Free Crypto Signals Channel

When you enter the cryptocurrency scene, you’ll realize there are different trading styles you can adopt. For some participants, they trade on a long-term basis while others will enter and exit positions within 24 hours. If you want more flexibility in this investment scene, you can swing trade crypto.

Therefore, in this guide, you’ll learn how to swing trade crypto from the comfort of your home.

Learn How to Swing Trade Crypto: Quickfire Walkthrough to Swing Trade Crypto Under 5 minutes

Swing trading is a proven method to secure profits in the cryptocurrency market. If you’re looking to start crypto swing trading immediately, this quick walkthrough is for you.

- Step 1: Select a Broker: You cannot swing trade crypto without first choosing the right platform. An easy pick here is a broker like bybit, which is highly cost-effective and has a simple user interface.

- Step 2: Open an Account: Choosing a trading site is the first step, but that’s not all. You must open an account on the platform you’ve chosen. On bybit, simply create a username, enter your email address, and choose a password. For a broker like bybit, you’ll need to complete a Know Your Customer (KYC) process. Here, you’ll provide some personal details and documents to validate your identity and home address. The documents include a valid ID and a bank statement/utility bill.

- Step 3: Fund your Account: You cannot swing trade crypto without having some capital in your brokerage account. bybit requires you to make a minimum deposit of $200.

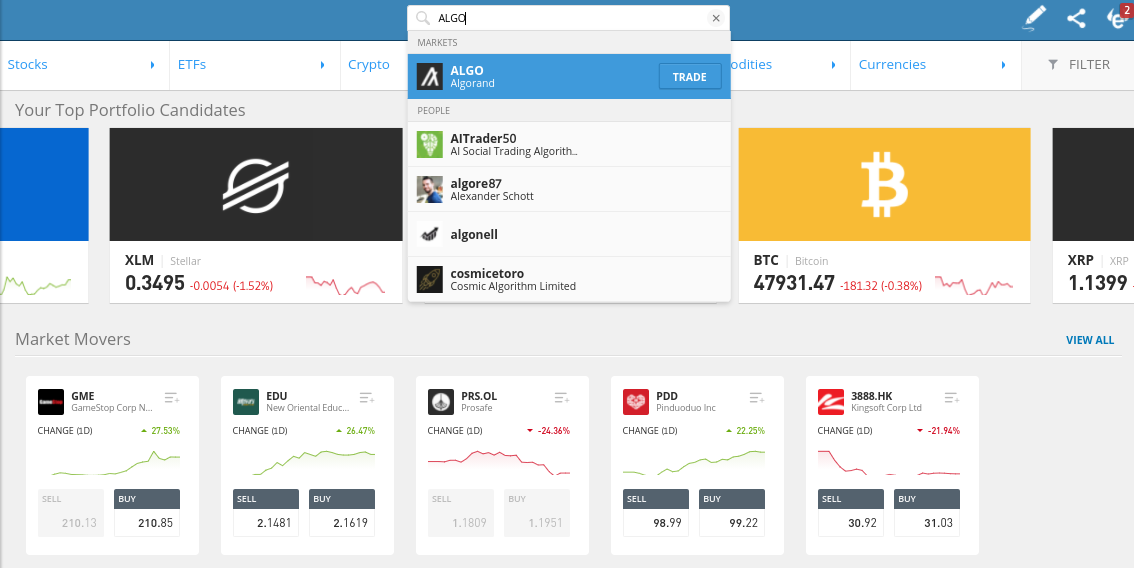

- Step 4: Choose a Market: Once you’ve funded your account, you can now proceed to swing trade crypto. However, you must know the market you’re looking to trade. Therefore, use the search tab to look for the cryptocurrency pair you want to speculate on.

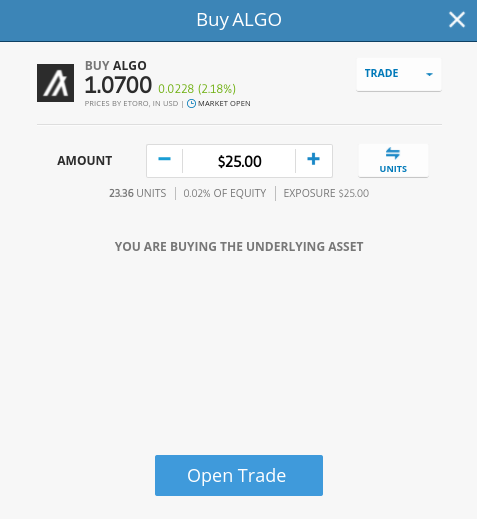

- Step 5: Open Your Trade: After locating the desired crypto pair, choose an order by which you intend to enter the market. You can choose from both a buy or sell order – depending on whether you think the market will rise or fall. Following that, enter your stake, and open the trade.

Once you complete these steps, you’d have entered the market you want to swing trade. As a swing trader, your task is to determine how to maximize the highs and lows of a cryptocurrency pair.

This means that while some of your trades will only last for a few minutes, others might go on for days. Therefore, you can consider CFDs in cases where you have to open and close positions within a really short period. In doing so, you can add leverage to your position and short-sell with ease.

67% of retail investor accounts lose money when trading CFDs with this provider.

What is Crypto Swing Trading?

Swing trading involves targeting market movements and knowing when to open or close a position. In a similar manner to day trading, this style of trading also involves speculating on the value of your chosen pair. Therefore, in learning how to swing trade crypto, you must understand the importance of studying the markets.

However, with swing trading, you can keep your positions open for more than a day. Your target is to make gains and if that requires you to keep your trade open for multiple days or even weeks, you can do that. This is why swing trading is a more convenient option if you need time to trade effectively.

Choosing a Broker to Swing Trade Crypto

To swing trade crypto, you must know the best brokers you can use for that purpose. The cryptocurrency industry is filled with many brokers and exchanges. Therefore, you need to know the right metrics for assessing the brokers with which you should swing trade crypto.

In this section, we have discussed the important things to consider when evaluating different crypto swing trading platforms.

User Interface

The best brokers are easy to use. If you want to swing trade crypto, you’ll need a broker that makes it convenient for you to navigate your way around the site. This will make it seamless for you to move fast and enter trades swiftly.

Therefore, when you’re looking to choose a broker with which you’ll swing trade crypto, examine the platform’s user interface and how suitable it is for beginners. bybit is a broker that ticks this box owing to the platform’s user-friendly design.

Markets

You must examine the markets available to swing trade on a broker especially if you’re looking to make profits from newly launched tokens. Many of these new or small-cap projects may not have been listed yet. Therefore, it’s crucial that you confirm the markets supported by the broker before opening an account.

For a broker like bybit, you have a wide range of options to choose from. You can access more than 200 digital currency markets on the broker – which is huge. So, if you’re looking to swing trade a token and you’re unsure of where it might be listed, you might want to check bybit.

Fees and Commissions

Brokers make money by charging different fees and commissions. While there’s no broker where you won’t incur one fee or another, certain trading platforms are more cost-effective than others. This means that, on such brokers, you don’t incur huge fees that will affect your profit potential.

So, when choosing a broker to swing trade crypto, consider the fees you’ll be charged.

Trading Commissions

Some brokers charge commissions when you open and close trades. In most cases, this is charged as a variable percentage. For instance, suppose a broker has a 0.4% trading commission. This means that the fee will be charged both on your initial stake and the final value when you close the trade.

You might think that the effect of this percentage is minimal. However, when trading commissions accumulate, you’d see how it can affect your profits. Therefore, always consider commission-free brokers when swing trading crypto.

The Spread

Knowing what the spread entails will boost your swing trading knowledge. Essentially, the spread refers to the gap between the ‘buy’ and ‘sell’ price of your desired pair.

Let’s put this in context for better understanding.

- Suppose BTC/USD has a ‘buy’ price of $45,000, and;

- The ‘sell’ price of the pair is $45,200

- This implies a spread of 0.4%

The implication of this is that, for you to attain the break-even point, you must secure a profit that covers the 0.4% gap.

Other Trading Fees

Asides from the main trading fees discussed above, there are some other charges you need to consider when choosing a broker.

We have discussed the common ones below:

- Overnight Charges: If you’re swing trading CFDs and you leave the position open for more than a day, you’ll pay a fee. This fee will be paid for each day the position is left open.

- Deposits and Withdrawals: This is another fee you need to consider before choosing a broker. On some crypto swing trading platforms, you’ll be required to pay a fee when you make deposits and process withdrawals.

- Fees for Inactivity: When you open a trading account, most brokers expect you to keep it active. If your account is deemed inoperative, you might be charged a monthly fee for inactivity. This is a fee that remains intact until your account becomes active or you run out of funds. However, if you keep a long position open, you have nothing to worry about.

For cost-effective crypto swing trading, choose a spread-only broker. For brokers in this category, you only have to worry about making enough profit to cover the difference between your ‘ask’ and ‘bid’ price. Examples of spread-only brokers include bybit and AvaTrade.

Payment

Supported payment options at a broker are another relevant metric to use when choosing a crypto swing trading platform. The best brokers are those that support different payment types, making it seamless for you to make deposits and process withdrawals.

Therefore, you should look out for swing trading platforms that support debit/credit cards, e-wallets, and wire transfers. This way, you can switch from one payment option to another depending on which suits your needs.

Customer Support

It’s highly satisfactory when you need to reach a broker’s customer support unit and you get a fast response. This not only boosts your confidence in the broker but also helps you get on with swing trading as smoothly as possible.

Here are some things you might want to consider:

- 24/7 Availability: You can never say when you’d need to reach a broker’s customer support. Therefore, if you can access a broker’s customer support 24/7, that’s a significant factor to consider.

- Support Channels: The best brokers provide various methods to reach a customer care representative. Some of the channels you should look out for include live chat and telephone support.

As such, you should read reviews from users concerning the responsiveness of a broker’s customer support unit.

Swing Trade with Leverage

You are most likely learning how to swing trade crypto for the purpose of making profits. An effective way to go about this is to use leverage when trading. Therefore, assess whether your chosen broker offers leverage and what limits are available.

For instance, suppose a broker allows you to swing trade crypto with up to 1:2 leverage. The implication of using this leverage is that you can stake $100 to open a $200 position.

Best Brokers For You to Swing Trade Crypto

If you have to search the market and assess all brokers based on the metrics we’ve discussed, you might find the process tiring. Therefore, to save you the trouble, we have highlighted below the top brokers for you to swing trade crypto from the comfort of your home.

All of the brokers listed below are superb for newbies and heavily regulated, and it shouldn’t take you more than five minutes to open an account with your chosen provider.

1. bybit – Overall Best Broker To Swing Trade Crypto

bybit prides itself as a leading broker that makes swing trading convenient for beginners. The platform provides a copy trading tool that allows you to get started in the cryptocurrency markets seamlessly. With this tool, you can identify leading traders and copy their open positions like-for-like. This way, you can make profits from swing trading without having prior knowledge of this marketplace.

Furthermore, bybit allows you to make payments using different options including debit/credit cards, e-wallets, and wire transfers. You can get started with the broker by depositing a minimum of $200 in your account. But more importantly, you can start swing trading crypto for as little as $25 per position. With this cost-effective structure, the broker serves more than 20 million users across many cryptocurrency markets.

Since you’re swing trading, you may enter the market in different ways based on your desired strategy. For instance, if you’re swing trading for a few days or weeks, you can buy crypto tokens and hold them until you decide to exit the market. On the flip side, if you’re swing trading a position for less than 24 hours, your best bet is to utilize CFDs. This will allow you to trade with leverage and gain access to short-selling facilities

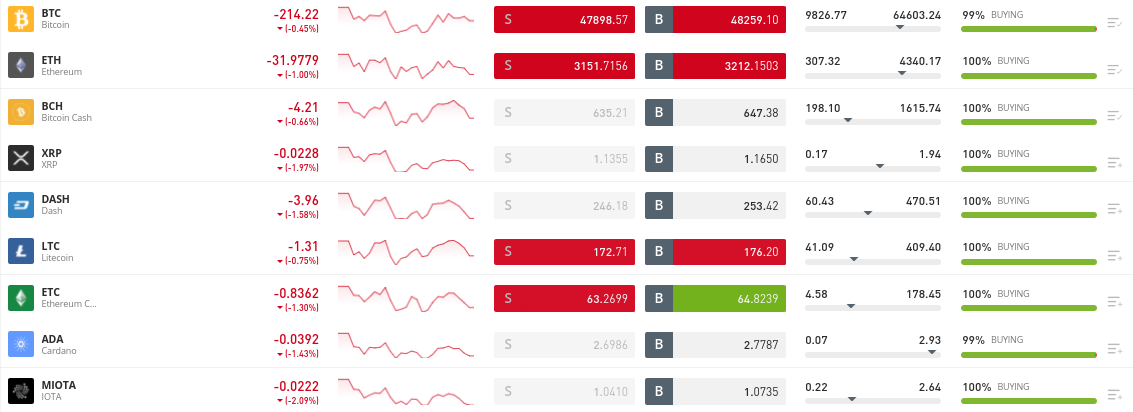

When it comes to fees, bybit doesn't charge variable commissions like other brokers in this space. On the contrary, you will only need to cover the spread. When swing trading crypto at bybit, the spread starts at just 0.75%. In terms of supported markets, bybit offers dozens of pairs. This includes popular tokens like Ethereum, Bitcoin, and XRP - as well as more recent additions to the industry - such as Decentraland and AAVE.

Finally and perhaps most importantly, bybit is a regulated broker audited by top financial authorities such as CySEC, the FCA, and ASIC. This heavy regulation keeps the broker in check and ensures the crypto swing trading platform stays within its established scope of operations. Consequently, users get a reasonable level of protection when swing trading with this broker.

- Swing trade dozens of crypto assets on a spread-only basis

- Regulated by the FCA, CySEC, and ASIC - also approved in the US

- User-friendly platform and minimum crypto stake of just $25

- $5 withdrawal fee

2. AvaTrade – Great Swing Trading Platform for Technical Evaluation

If you’re swing trading crypto, you’ll want access to technical analysis tools and charts that help you understand the markets. While this might take a while to learn, it’s a crucial part of your swing trading journey, as it helps you to make informed choices. From our review, the best broker that offers technical analysis tools when swing trading is AvaTrade. The broker provides in-depth charts and technical indicators that you can leverage to make consistent gains.

Furthermore, the platform supports an impressive selection of cryptocurrency markets. Depending on your trading strategy, you can decide to go long or short. Whichever method you choose, you can trade all available markets with leverage, which is an effective feature you can use to boost your returns. AvaTrade also supports third-party platforms such as MT4 and MT5, all of which feature technical analysis tools that make it easy to assess trend lines.

Additionally, when you’re swing trading, you’ll want to consider a broker that’s cost-effective. AvaTrade ticks this box since it’s a spread-only broker, meaning you don’t have to pay any commissions. This will help you retain more of your trading profits. Furthermore, you pay no fees on deposits and withdrawals. The platform also supports various payment options, making it easy for you to deposit funds.

When it comes to swing trading, choosing a regulated broker is important if you want some credibility. AvaTrade is licensed in over seven jurisdictions, indicating the broker’s reliability. Furthermore, the broker allows you to get started easily by offering a demo account that you can use to practice crypto swing trading risk-free. Once you’re ready to swing trade with real money, simply make a minimum deposit of $100 and get started.

- Lots of technical indicators and trading tools

- Free demo account to practice swing trading

- No commissions and heavily regulated

- Perhaps more suited to experienced traders

How Does Swing Trading Work?

As earlier established, you trade crypto in pairs. This means that when you’re trading a particular token, you must do so against another asset. Therefore, when you’re swing trading, you’ll need to choose between crypto-cross or fiat-to-crypto pairs.

If you’re trading crypto-pairs, this means your other asset will be a digital token such as ETH and BTC. On the other hand, if you’re trading fiat-pairs, the other asset will likely be USD among other currencies. Each of these pairs has an exchange rate that shifts every second based on wider market movements.

Therefore, a pair will witness an increase if more people are buying it. However, if more people are selling off the pair that you’re swing-trading, then the value will decrease.

- Fiat Pairs: This is one of the two options available. Here, the pair will include a fiat currency and a digital asset. Since USD is the default industry currency, it’ll likely be the fiat option you’ll get in this pair. Examples of fiat-pairs include BTC/USD and ETH/USD. Additionally, fiat-pairs offer you access to tighter spreads and more liquidity, which are features that make your crypto swing trades more profitable and seamless.

- Crypto Pairs: The other option is to trade a crypto asset against another competing token. Here, you might trade Ripple against Bitcoin. This pair would be displayed as XRP/BTC.

However, it’s preferable to go with fiat trading pairs, especially if you’re a beginner in the cryptocurrency scene. This is because crypto-cross pairs can be difficult to understand sometimes.

Once you decide on which pair to go with, the next thing is to determine the order which you’ll use to enter the market. There are essentially two orders you can use in this respect.

These are the ‘buy’ and ‘sell’ orders.

- For a ‘buy order,’ this comes into play when you’re expecting the token you’re swing-trading to increase in price.

- However, if you’re expecting a value decrease, then you should use a ‘sell order.’

Next, you’ll need to know the order types by which you can instruct the broker on how to open your trade. Here, you also have two types, namely ‘market order’ and ‘limit order.’

- Market orders are used when you’re fine with the broker opening your position at the next available price.

- However, if you have a target price in mind when swing trading, you can set your broker to open your position when the token reaches that point. To do this, you’ll use a limit order.

Notably, when you swing trade crypto, it’s often because you want to make a profit from market changes. Therefore, to enter and exit trades, you must have target prices in mind.

After all, swing trading is about making consistent gains across numerous short-term trades. This means that a limit order will be more favorable to use since you can set the entry point for opening your positions.

Best Strategies To Swing Trade Crypto

Since you’re swing trading crypto to make returns, you must understand the different strategies you can use to maximize your positions. Experienced crypto swing traders use these strategies to secure profits and have a thorough understanding of the markets.

Therefore, pay attention to the crypto swing trading strategies discussed in this section.

Minimize Trading Costs

As we mentioned earlier, brokers charge different fees on your trades. The effect of this is that a broker with a high-fee structure will adversely affect your returns. You’ll end up paying one fee or another, all of which accumulates to reduce the size of your potential swing trading profits.

- Therefore, it’s smarter to assess different brokers and decide on which to swing trade with.

- In that case, one significant factor you should consider is the broker’s cost-effectiveness.

- This is why bybit stands out among other brokers, as it is a spread-only trading platform.

Following your assessment, decide on a credible broker and subsequently use the platform for your crypto swing trades. That way, you can avoid using different brokers and losing your profits to necessary fees.

Set Stop-Loss Orders

In learning how to swing trade crypto, you must know how a stop-loss order works. This is crucial, as it will ensure you are able to swing trade in a risk-averse manner. In doing so, you will ensure that you do not burn through your trading capital.

This means that even as a swing trader, although not mandatory, you can close multiple trades within a day based on the forces of demand and supply. This is why you need to set a stop-loss for your swing trades.

With this feature, you can instruct the broker on the amount of loss you’re willing to incur on your open position. Therefore, once the token you’re swing trading hits that price, the broker automatically closes your trade.

For instance:

- Suppose you enter the BTC/USD market at $45,000

- You can set a stop-loss order at 10% below the entry price

- This will be equivalent to $40,500

- This means that if the market doesn’t move in your favor, the broker will close your position once Bitcoin reaches $40,500

On Balance Volume (OBV) Indicator

OBV is one of the popular indicators used by crypto swing traders to assess the market and make speculations. The indicator is volume-based. This means that it predicts potential market movements based on the volume of a token.

- The indicator keeps track of an asset’s volume and once there’s a price increase, the OBV recalculates the total figure for that crypto token.

- This indicator is based on the notion that a crypto token’s volume determines its current and future price.

- For instance, if a market is on a downward trend, this means that more people are selling than they are buying.

A swing trader might leverage this information to determine whether to enter a market or exit it. To that end, swing traders leverage the OBV to make their decisions. Therefore, the direction of a market’s OBV figure could tell a trader whether there’ll soon be a price increase or decrease.

Market Alterations

Since cryptocurrencies are volatile, you should expect market trends to change each and every day. In most cases, when too many investors sell off their assets, the market can move in the opposite direction. However, the downward movement of an asset doesn’t mean it won’t rise again.

As a swing trader, you could enter such a market for the ultimate purpose of gaining from the reversal when it happens. This is a way many crypto swing traders make consistent gains in the market. However, doing this must mean you’re informed about the pair you’re swing trading.

This takes us to the last strategy to be discussed in this section — research.

Do Your Research

When you’re learning to swing trade crypto, you’re are required to research the market on a regular basis. After all, the cryptocurrency scene is characterized by uncertainty. This is why decisions must be made after due diligence and understanding of the crypto asset in question.

Always read on the trajectory of a project and how it has performed in the market. This is how you can create a sustainable swing trading plan that will help you to accumulate returns over time.

Benefits of Crypto Swing Trading

Despite all we have discussed thus far, you may still have doubts about swing trading crypto. This might be the case if you’re a beginner and you’re trying to know all that’s important before entering markets.

To help gain more insights, here are some benefits of swing trading crypto.

More Time to Analyze The Markets

Sometimes, you might open a trade without having all the information you need. This might be because your analysis of the market suggests that it’s a good time to do so. Yet, after opening the trade, you’ll want to know more about the market.

Since you can keep your positions open for more than a day, you get the time you need to evaluate the market appropriately and make informed trading decisions.

Leverage

In learning how to swing trade crypto, you definitely want to know the ways to maximize your positions. Leverage is an effective way to go about that, as this feature allows you to open positions even when you don’t have the required capital. This means that with leverage of 1:10, you can open a $1,000 position with just $100 in your trading account.

Risks of Crypto Swing Trading

The crypto industry is one that involves different forms of risks. Here, we discuss the ones you need to know about before starting your crypto swing trading journey.

Volatility

Although you don’t have to constantly look over the charts when swing trading, you still need to be aware of price movements. This is because the cryptocurrency scene is characterized by high volatility, meaning prices can take the opposite direction at any time.

Therefore, as a crypto swing trader, you must know when to use your take-profit and stop-loss orders accordingly. This way, you’d be able to hedge your risks effectively.

Unregulated Trading Platforms

Unregulated exchanges will allow you to swing trade without completing a KYC process. However, this is often at the expense of security, as these exchanges are less credible when compared against regulated brokers.

Using brokers like bybit and AvaTrade places you in a better position to maximize your swing trades on a legitimate platform. Not only is this because they are heavily regulated, but they are spread-only brokers that provide a fair and transparent trading arena.

Learn How to Swing Trade Crypto – Detailed Walkthrough

Earlier in this Learn How to Swing Trade Crypto Guide, we briefly discussed the steps required to get started in the digital asset market. If you’re a beginner in the cryptocurrency trading scene, you’ll need a more extensive explanation of how to go about those steps.

With this in mind, below you will find a detailed walkthrough of how to swing trade crypto in under 10 minutes.

Step 1: Open an Account

You have to create a brokerage account – with which you’ll swing trade. Regulated brokers will require you to complete a KYC process before fully activating your account.

Here, you’ll need to provide some personal details, upload a government-issued ID, and submit a utility bill/bank statement to validate your address.

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Fund Your Account

Here’s where you make a deposit into your trading account. Identify the broker’s minimum deposit requirement and add funds to your account accordingly. For instance, with bybit, you’d need to deposit at least $200.

Additionally, you can also use different payment methods for this purpose, including debit/credit cards, e-wallets, and wire transfers. But as a swing trader, you might want to prioritize the first two payment options, as wire transfers can be slow.

Step 3: Choose a Market

Once you’ve made a deposit into your account, you can now proceed to swing trade. But first, you must select a trading pair.

So, if you want to swing trade Algorand, simply input the token name in the search box to find it.

Step 4: Open your Trade

On the token’s page, decide on the order you want to use.

Remember – you can choose between a ‘buy’ and ‘sell’ order. Following that, enter your stake, and open the trade!

Learn How to Swing Trade Crypto – Conclusion

In this Learn How to Swing Trade Crypto Guide, we have explained in detail all you need to know. If you want to make small but consistent gains in the crypto markets, swing trading is your best bet. But to ensure you get a high-quality experience, choose a regulated broker that offers cost-effective trading fees.

For this purpose, bybit stands out – as the regulated broker allows you to swing trade crypto on a spread-only basis. Following that, learn the many swing trading strategies that you have at your disposal and incorporate them to maximize your profit potential.

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

How do you swing trade crypto?

You simply need to start by opening a trading account, preferably with a regulated broker. After that, deposit funds into your account and place a buy or sell order. Remember that you should only swing trade crypto after properly researching your chosen pair.

Where can I swing trade crypto?

The cryptocurrency trading industry is huge. As such, there are many trading platforms for you to use. But if you’re looking to swing trade in a cost-effective manner and with a regulated broker, the best options are bybit and AvaTrade.

Can you swing trade crypto with leverage?

This is perhaps another reason why you need to be careful about the broker you choose. Regulated brokers like bybit and AvaTrade will allow you to trade leveraged CFDs. This is offered in a licensed and safe environment – which can’t be said for the leverage offered by unregulated crypto exchanges.

How can I make money from swing trading crypto?

This is where effective strategies come into play. If you’re looking to make small but consistent returns from your crypto swing trades, use technical indicators, study charts, take advantage of market movements, and do your research.

What is the best crypto pair to swing trade?

BTC/USD. Most swing traders choose this pair, which contains both Bitcoin and the US dollar. Additionally, the pair offers you the tightest spreads and largest liquidity levels.