Bitcoin Faces Tumble as Market Witnesses $426 Million Liquidation

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin, the pioneer in cryptocurrencies, encountered a significant stumble today, witnessing a 7% plunge from its pinnacle at $43,810 to a low of $40,400. Simultaneously, the second-largest crypto, Ether, also dipped 8.5% to $2,145, mirroring the trend in various altcoins.

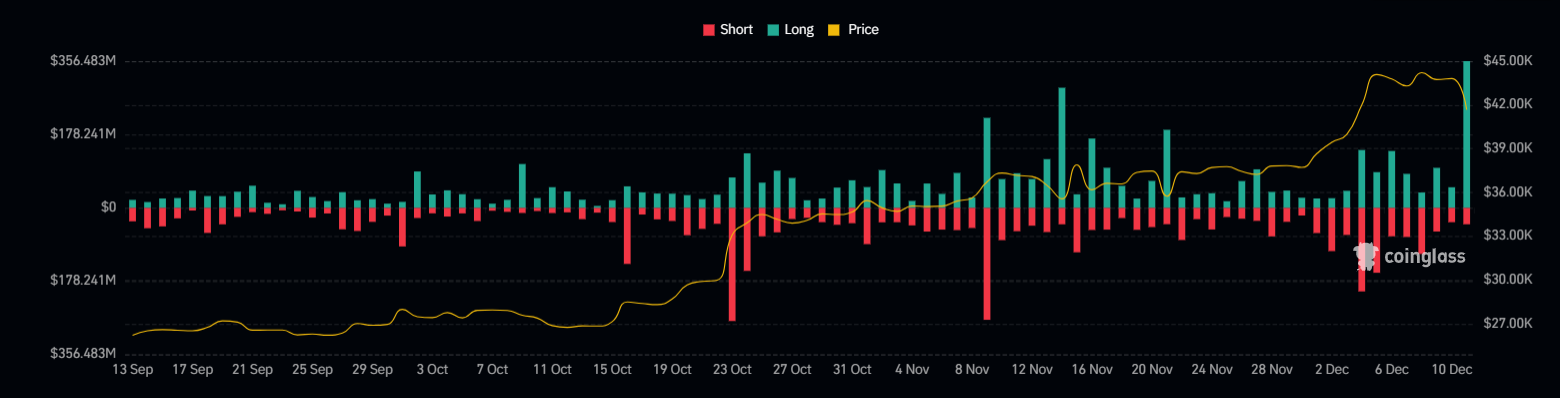

This abrupt downturn sparked a cascade of liquidations on centralized exchanges, leading to traders losing their positions due to insufficient funds. CoinGlass data reveals approximately $121 million worth of Bitcoin positions were liquidated, with $103 million stemming from long positions. The collective liquidations across the crypto spectrum amounted to a staggering $426 million.

Liquidations transpire when traders are compelled to close positions owing to adverse market movements that deplete their initial margin or collateral. This phenomenon is particularly prevalent in derivatives markets, where leverage is utilized to amplify potential gains or losses.

Google Amends Crypto Laws Ahead of Possible Bitcoin ETF Approval

In a parallel development, Google announced a revision of its cryptocurrency ad policy, permitting the promotion of “Cryptocurrency Coin Trusts” in the U.S. commencing January 29. These financial products enable investors to trade shares in trusts holding substantial amounts of digital currency.

The policy, globally applicable to all Google accounts, comes with a caveat: advertisers must adhere to local laws in other regions. Google, in a stern warning, emphasized that policy violations would result in account suspension following prior notice.

Interestingly, Google’s policy shift aligns with the anticipated approval of spot bitcoin exchange-traded funds (ETFs) in the U.S. by the Securities and Exchange Commission (SEC). However, ambiguity shrouds whether ETFs would qualify as “Cryptocurrency Coin Trusts” according to Google’s definition.

The SEC is poised to decide on applications from notable firms, including BlackRock, Bitwise, WisdomTree, Invesco, Fidelity, Valkyrie, and VanEck, between January 5 and January 10.

Okay the window for potential spot #Bitcoin ETF approval is looking like its gonna be between Jan 5 & Jan 10 2024. I spoke with @thomasg_grizzle & @ScottW_Grizzle this morning and nailed this call. https://t.co/sOU950QlXj pic.twitter.com/y9JYdEpjNH

— James Seyffart (@JSeyff) November 30, 2023

The crypto market remains on edge, with Bitcoin traders navigating through volatile waters amid liquidations and regulatory updates.