What is Cryptocurrency Staking?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Crypto Staking is a way that crypto holders can earn interest on their staked crypto. To do this, crypto holders will have to deposit their cryptocurrency in a wallet that has staking functionality. They leave it there for a certain period of time.

How Does Cryptocurrency Staking Work?

Staking one’s cryptocurrency helps the blockchain in two ways, known as Security and Transaction verification. Cryptocurrency holders help the blockchain network when they stake their crypto holdings. And, as a reward, they are earning interest on their staked crypto. When people stake their crypto, the network will then pick some of these people to validate transactions on the blockchain. How much do crypto individual stakes, increases his or her chances of getting selected?

Various Ways of Staking

Staking can be done in four ways. The first way is by delegating. This is for cryptocurrency investors who don’t want to function as transaction validators. Such crypto investors contribute their crypto to a validator that pools crypto from other investors for staking. In return, these investors get a fraction of the reward paid to the validator for his or her efforts.

The second way is by staking one’s crypto via a pool service. Examples of such services include Stake.fish and RocketPool. This pool staking method sums up many validators into one pool to get higher staking rewards.

The third method of staking is via liquid staking services. An example of such a staking platform is Lido. This enables crypto holders to get staking rewards while they are still in possession of their tokens. Nevertheless, this may be too complicated for crypto investors who are new to staking.

The fourth and last method of staking is by running one’s staking node. However, this involves a lot of technical skills as well as equipment. The reward that comes with this is greater governing rights.

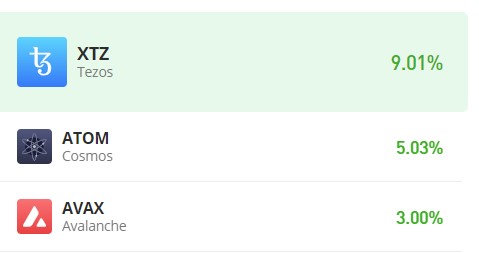

Examples of Well-Known Tokens That are Used for Staking

Here are some examples of well-known tokens that can be staked. The fame of these cryptos comes from a lot of things, like the project itself and market capitalization.

Tezos (XTZ)

This project started in 2014, Tezos is a crypto that supports smart contracts. Also, it possesses a self-repairing mechanism to elude “hard forks.” Tezos has a market capitalization of $1 billion and is famous for the potential it has for the future. To be a baker (Validator) on the XTZ blockchain, such an individual will have to possess 6,000 Tezos and a starting lock-up time of 2 weeks. However, one can delegate if he or she doesn’t have 6,000 XTZ to get a yearly percentage yield of three percent (3%).

Solana (SOL)

The Solana Blockchain is focused on DeFi (Decentralized Finance). Solana tokens were initially launched in 2020 at a price of $0.22. But by 2021, this token valued at $250, with a market capitalization of $75 billion. Subsequently, the bear market affected it, and its market capitalization dropped to $9 billion, but it still stands as one of the big cryptos.

There is no set limit for becoming a validator on the SOL blockchain. Both the delegator and validator pool have a lock-up duration of 120 hours (5 days). Meanwhile, the shared interest can be approximately 7% APY.

Cardano (ADA)

ADA has existed for close to ten years. Its proof-of-stake blockchain is a smart contract enabled with great scalability, and it took off in 2015. Cardano stands among the top 10 biggest cryptocurrencies by market capitalization at $14 billion.

Also, the ADA has no minimum limits on its lock-up period. One can just plug into any big and recognized delegated pool to commence earning interest with virtually no problem. Cardano’s APY is roughly 5%.

Where can Someone Stake Crypto?

Proof-of-stake cryptocurrencies can be staked on the following platforms:

- Exchanges like Binance and Coinbase.

- Staking Platforms.

- Private wallets.