FTX Reveals $7 Billion in Assets Amid Founder’s Legal Woes

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

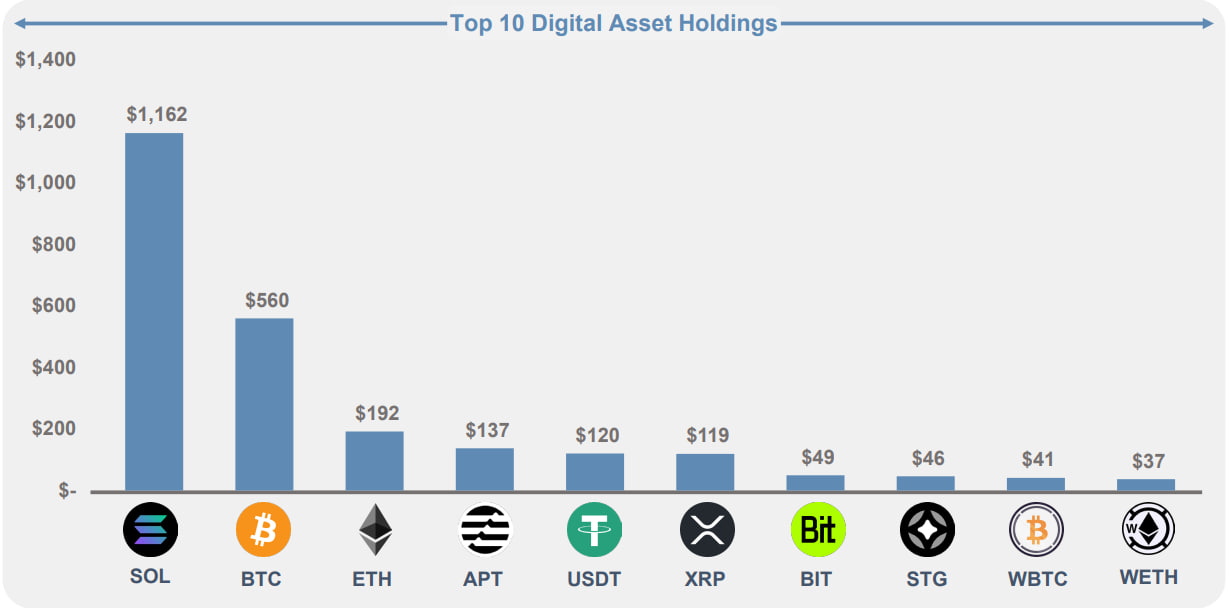

FTX, one of the globe’s major cryptocurrency exchanges, has disclosed a hefty asset portfolio valued at approximately $7 billion, per a recent court filing. The report, submitted on Monday, shines a light on the exchange’s holdings, which include $1.16 billion in Solana (SOL) tokens and $560 million in Bitcoin (BTC).

This revelation comes in the wake of FTX founder Sam Bankman-Fried facing multiple fraud charges and awaiting trial next month. Bankman-Fried’s alleged financial misconduct is under scrutiny as the exchange grappled with bankruptcy in November of the previous year.

John J. Ray III, the current CEO of FTX, has been highly critical of the previous management’s financial mismanagement and has pledged to make reparations to creditors.

According to the court document, FTX has managed to secure $1.5 billion in cash since November 11, 2022, in addition to the $1.1 billion it held at that time. Furthermore, FTX holds $3.4 billion in cryptocurrencies as of August 31, 2023, encompassing a wide array of over 1,300 tokens, some of which are lesser-known and potentially less liquid, such as MAPS and serum (SRM).

The document also sheds light on the staggering $2.2 billion in various forms, including cash, crypto, equity, and real estate, received by Bankman-Fried and other top executives in the months preceding the bankruptcy. These substantial payments may potentially be subject to legal scrutiny and could be reallocated to the pool of assets for distribution to creditors.

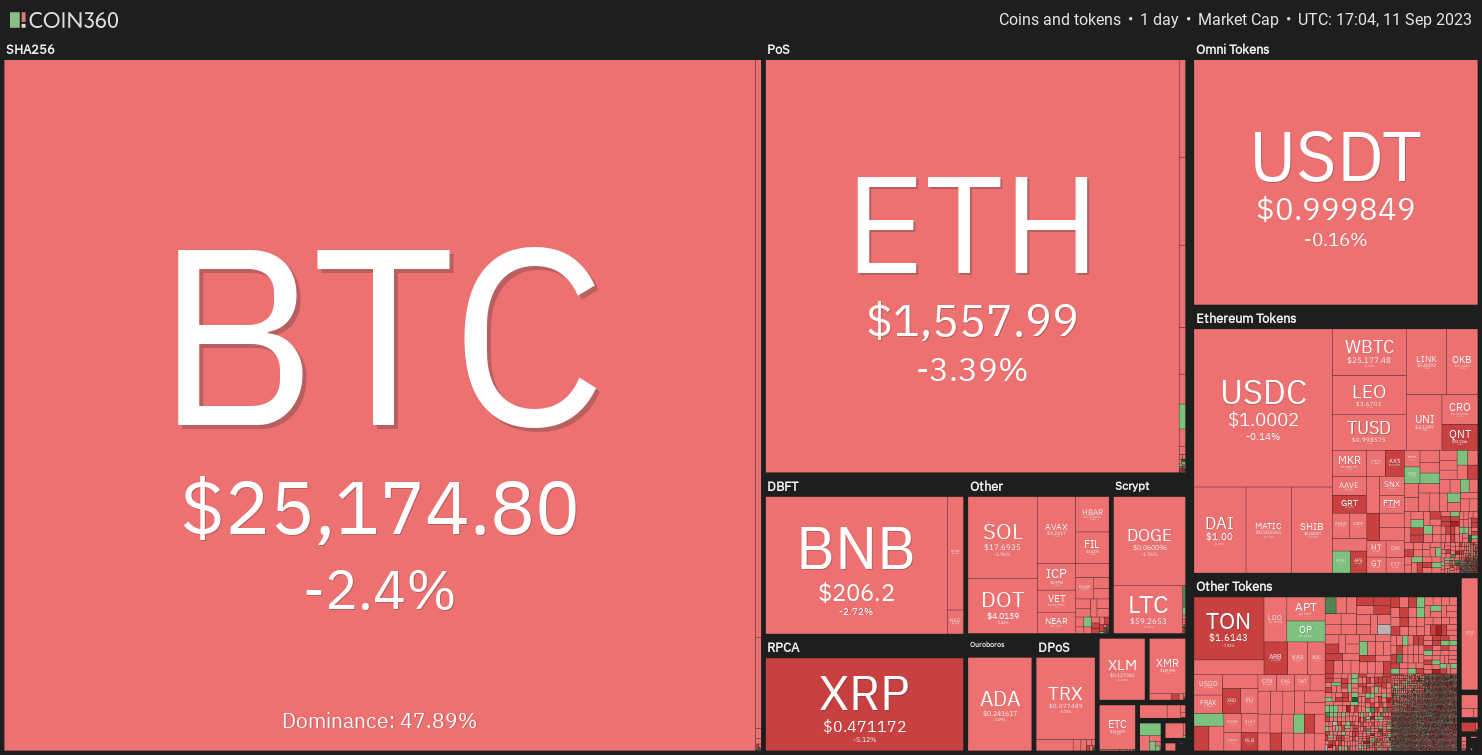

Crypto Market Suffers Following Latest FTX Revelation

What’s really interesting is that the recent revelation has set off panic across the crypto market. Why? Many crypto spectators see the revelation as bad news considering the struggling exchange could be forced to liquidate these assets to satisfy customer refund obligations. They fear that liquidating such a large volume of crypto assets at once could send the market into a steep bearish spiral, triggering panic and causing many to sell their holdings.

At the time of this report, the broader crypto market is a “sea of red,” with Bitcoin and Ethereum down over the past 24 hours by 2.4% and 3.4%, respectively. The same story is seen across the market, with losses in some crypto assets running as high as 9% (Arbitrum).