Bitcoin Accumulation Trend Shifts to Balanced Regime

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

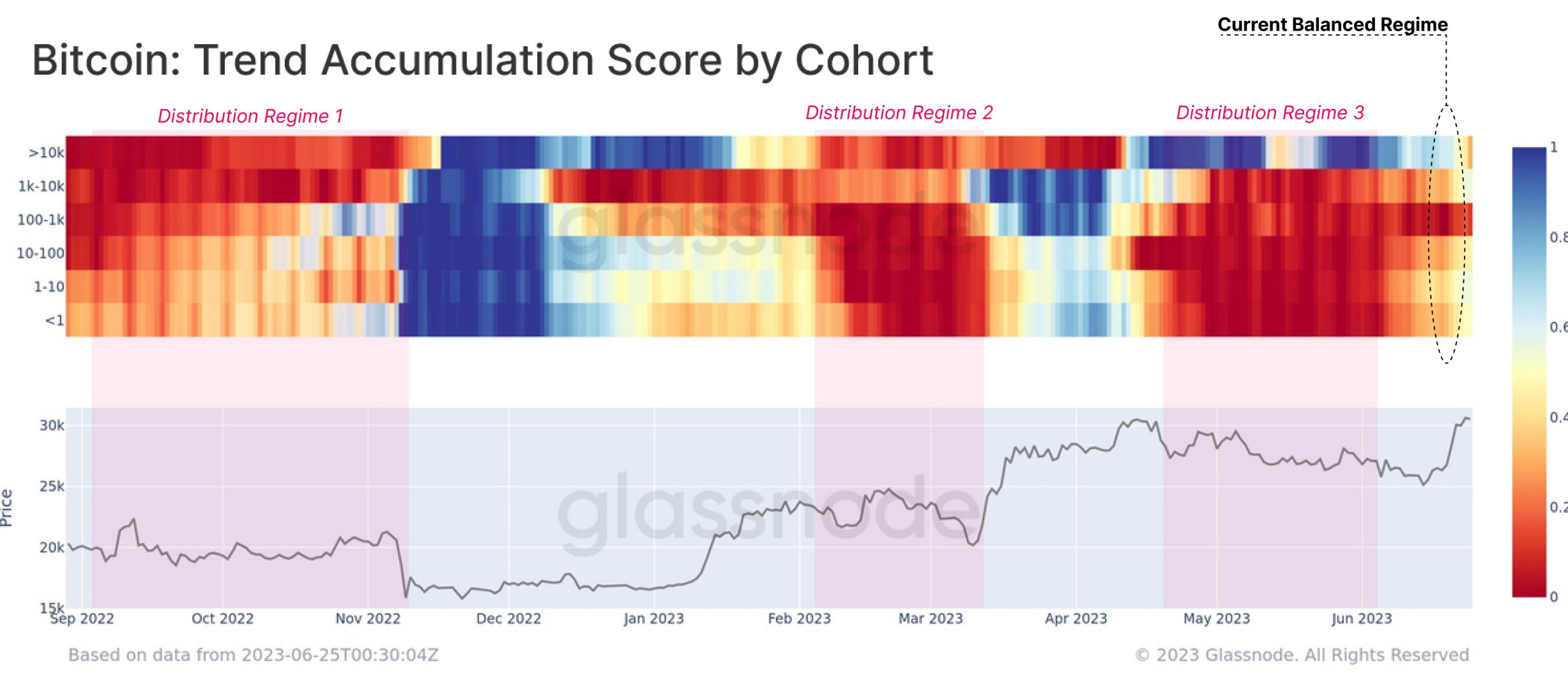

In recent data provided by Glassnode, a leading on-chain analytics firm, it has been observed that the trend of Bitcoin accumulation has undergone a significant transition. Previously dominated by heavy distribution, the current phase shows a balanced regime of accumulation.

As Bitcoin prices surpassed the $30,000 mark and maintained stability, investors who were actively engaged in accumulation have taken a pause. Presently, it is the larger holders, known as dolphins and sharks, who are driving the aggressive accumulation.

Dolphins are investors holding between 100 and 500 bitcoins, while sharks encompass those holding 500 to 1000 bitcoins. The data suggests that these categories of investors are currently the primary participants in the ongoing aggressive accumulation phase.

Coinciding with the price increase, short-term holders have seen a surge in the number of coins in profit. As Bitcoin’s value shifted from the $25,000 to $30,000 range, short-term holders collectively realized profits from over 1.8 million coins, representing approximately 66.4% of their total holdings.

This substantial profitability among short-term holders is an encouraging sign. Historical data analyzed by Glassnode indicates that similar phases of profitability among short-term holders have typically preceded significant price surges.

The chart provided by Glassnode in its report underscores this trend and reinforces the notion that the current market conditions could be indicative of bullish momentum in the near future.

Final Word: Bitcoin Accumulation Shift

Overall, the transition from heavy distribution to a more balanced accumulation regime in Bitcoin, coupled with the profitability of short-term holders, highlights an optimistic outlook for the cryptocurrency.

The involvement of dolphins and sharks in aggressive accumulation suggests growing confidence and interest in Bitcoin’s potential. Market participants and enthusiasts eagerly await the unfolding of events in anticipation of potential price action.

You can purchase Lucky Block here. Buy LBLOCK