Bitcoin Market to See Influx of $155 Billion from BTC ETFs: CryptoQuant

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The crypto market stands on the brink of a massive influx of capital should the U.S. Securities and Exchange Commission (SEC) greenlight spot Bitcoin exchange-traded funds (ETFs), according to a comprehensive report by CryptoQuant, a renowned blockchain analytics firm.

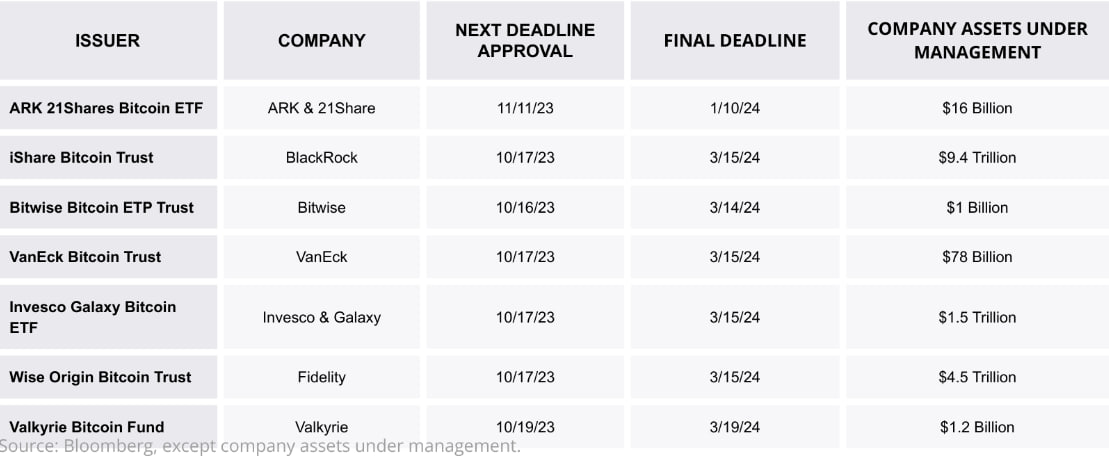

These are financial instruments designed to track Bitcoin’s price while securely holding the actual cryptocurrency in custody. For investors, these ETFs offer a gateway to BTC exposure without the need to acquire or store the digital assets themselves. Currently, the SEC has multiple applications for spot Bitcoin ETFs pending, with a critical decision deadline set for March 2024.

CryptoQuant’s analysis projects that if ETF issuers allocate merely 1% of their assets under management (AUM) to these funds, a staggering $155 billion could flood into the Bitcoin market. This substantial injection equates to nearly a third of Bitcoin’s existing market capitalization. Under this scenario, Bitcoin’s valuation could surge to an impressive $73,000.

Furthermore, the report suggests that the approval of spot Bitcoin ETFs could set off a new wave of institutional adoption, reminiscent of the 2020–2021 period when major corporations integrated Bitcoin into their balance sheets. The report contends that the next significant surge in institutional demand may originate from financial institutions offering their clients Bitcoin access through spot ETFs.

Bitcoin Surges to $30,000 Following Erroneous Reporting

Recent market events illustrate the anticipation surrounding spot BTC ETF approvals. An erroneous report by Cointelegraph momentarily sent Bitcoin prices soaring to $30,000, underscoring market optimism about this potential milestone in the crypto industry.

The report additionally underscores the growing market confidence as evidenced by the Grayscale Bitcoin Trust (GBTC) discount, which has reached its lowest level in nearly two years. GBTC, the world’s largest crypto fund with $16.7 billion in AUM, has historically traded at a discount to its net asset value due to liquidity constraints and limited redemption options.