs with this provider.

What is Crypto Day Trading?

In learning how to day trade crypto, you must consider what the concept precisely entails. Cryptocurrency trading is pretty much like investing in any financial instrument. When you make an investment, your goal is to generate monetary gains.

As such, you have to sell at a higher price than the commodity’s buying value. In the same manner, when you day trade crypto, you’re speculating that there will be a price increase on the token.

Therefore, when this token’s price increases, you sell it and secure your returns. The major difference with day trading is that this buying and selling process happens within a short period and multiple times in a day.

- For instance, suppose a token such as Algorand is priced at about $1.05.

- You enter the market at that price and sell when the token hits a price of $2.50.

- Based on this trade, you’ve gained a profit from the token’s 95% increase.

- Your profit on this trade is essentially 95% of the amount you stake. For instance, if you risked $100 on the trade, you would have made gains of $95.

You should note that cryptocurrencies are traded in pairs. This means that the token you’re day trading is paired against another asset. Consequently, your chosen token is valued based on that other asset which can be USD or BTC among other options.

So, as a crypto day trader, your task is to predict whether your chosen token will increase or drop in value. Based on your speculations, you then open a position. The interesting thing about day trading is that you don’t have to wait too long to make returns. You simply look towards maximizing the constant price movements of the market.

Choosing a Broker to Day Trade Cryptocurrency

As the cryptocurrency industry grows in size, many new brokers continue to emerge every day. While these brokers give you access to the marketplace, not all of them can serve you adequately. This makes it important to consider certain factors when choosing a broker.

This is because the broker you choose determines your experience when day trading cryptocurrency. As such, below we have highlighted some of the key things you need to consider before choosing the best crypto day trading broker for your needs.

Regulation

One of the key things to consider when choosing a broker to day trade is whether or not the platform is regulated. A regulated broker affords you more security and credibility.

- Often, these regulated brokers have certain guidelines to which they have to comply. This way, they cannot act beyond their scope of operations, meaning you enjoy a reasonable level of protection.

- For instance, AvaTrade are all regulated. AvaTrade is licensed in more than seven jurisdictions.

Trading with brokers of this nature puts you in the regulator’s safety net. This is good for numerous reasons, one of which is that regulated brokers keep your capital separately from the company’s, meaning you always have access to your money when you desire.

Fee-structure

Brokers charge different fees during the execution of a trade. From making deposits to the point you close a trade, there are different fees you might have to pay. As such, you have to consider the fee structure of your desired broker to see how much the platform charges across different services. Most importantly, consider the commissions and spreads.

To day trade in a cost-effective manner, it will be smart to consider brokers that charge very low fees or even none at all.

Additionally, the broker has a low minimum deposit requirement of just $200 and you can start trading with as little as $25 per stake. Therefore, using such a broker means you can make meaningful profits on your short-term trades.

Markets

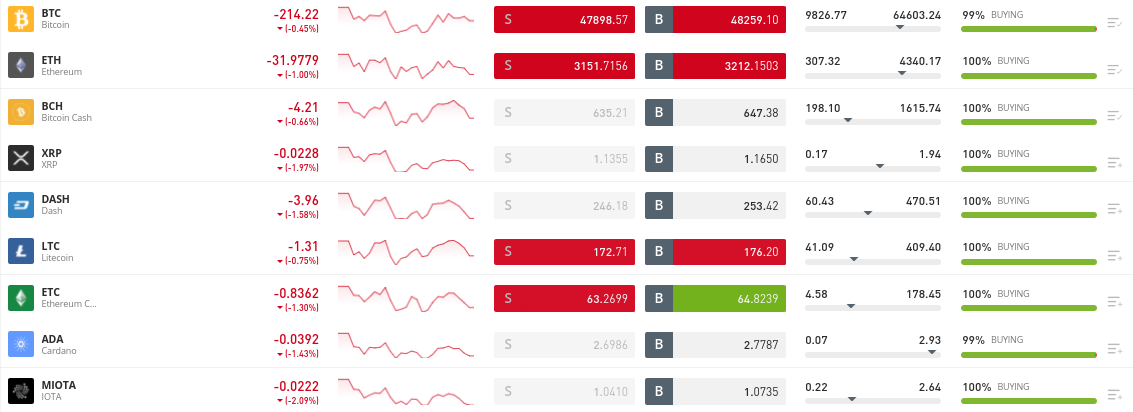

It’s crucial to consider whether your broker supports the cryptocurrency you intend to day trade. While there are thousands of tokens that can be day traded online, this doesn’t mean that all brokers support these coins.

- Therefore, if you’re looking to make a profit from small-cap projects, you must check to confirm whether there’s a market for it on your chosen broker.

- In this regard, you may want to consider ByBit, as the trading platform supports a wide range of cryptocurrency markets. In fact, there are over 200+ crypto markets on the platform – all of which can be traded with leverage.

This includes crypto-cross pairs, fiat-to-crypto pairs, and numerous Defi tokens. Therefore, if you’re unsure whether your broker supports your chosen project, be sure to check this prior to opening an account.

Payment Methods

In learning how to day trade crypto, you need to understand the importance of payment options. When you use a leading broker like AvaTrade, you get a wide range of payment options to make your deposits. These three platforms support debit/credit cards, e-wallets such as Paypal, and wire transfers.

Preferably, use debit/credit cards or e-wallets to make your payments when day trading, as they are faster than wire transfers. Furthermore, these brokers ensure you can make withdrawals and get your funds quickly, which is a great perk for a day trader.

Research Extensively

First, when you’re day trading crypto, it’s crucial to research adequately. This will inform your choice of projects and your trading strategy. Therefore, brokers that offer you the avenue to learn while trading are preferable. When you use these brokers, you get access to educational tools, charts, guides, and even courses.

This long list also includes research tools and technical indicators that you can use to analyze cryptocurrency market updates. Having these tools at your chosen broker makes it more convenient and seamless for you to day trade crypto.

Best Brokers For You to Day Trade Cryptocurrency

Your knowledge while learning how to day trade cryptocurrency will not be complete until you know the best brokers to use. With this in mind, below we discuss the best online brokers that allow you to day trade crypto in a low-cost and safe environment.

1. AvaTrade – Superb Day Trading Platform for Technical Evaluation

When learning how to day trade crypto, you need to understand the importance of technical analysis for making informed decisions. While this may take some time to understand, it’s a popular strategy used by many day traders to maximize their returns.

AvaTrade stands out in this regard 0 as the broker is designed for you to day trade and perform technical analysis of the market in real-time. The platform is also adequately regulated across seven jurisdictions and deals mainly in CFD instruments.

The broker supports numerous cryptocurrencies all of which are available for you to day trade with leverage. You can also decide to go long or short. The broker also integrates third-party platforms MT4 and MT5 - through which you can conveniently evaluate market updates. Furthermore, concerning fees, AvaTrade is a broker where you only incur spreads.

The implication of this is that you don’t pay commissions and various other fees that are payable to other brokers. Instead, all you have to cover is the difference between the opening and closing price of the cryptocurrency pair you’ve chosen. You can start day trading with this platform by fulfilling the minimum deposit requirement of just $100.

- Lots of technical indicators and trading tools

- Free demo account to practice day trading

- No commissions and heavily regulated

- Perhaps more suited to experienced traders

How Does Crypto Day Trading Work?

We earlier mentioned that cryptocurrencies are traded in pairs. We will give a more detailed explanation here. When you’re day trading, you have to choose between fiat-pairs and crypto-pairs.

This means that you’ll be pairing your chosen token with either of the two options, whether fiat money like USD, euros, or any cryptocurrency such as BTC and ETH. Each pair has an exchange rate, which changes every second because it’s affected by the forces of demand and supply.

Therefore, if more people are buying the pair, the price will increase. On the other hand, if more people are selling that particular pair you’re day trading, the value will drop.

Here are the two pair types you can day trade explained in more detail:

- Fiat Pairs: This is one of the two pairs you can go for. Here, you’ll be choosing a pair that comprises a fiat currency and a digital token. In most cases, the fiat option you’ll get is USD, as it’s the benchmark currency in this industry. Therefore, examples of crypto pairs are ETH/USD and BTC/USD. Furthermore, using this pair type to day trade crypto offers you access to more liquidity and tighter spreads.

- Crypto Pairs: You can trade a token against another competing digital asset. For instance, you might trade the value of Algorand against that of Bitcoin. In that case, you’ll have your pair appear as ALGO/BTC. However, while crypto-cross pairs are an option for you to day trade, you should stay away from them as a beginner. This is because you need to have in-depth knowledge of both digital tokens in the pair.

Now that you understand how day trading crypto works, the next thing is to understand the different orders by which you can enter the market. You have to decide whether you’re entering the market with a “buy” or “sell” order.

- You use a “buy order” when you are speculating that the token will witness a price increase.

- On the other hand, you use a “sell order” when you predict that there will be a drop in the token’s price.

- However, this is not all you need to learn how to day trade crypto. You also have to know what order type to use and why.

Concerning this, there are two order types for you when day trading.

- You can use a “market order” when you want the broker to execute your trade at the next available price.

- On the other hand, you use a “limit order” when you have a specific entry price when you intend to enter the market.

When you’re day trading crypto, limit orders are preferable. This is because as a day trader, you’re looking to profit from constant price movements, meaning you readily have entry and exit prices in mind. Therefore, using a limit order allows you to instruct the broker to enter and exit the trade automatically – at your desired prices.

Best Cryptocurrency Day Trading Strategies

To make impressive returns consistently in your crypto day trading journey, you need to understand the different strategies at your disposal. Seasoned crypto day traders leverage many strategies to make profits and have a more in-depth understanding of the market they’re entering.

Therefore, if you want your returns to become substantial, you’ll have to follow this trend. Here are some of the most popular strategies you can use when day trading crypto.

Market Corrections

The market constantly moves in different directions. This means that a market that’s currently on an upward trend can suddenly take the opposite position. This often happens when investors sell off their assets to make a profit. However, when this happens, especially for a well-established asset, it doesn’t mean that such a token won’t increase anymore.

Essentially, market alterations are often temporary, meaning the token will likely still witness an upward trend. Therefore, as a smart crypto day trader, it might do you some good to enter a buy position when the token’s value is down. That way, you get to make a profit when the coin’s price increases later on.

RSI Indicator

As earlier mentioned in our Learn How to Day Trade Crypto Guide, investors make use of indicators to analyze the market.

- The RSI indicator, in particular, is used to determine the status of a token, whether it has been oversold or overbought.

- If the asset has been oversold, this could mean that new buyers are set to enter the market.

- In that case, you can enter and exit the market to make quick profits.

- On the other hand, if the token is overbought, this is often an indication that the token is in a “bear” market.

- If you anticipate that a correction might happen soon, you can enter the market to take advantage of the reversal before it occurs.

The RSI is just one of dozens of useful technical indicators that you should explore when you learn how to day trade crypto for the first time.

Market Research

Beyond indicators, learning more about a project is a smart strategy. The best crypto day traders are those who understand the trajectory of the coin they are looking to buy or sell. When you understand the historical data of a token, you’re likely to make a more informed decision when placing a trade.

Therefore, you should not underestimate the importance of researching thoroughly and creating an effective strategy before day trading.

Benefits of Crypto Day Trading

You may still be skeptical about day trading crypto. This is not out of place, especially if you’re a beginner in the digital asset market. To help you further understand how things work, we have highlighted some benefits of day trading crypto.

Long or Short-term Trading

Although the focus of this Learn How to Day Trade Crypto Guide is on short-term positions, it’s pertinent to consider the perks of holding tokens for a longer period. When you engage with long-term trading, you’re essentially buying a coin and holding it for a lengthy period until the price increases and is profitable to sell.

This strategy is referred to as “buying and holding.” In this case, you can take ownership of your tokens and store them in a wallet. However, you may not want to go through the stress of transferring your tokens to a wallet. In that case, you can simply use a broker like AvaTrade that offers you an in-built wallet to store your digital assets.

Leverage

When day trading with a broker like AvaTrade, you have the option to apply “leverage.” Day trading with leverage means you can open large trades when you don’t have as much money as you need.

- That is, suppose you intend to place a buy order of $1,000, but you only have $100 in your trading account.

- In this case, you can apply leverage of 1:10.

- In doing so, you get to open a position worth $1,000, meaning the broker will essentially loan you the rest.

You should, however, note that although leverage is an effective way to maximize your returns, it’s also a risky venture.

Trading Around The Clock

A significant advantage of day trading crypto is that you can do so anytime you desire. This is unlike trading with traditional markets, where you cannot buy stocks or shares once standard trading hours have closed. This is limiting and doesn’t favor you as a trader that intends to open and close numerous positions across the day.

Risks of Crypto Day Trading

Ordinarily, the cryptocurrency scene involves high risks and different levels of uncertainty. However, when you’re day trading crypto, you have to contend with even more risks.

We consider the risks of crypto day trading in the sections below.

High Volatility

Cryptocurrencies can increase and decrease in value within the space of a second. This might not be an issue if you’re trading long-term and will only sell your assets after they have increased significantly in value.

However, when day trading crypto, you have to constantly monitor the market because you’re looking to gain a profit from ever-changing movements.

Therefore, it’s important to use your take-profit and stop-loss orders smartly. These are effective ways to hedge your risks and maximize your returns. Essentially, as a crypto day trader, you must be ultra-aware of market updates.

Unregulated Exchanges

If you’re unwilling to go through a KYC process, you may look to use an unregulated exchange. While these platforms will allow you to day trade crypto anonymously, they expose you to a lot of risks. Preferably, you should day trade with regulated brokers as they are more credible.

They help you mitigate your risks and generally put you in a better position to day trade in a cost-effective manner. This is why it’s smart to use licensed brokers such as AvaTrade.

Learn How To Day Trade Cryptocurrency — Detailed Walkthrough

At the beginning of this Learn How to Day Trade Crypto Guide, we provided a brief explanation of how you can get started in this industry. The explanation we gave might be sufficient for a cryptocurrency expert.

However, if you’re just getting started at crypto day trading, you’ll need a more thorough explanation. Below, we have provided a detailed walkthrough on how to place your first crypto day trading order in less than 10 minutes!

Step 1: Choose a Trading Site

We have stated why it’s important to exercise some care when choosing a broker. This is because your broker determines your day trading experience. However, selecting the right broker can be difficult, so you should look out for a few core metrics.

This includes whether the broker is regulated, has a low-fee structure, supports numerous payment options, has a low minimum deposit requirement, provides plenty of cryptocurrency markets, and has a simple user interface. When you consider these things, you’ll likely choose the right broker.

To help you out as a beginner, we have done some research on the best brokers and found three leading platforms you can use. As a newbie crypto trader, you can use AvaTrade to enter and close different positions across the day.

While the first latter two platforms specifically deal in CFDs, some brokers allow you to trade these derivatives as well as invest in the actual crypto asset itself.

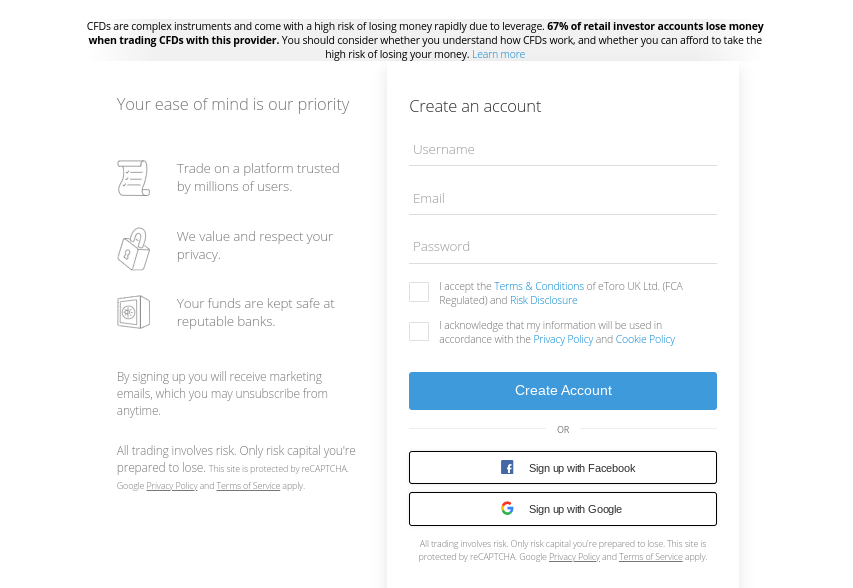

Step 2: Open a Trading Account

You need to set up your account before you can start day trading. Since you’re using a regulated broker, you have to go through a KYC process. This means that you have to submit some personal details and upload a government-issued ID.

Additionally, you’ll also have to provide a document that validates your address. This can be your utility bill or bank statement. Once your account is verified, you start day trading.

Open Crypto Day Trading Account

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 3: Add Funds to Your Account

You cannot day trade with an empty account even if the platform allows you to apply leverage. Therefore, you must consider the broker’s required minimum deposit and then add funds to your account accordingly.

On Ava Trade, you can add funds to your account using either your debit/credit card or an e-wallet. You can also use a wire transfer. However, this is not your best option, as the process is often slow.

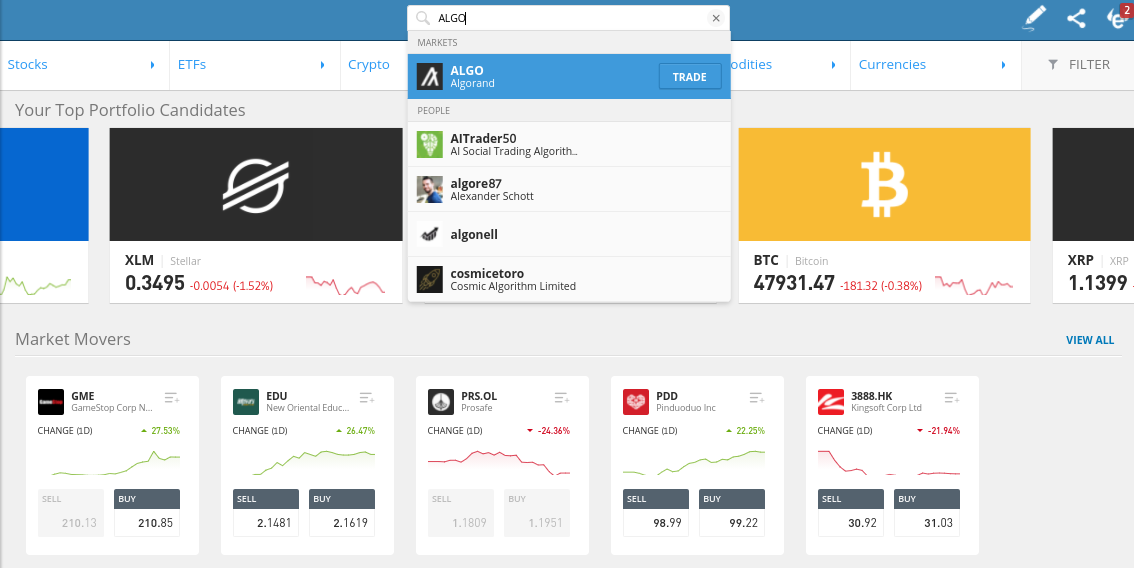

Step 4: Choose a Trading Market

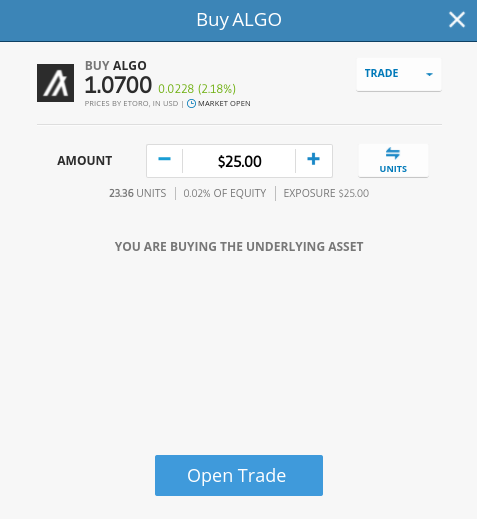

Here, you’re required to select the trading pair of your desired token. Suppose you intend to day trade ALGO, you simply need to locate the search bar and look for the token by inputting its name.

Step 5: Open Your Trade

Once you get to the respective token’s page, specify the orders you will be using. That is, create a buy or sell order at the prices you desire for each.

Following that, enter the amount you intend to stake and click “Open Trade” to get started. Once you do, you’ve now kickstarted your day trading journey!

Learn How To Day Trade Crypto — Bottom Line

If you’re looking to make a profit from the constant price shifts in the cryptocurrency market, day trading will likely interest you. While this form of trading comes with more responsibilities, you can navigate the market easily once you understand the best strategies and subsequently do your own research.

In this How to Day Trade Crypto Guide, we have shown you all you need to know about the subject. Once you choose the right broker and you understand the market you’re entering, you’re good to go.

Open Crypto Day Trading Account

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

How do you day trade crypto?

You can get started by opening an account with a regulated broker. Once you do, fund the account and decide whether to place a buy or sell order on your chosen crypto pair. This should be based on your research of the project you intend to day trade.

Where can I day trade crypto?

There are numerous brokers and exchanges for you to day trade crypto. However, the best options for you are ByBit and AvaTrade. They all allow you to trade cryptocurrencies in a cost-effective way.

Can you day trade cryptocurrencies with leverage?

To do this, you need to choose a broker that supports leveraged CFDs. AvaTrade all do.

How can I make money from crypto day trading?

If you want to maximize your returns from crypto day trading, you need to use effective market strategies. This includes taking advantage of market corrections and using technical indicators. You also need to research adequately and know when to go long or short.

What is the best cryptocurrency pair to day trade?

The most day traded cryptocurrency pair in the market is BTC/USD. This pair comprises Bitcoin and the US dollar. Day trading this pair lets you enjoy the largest liquidity levels and the tightest spreads.