Uniswap (UNI/USD) Markets Are Pushing High Below a Depression

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – May 18

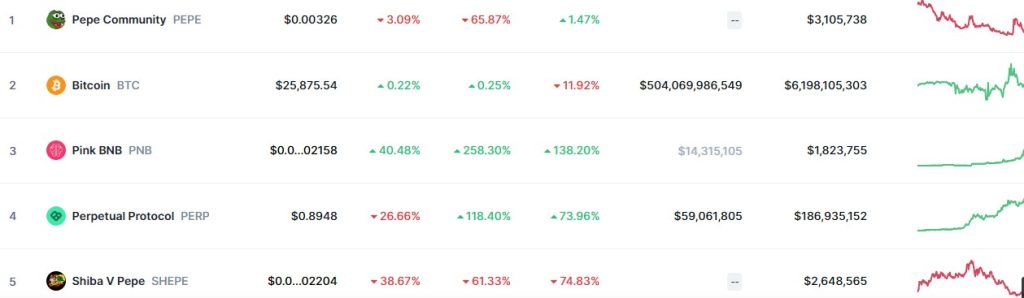

The UNI/BTC markets operations have been pushing high below a depression setting over time. The crypto=economic trade lacks the positive tendency of keeping surges through resistance lines around $6 as the last several hours have produced high and low trading zones of $5.4266942 and $5.2987511, maintaining a minute negative pf 0.50. As a result of that sentiment, long=position takers needed to suspend actions. It’s still good for investors to keep their positions, running ahead of the upcoming bullish market trend.

UNI/USD Market

Key Levels:

Resistance levels: $6, $6.50, $7

Support levels: $4.50, $4, $3.50

UNI/USD – Daily Chart

The UNI/USD daily chart showcases the crypto-economic markets are pushing high below a depression formation and have featured around the trend line of the bigger indicator. The 14-day SMA trend line is at $5.4539831, underneath the $5.8002622 value of the 50-day SMA. The Stochastic Oscillators are at 72.60 and 85.76 levels. That portends the capacity of buyers is vastly approaching exhaustion.

What is the UNI/USD market‘s trading gravitation weight to the upside over the buying signal sides of the SMAs?

The UNI/USD trade operations to the upside are likely not to play out sustainably above the buy signal side of the 50-day SMA trend line in the near time, as already been observed that crypto markets are pushing high below a depression. At this point, we expect traders wishing to go longing to put it on hold.

On the decreasing-moving direction of the technical analysis, it is likely to witness a bearish trading candlestick around the trend line of the 14-day SMA. The maximal barrier-trading line is at around $6. In the meantime, shorting of positions isn’t as well encouraging for bears to embark upon.

UNI/BTC Price Analysis

In contrast, the pushing rate in the market operations of Uniswap against Bitcoin still observes the mode of pushing high below a depression setting around the smaller SMA trend line. The 50-day SMA indicator is above the 14-day SMA indicator. The Stochastic Oscillators are in the overbought region, pointing northbound in a tentatively-moving manner to suggest the buying stance is on the verge of peaking shortly. Nonetheless, the base crypto may not lose back to revisit its previous low.

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK