Bitcoin Eyes $47k; Glassnode Highlights Possible Short Squeeze

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin (BTC) recorded its highest point in over twelve weeks, $46,730 in the early hours of Tuesday, as market sentiment remains bullish. At press time, the benchmark cryptocurrency trades around the $46k psychological level about 30% away from its all-time high of $64,800, following a minor dip.

In its weekly review published on Monday, on-chain analytics provider Glassnode noted that:

“As a well-observed technical indicator for bull/bear bias, the market’s response to a rejection or breach of the 200-day MA is likely to be a source of attention over the coming weeks.”

The analytics provider also noted that there exists the potential for a Bitcoin supply squeeze. Glassnode revealed that there also exists a significant recovery of Long-Term Holder (LTH) owned coins. The company detailed that the total supply held by this group of investors has reached 12.48 million BTC, which is notably similar to the volume of cryptos held by LTHs in October 2020, right before the 2021 bull run began. Glassnode explained that:

“This on-chain response is largely indicative of the volume of coins that [got] accumulated in Q1 2021 that remain tightly held. It too paints a quite bullish picture for aggregate market conviction.”

According to the analytics company, increases in LTH Bitcoin supply indicate bear market accumulation, and bull runs get triggered by supply squeeze forged in bear markets.

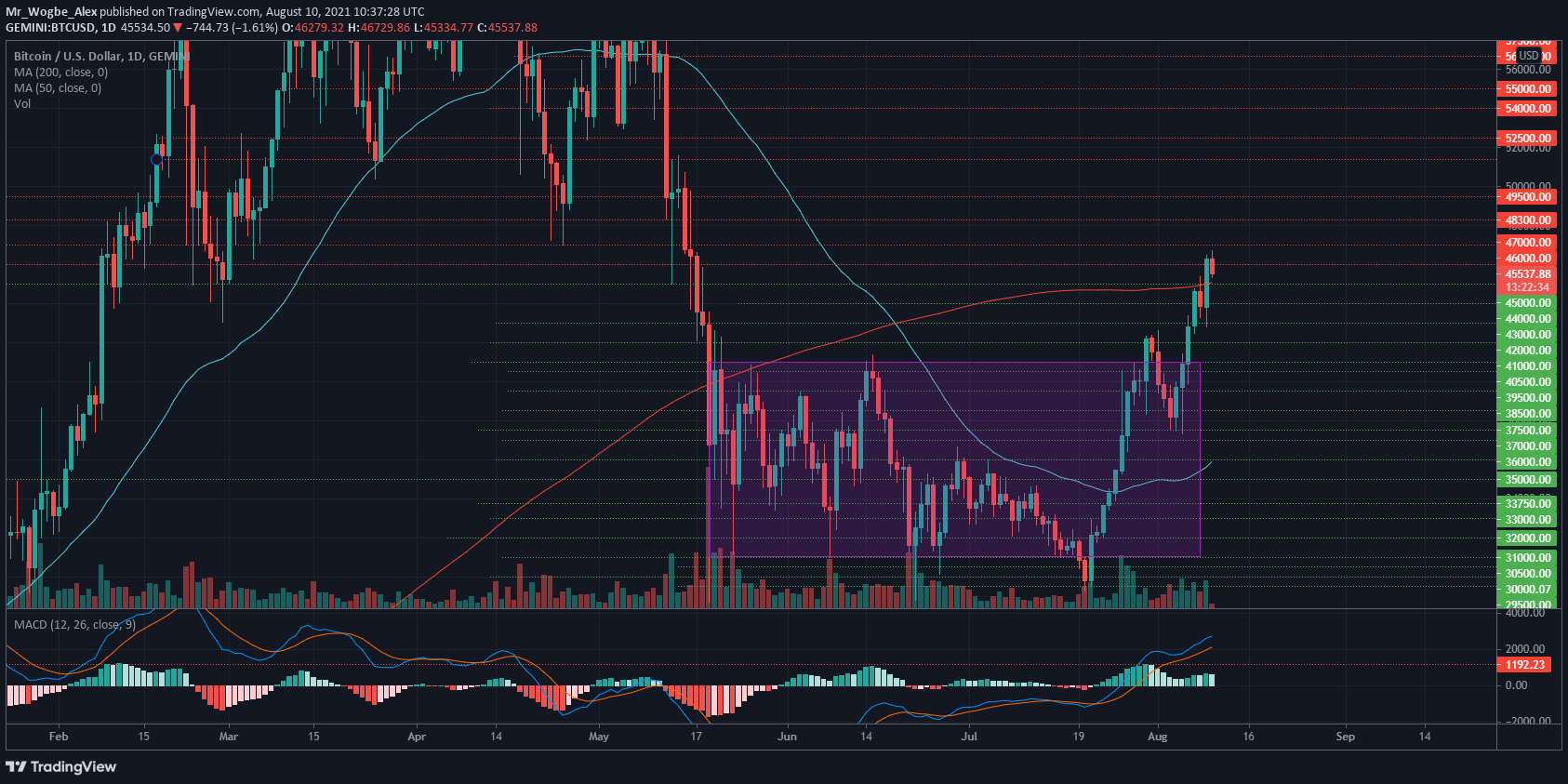

Key Bitcoin Levels to Watch — August 10

BTC has finally broken above the critical 200 SMA on our daily chart, typically regarded as a strong bullish indicator. The primary cryptocurrency needs a move above the $47k resistance to solidify its bullish resurgence towards the $50k psychological resistance.

That said, bulls need to keep the price above the $45k support to confirm a bullish continuation over the coming days. However, BTC has ventured into overbought conditions, making it likely to see a correction believe the $45k support soon.

Meanwhile, our resistance levels are at $46,000, $47,000, and $48,000, and our key support levels are at $45,000, $44,000, and $43,000.

Total Market Capitalization: $1.85 trillion

Bitcoin Market Capitalization: $854.9 billion

Bitcoin Dominance: 46%

Market Rank: #1