Bitcoin Exchange Supply Hits 5-Year Low Amid Dynamic Shift

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

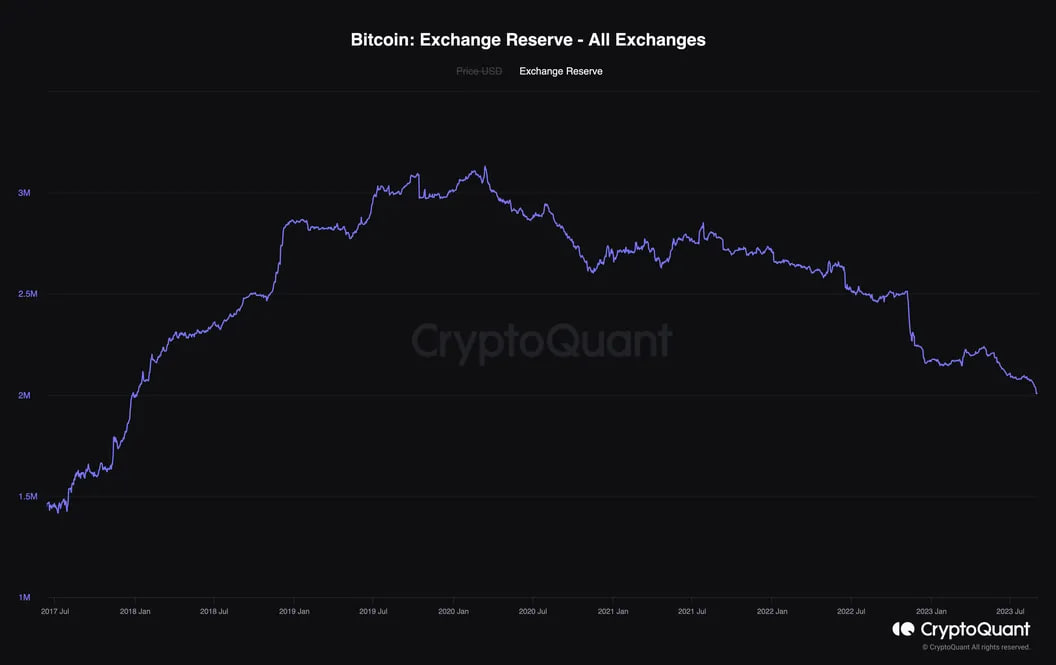

In a remarkable turn of events, the quantity of Bitcoin (BTC) held within centralized exchanges has now reached its lowest point in over half a decade. This intriguing development points to a notable change in both market trends and the behavior of investors.

Recent data furnished by CryptoQuant, a blockchain analytics powerhouse, reveals that the exchange reserve of Bitcoin has descended by 4%, settling at a mere 2 million BTC (equivalent to $54.5 billion) this month. This reduction marks the lowest tally since the outset of January 2018.

The immediate upshot? A scarcity of available Bitcoins on trading platforms, which could serve to alleviate the pressure to sell and amplify the cryptocurrency’s value.

Factors Affecting Bitcoin Supply on Exchanges

CoinDesk’s report shed light on the potential drivers behind this drop in exchange supply:

- Strategic Hodling: An increasing number of investors are orchestrating the migration of their Bitcoin holdings to cold storage or hardware wallets, an approach that underscores their anticipation of higher future valuations.

- Decentralized Exchange Surge: Investors are embracing decentralized exchanges (DEXs) and peer-to-peer platforms, bypassing the need to deposit their Bitcoins onto centralized exchanges and thus creating a dent in exchange holdings.

- Innovative Trading Solutions: Services like Copper’s ClearLoop are gaining traction, enabling traders to execute transactions without the necessity of moving funds to centralized exchanges. This revolutionizes efficiency and safeguards the process.

- Portfolio Diversification: The allure of alternative cryptocurrencies or stablecoins is driving investors to diversify their holdings, a move bolstered by lower fees and quicker transactions.

Final Word

This descent in exchange supply not only mirrors the maturation and sophistication of the crypto market but also signals a shift in the dominance and competitiveness of exchanges.

As mentioned, these declining reserves could potentially have a favorable impact on Bitcoin’s valuation, lessening the risk of large-scale sell-offs while magnifying demand for the finite pool of 21 million Bitcoins. However, it’s vital to acknowledge the sway of external factors such as regulatory shifts, macroeconomic events, and technical markers that could still influence market trajectory.

Interested in learning how to day trade crypto? Get all the information you need here