Uniswap (UNI/USD) Price Is Correcting, Reshaping for Recoups

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – March 15

A relaxation pushing velocity has been occurring in the way that bulls have been formerly featured, as the UNI/USD market is correcting and reshaping for recoups near the line of $12.50.

The stochastic oscillators in the oversold area are creating a bouncing-myth crypto signal as they attempt to finish their moves around the middle Bollinger Band, indicating that more downward forces are probably not going to be felt. In conclusion, it is anticipated that purchasers will reclaim their positions at the expense of a bullish candlestick.

UNI/USD Market

Key Levels:

Resistance levels: $17.50, $20, $22.50

Support levels: $12.50, $10, $7.50

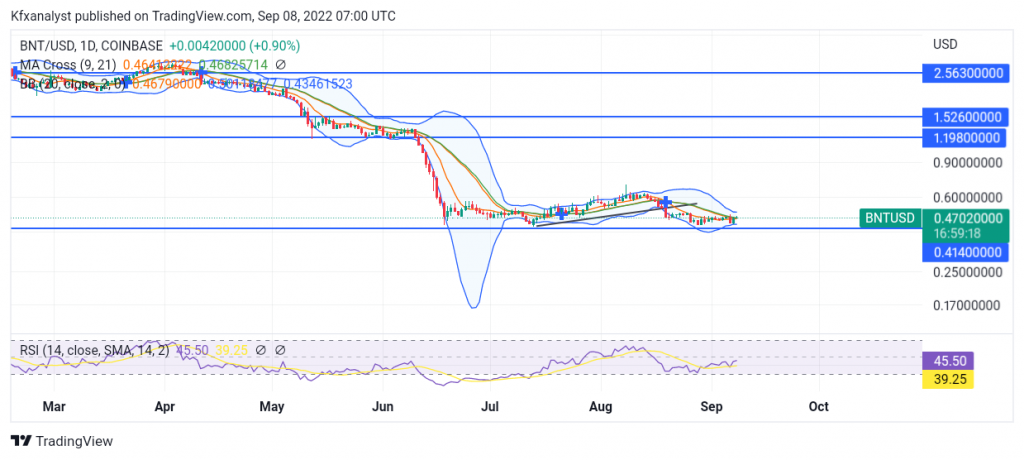

UNI/USD – Daily Chart

The UNI/USD daily chart showcases that the crypto market is correcting, reshaping for recoups toward the middle Bollinger Band.

The impact of uprising forces in recent operations has placed the Bollinger Bands to the upside. In the meantime, the middle trending part of the indicators appears to be instrumental in the subsequent activities. The stochastic oscillators have the blue part stepped into the oversold area.

What trading pattern is the UNI/USD market presently sticking to at the locations of the Bollinger Bands?

As it has been observed technically, a relaxation price action in the UNI/USD trade has produced a pattern in the form of ranges, given that the crypto market is currently correcting and reshaping forrecoups.

Given the state of the market, it appears that long-position placers will need to see the reemergence of a bullish candlestick in order to get decent long-term entry orders. A substantial harder support has been formed around the lower part at $10 for buyers to return upwards, based on a worst-case scenario against bulls from about the middle Bollinger Band’s zone.

It doesn’t seem psychologically acceptable for bears to obtain more consistent pushes southward at this time, as evidence suggests that downward forces have been reaching lower ends. If that assumption is given another perfect outlook, then before the stochastic oscillators obtain a decent entry for shirting position orders, they must obtain a positional form to a higher location to point back south.

UNI/BTC Price Analysis

In contrast, the Uniswap market has been placed under a correction against Bitcoin, reshaping for recoups from around the middle Bollinger Band.

In the oversold area, the stochastic oscillators have been positioned southerly across a few points. The Bollinger Band trend lines are momentarily oriented upwards, offering pivotal marks that the market has been retreating from. It seems that the basic cryptocurrency is receiving a heads-up to rise again soon.

\

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK