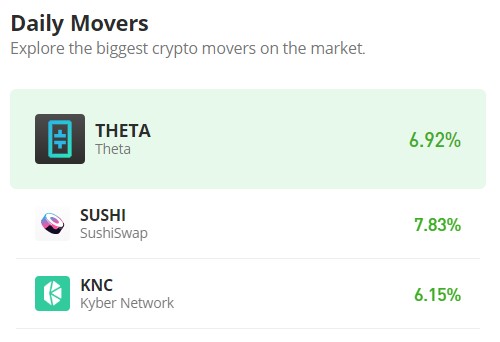

Uniswap (UNI/USD) Trade Is in an Overbought State, Risking a Fall

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – June 22

The Uniswap market activity is in an overbought state, risking a fall as the price trades around $4.8209963 between the high and low-value points of $4.9070530 and $4.7675727.

Buyers’ positive rate of percentage is kept around 0.99, suggesting that the motion to the north is tending toward an exhaustion stage. That being the case, any subsequent pushes past the overhead barriers will undoubtedly need to slow down at some point because there has been a slow-moving sign a little bit over the mid-point range limitations that have been pointed out.

UNI/USD Market

Key Levels:

Resistance levels: $5, $5.50, $6

Support levels: $4, $3.50, $3

UNI/USD – Daily Chart

The UNI/USD daily chart reveals the crypto-economic trade is in an overbought condition, risking a fall around the resistance of $5.

The furtherance of the formation of the trading candlestick to the upside against the smaller indicator poses a fake gravitational propensity index toward achieving a higher point up to the upper range line of $5.50. The Stochastic Oscillators are in an overbought position with a stretch mood, maintaining a range of 96.86 to 100.00 points to indicate that the upward movement is slowly approaching an end.

What would happen if the UNI/USD market pushed through more barriers to the 50-day SMA?

At this time of the technical write-up, the UNI/USD market operation tends not to break through some overhead resistances before the main point at $5.50 in a rush as the crypto market is in an overbought state, tempting to risk a fall in no time.

The situation at hand provides that long-position takers should be wary of a retracement process against the wall of the bullish candlestick formed against the trend line of the 14-day SMA recently. In the wake of maintaining a psychological trading point of view, buying sprees would have to be systematically pushed northward to the upper range point of $5.50 in the long run.

On the downside of the technical analysis, an extreme trading session has been signaling the necessary repositioning of stances by the UNI/USD bears between $5 and $5.50 levels. The 50-day SMA, located at $5.2597509, has identified the critical resistance of those values. Sellers may therefore plan on returning to those prices if a volatile occurrence that could cause an unheard-of spike doesn’t take place.

UNI/BTC Price Analysis

In contrast, the Uniswap market is yet to push back northwardly against the trending ability of Bitcoin, risking a fall underneath the trend lines of the SMAs.

The positioning of the Stochastic Oscillators from the overbought region to 58.43 to 49.96 levels poses an affirmation signal to ascertain the pace that the velocity has been keeping underneath the 50-day SMA indication, which is the 14-day SMA indicator. Before deciding when to buy back from a downturn, it would be the best trade strategy to let the oscillating tool move to a zone with less active trading.

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK