Ethereum Options Traders Bet on $4,000 Price Surge

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Ethereum, the second-largest cryptocurrency globally, is witnessing a surge in demand among options traders, anticipating its price to hit $4,000 by June or September.

Options, essentially contracts granting the buyer the right (but not the obligation) to buy or sell an underlying asset at a specified price and time, are driving bullish sentiments in the market.

Call options, indicative of bullish bets, speculate that the asset’s price will surpass the strike price, while put options, representing bearish bets, anticipate the price to drop below the strike price.

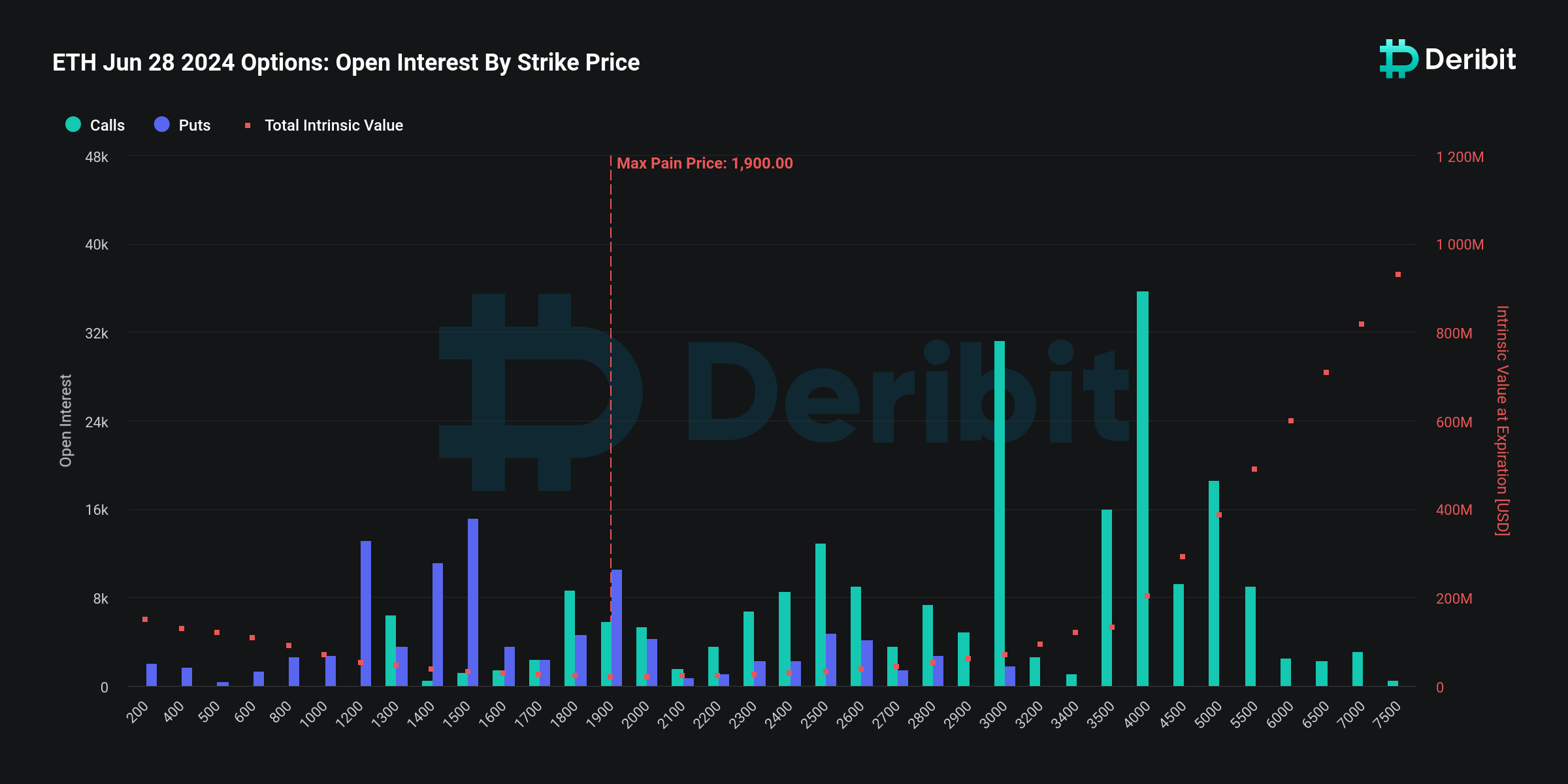

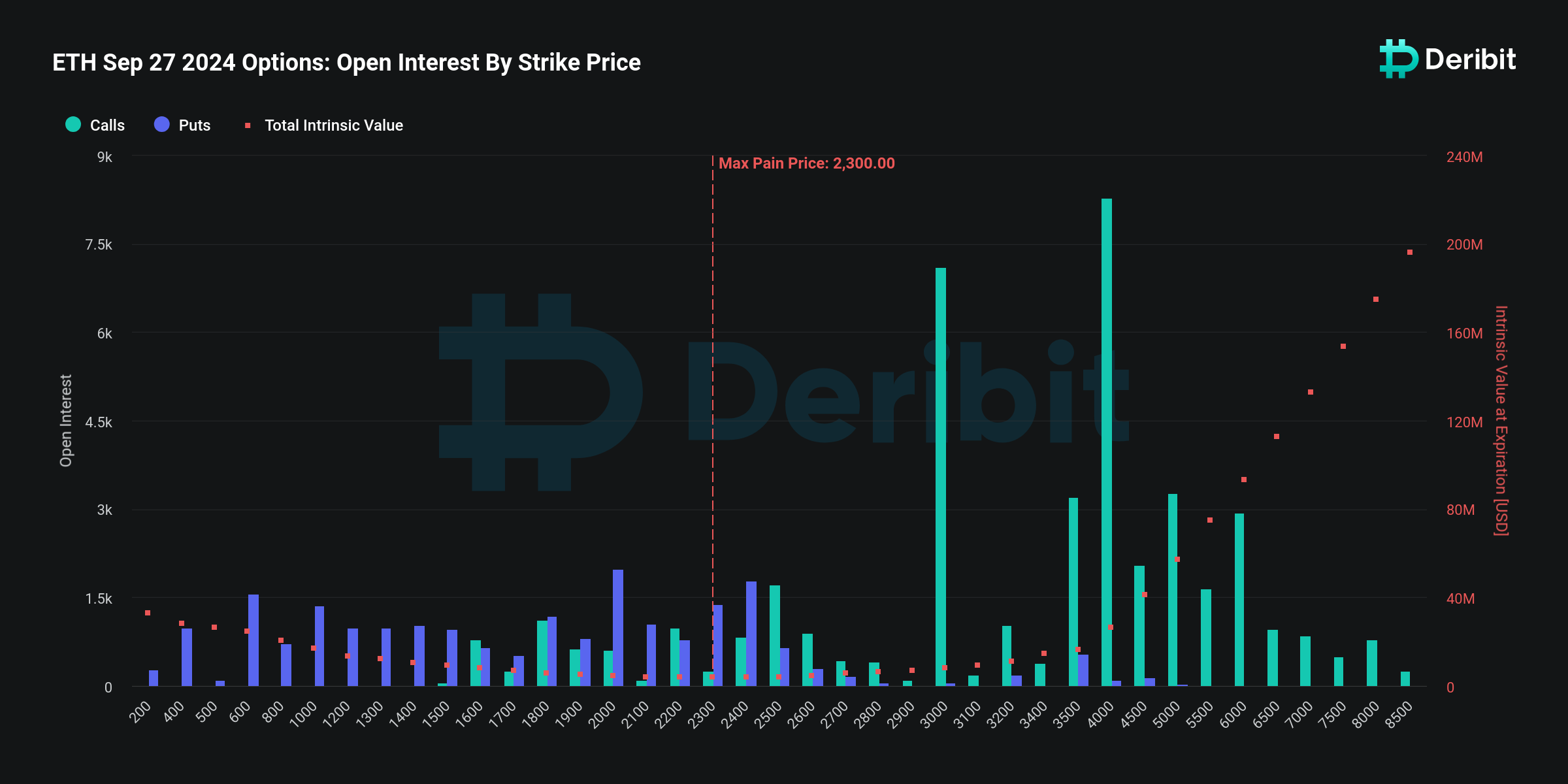

Data sourced from Deribit, the largest cryptocurrency options exchange, reveals that the $4,000 strike price stands as the top choice among ether call options for both June and September expiries. Deribit Chief Commercial Officer Luuk Strijers told The Block that this shows significant interest or expectation from the market participants.

The $4,000 target reflects a near doubling of ether’s current price, which experienced a 3% surge on Friday, hovering just below $2,500.

Ethereum ETF Approval Expectation Fueling Bullish Sentiment

The bullish sentiment surrounding ether is fueled by the prospects of a spot Ethereum ETF approval by the U.S. Securities and Exchange Commission (SEC) by May’s end. A spot ETF would empower investors to directly trade ether via a regulated platform, bypassing intermediaries or custody solutions.

While the SEC faces applications for spot ether ETFs from asset managers VanEck and Ark/21Shares, with a final decision due by May 23, Deribit’s Strijers warns against prematurely linking options activity solely to ETF news.

Factors like impending network upgrades, competition from rival blockchains, and Bitcoin’s correlation could sway Ethereum’s price trajectory.

For those intrigued by Ethereum and other cryptocurrencies, our crypto signals service offers timely and accurate market insights and trading tips, facilitating informed trading decisions.

Want to learn about the best crypto staking platforms? Click here