Bitcoin Records Strong Performance in Q2: CoinMetrics Report

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin (BTC) has shown resilience and strength in the first half of 2023, despite a challenging second quarter marked by regulatory uncertainty, inflation fears, and regional banking turmoil.

According to CoinMetrics, a leading provider of crypto data and analytics, BTC has gained 82% year-to-date, beating most other crypto assets with a market cap of over $1 billion.

Bitcoin Severs Correlation with Wall Street

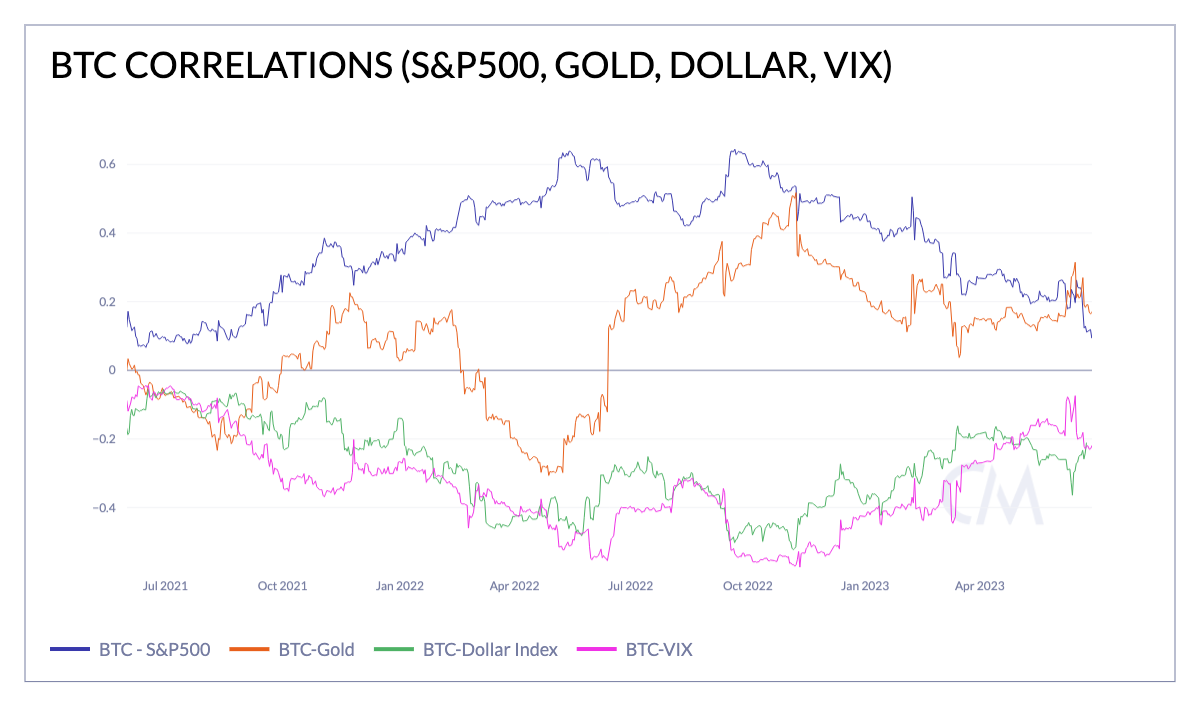

BTC also displayed a low correlation with traditional asset classes such as equities, gold, and the dollar index, indicating its potential as a diversifier and a hedge against macroeconomic risks.

CoinMetrics noted that BTC’s correlation with the S&P 500 index fell to 0.09 in the last 90 days, the lowest level since June 2021. Meanwhile, its correlation with gold rose to 0.16, reflecting its appeal as a “digital gold” and a store of value.

Lido and Bitcoin Cash Made Headways, Too

Among the top-performing crypto assets in Q2 2023, Lido (LDO) and Bitcoin Cash (BCH) stood out with gains of 95% and 133%, respectively.

LDO benefited from the anticipation of Ethereum’s Shapella upgrade, which will introduce proof-of-stake consensus and reduce ETH’s inflation. As CryptoSignals previously covered, BCH enjoyed a boost from its listing on EDX Markets, a new institutional-grade exchange backed by Fidelity, Citadel, and Charles Schwab.

On the other hand, some crypto assets suffered losses due to regulatory headwinds, such as Solana (SOL), Polygon (MATIC), and Cardano (ADA), which dropped 20% in June after being named in the SEC’s lawsuit against Coinbase. XRP, however, managed to rally 41% as the SEC vs. Ripple case approached its conclusion after more than two years of litigation.

CoinMetrics concluded that Q2 2023 was a mixed bag for the crypto market, influenced by various factors both within and outside the industry.

The report suggested that investors should pay attention to the evolving relationship between crypto and traditional markets as well as the crypto-native developments that could shape the future of the sector.

You can purchase Lucky Block here. Buy LBLOCK