Bitcoin’s Price Volatility Triggers Massive Short Liquidations

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

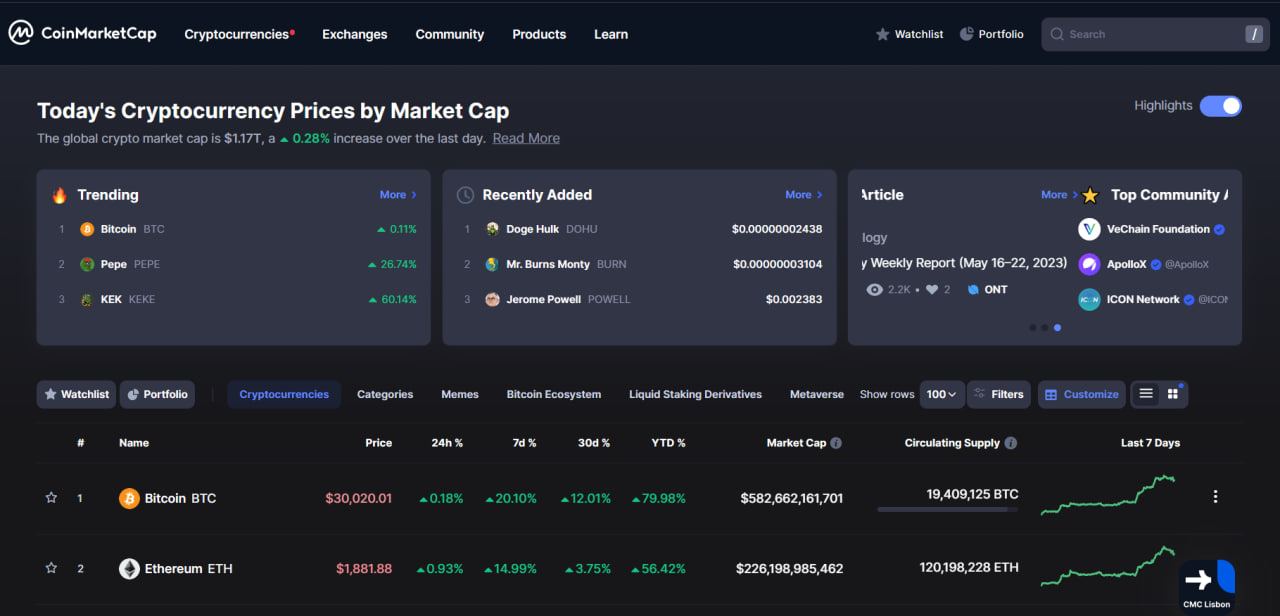

Short traders in the cryptocurrency market faced a major setback as Bitcoin’s price volatility led to the largest single-day losses since April. Recent data from CoinGlass reveals that over $178 million worth of short positions against various crypto tokens were liquidated within the past 24 hours.

In total, liquidations exceeded $203 million, encompassing both long and short positions. Bitcoin futures alone accounted for losses of $75 million, followed closely by Ethereum futures at $51 million.

Meanwhile, Binance recorded the highest losses among its counterparts, reaching $65 million. It was closely followed by OKX, with losses amounting to $58 million.

Liquidation occurs when an exchange forcibly closes a leveraged position due to the trader’s inability to meet the margin requirements. Insufficient funds to sustain the trade prompted the liquidation process.

Large liquidations often indicate potential turning points in steep price movements, enabling traders to adjust their positions accordingly. They can serve as valuable indicators for identifying local tops and bottoms in the market.

Bitcoin’s Recent Performance and Market Sentiment

Bitcoin revisited the upper-$30,000 band for the second time this year, driven by a surge in ETF filings in the United States. This influx of positive news likely contributed to a bullish outlook among traders. Consequently, major tokens like ADA, SOL, and DOGE recorded weekly gains of at least 10% each.

Bitcoin’s recent price surges have also fueled optimism among options traders, who are now placing bets on even higher prices. This sentiment marks a significant shift from the cautious outlook observed at the start of June, when regulatory actions against crypto exchanges Binance and Coinbase in the United States dampened bullish hopes.

You can purchase Lucky Block here. Buy LBLOCK