Bitcoin SOPR Metric Indicates Increasing Bullish Outlook By Investors

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Free Crypto Signals Channel

That said, analysts have compared the current metric levels to the market conditions of last year, which was regarded as the end of the bear market in that year.

According to the Glassnode data shared by analysts, the SOPR currently shows stark similarities with the summer of 2021, which they argued is a bullish sign.

When the metric crosses over the value of 1, it indicates that short-term holders (STHs) are offloading their holdings to realize profits, indicating that bullish sentiment has returned to the market. On the contrary, when the value of the SOPR drops below 1, it means that STHs are selling their holdings at a loss.

At press time, the metric has almost returned to levels not seen since 2021, which marked the end of the bearish market and the beginning of a bullish one. Pseudonymous cryptocurrency analyst, “SwellCycle,” recently highlighted the similarities between both markets on Twitter, asserting that the value has crossed one as it did in May to June 2021.

SwellCycle also noted that the bottom of the market had been achieved, which interestingly coincides with the trend reversal seen in Bitcoin of late.

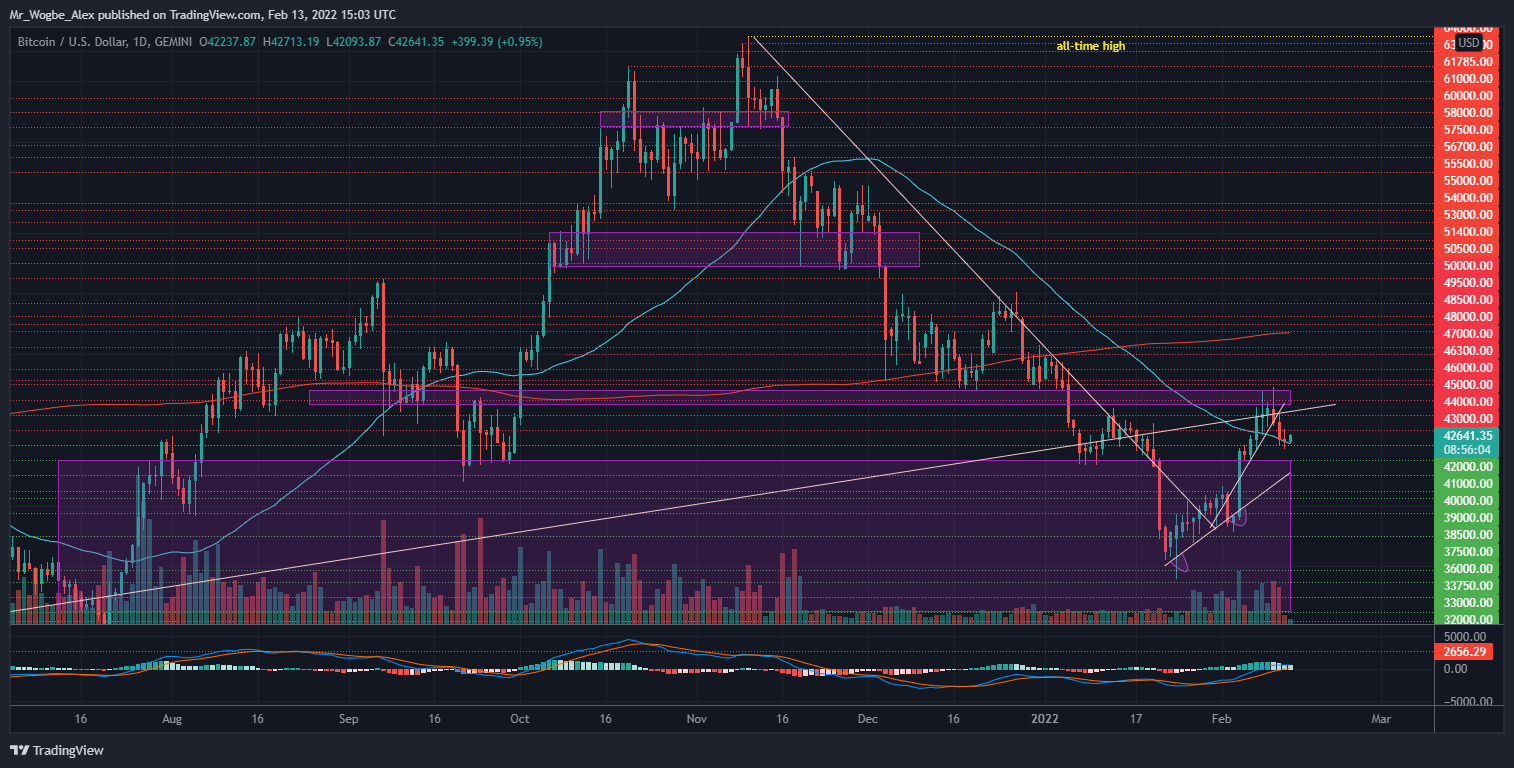

Key Bitcoin Levels to Watch — February 13

After suffering another rejection around the $45.65K barrier, BTC has spent the last 48 hours on a sideways range between $43K and $42K. The benchmark cryptocurrency appears to have received support from the daily 50 SMA after the rejection, which frustrated a sustained decline for BTC.

In light of the new SOPR sentiment in the market, the primary cryptocurrency could resume a bullish charge in the near term. On this bullish resumption, I expect to see BTC retest and obliterate the $45.65K pivot top and aim for the daily 200 SMA at $49.5K.

Meanwhile, my resistance levels are at $43,000, $44,000, and $45,000, and my key support levels are at $42,000, $41,000, and $40,000.

Total Market Capitalization: $1.91 trillion

Bitcoin Market Capitalization: $807.7 billion

Bitcoin Dominance: 42.2%

Market Rank: #1