Terraform Labs Files Chapter 11 Bankruptcy Amid SEC Lawsuits

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

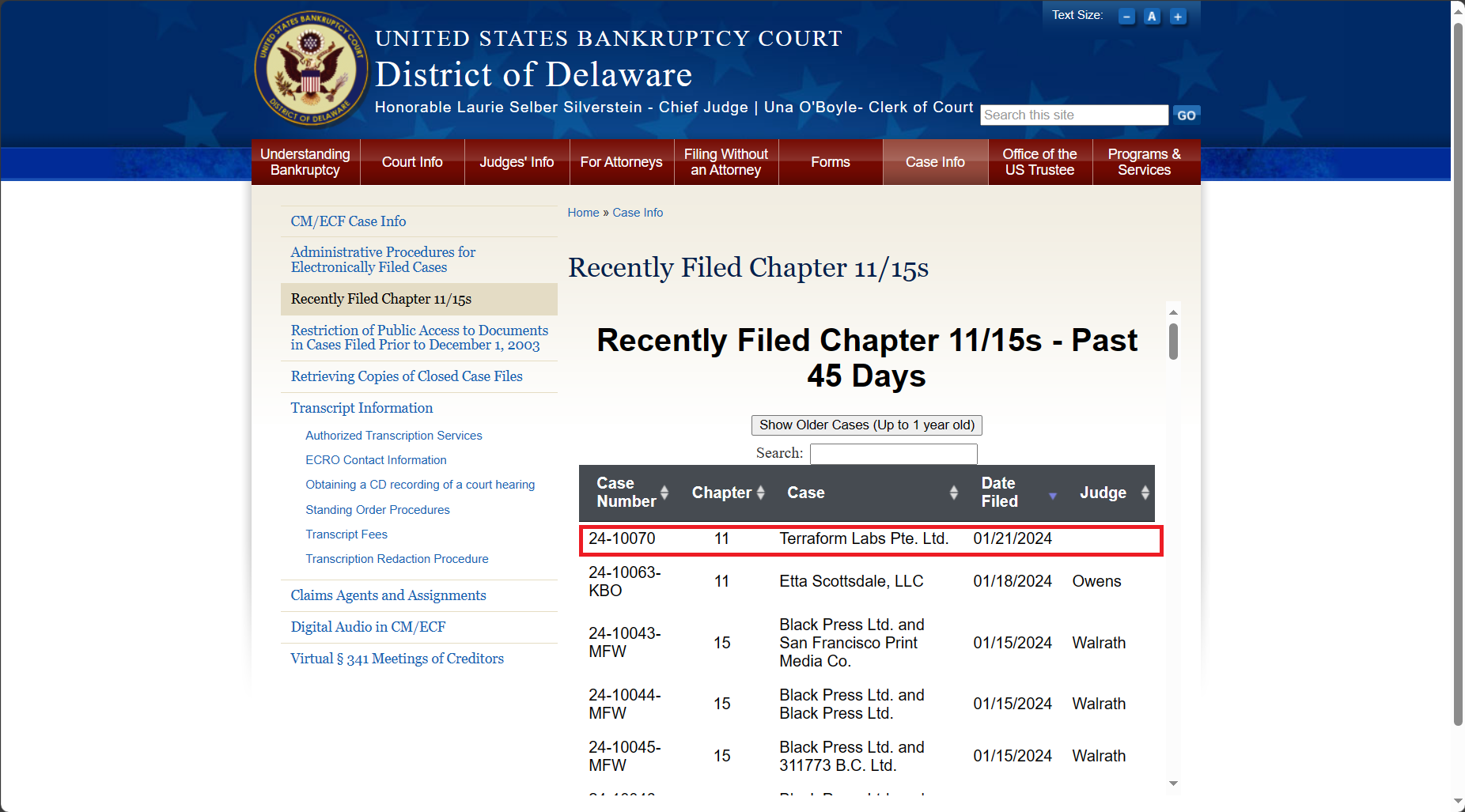

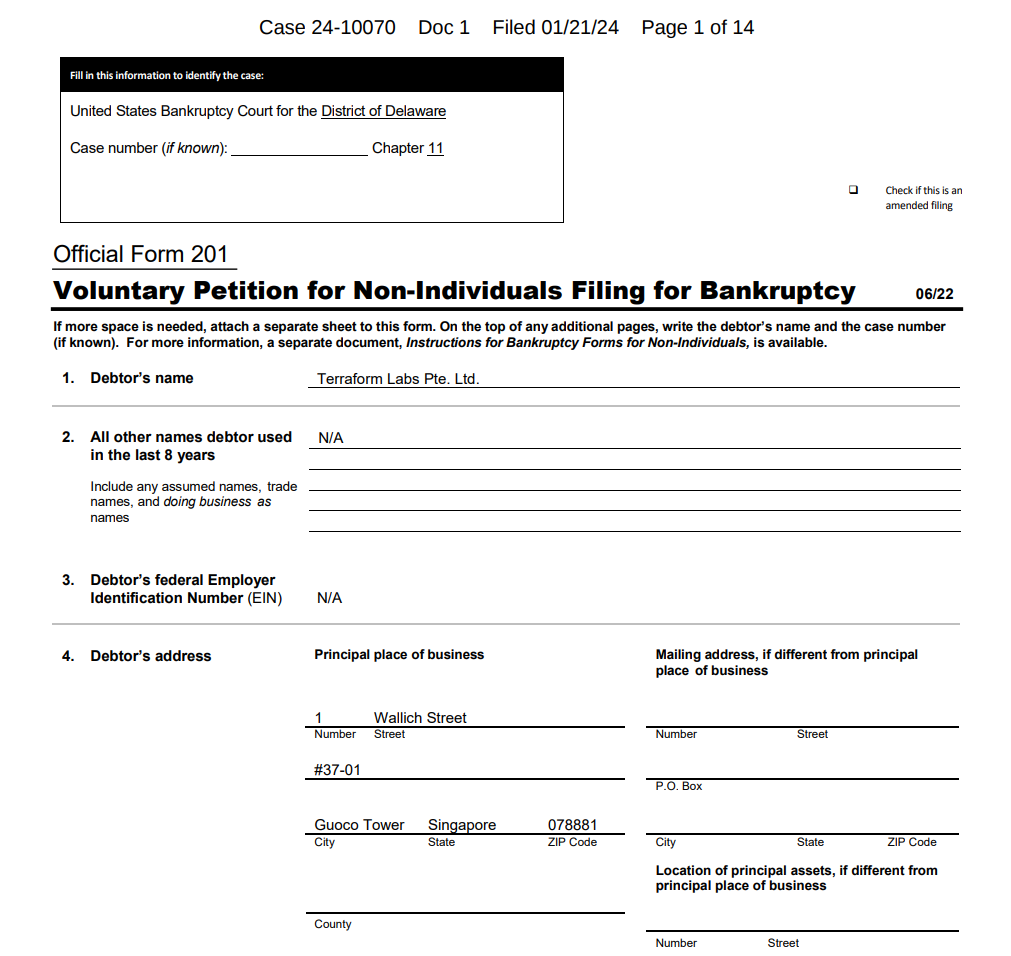

Singapore-based Terraform Labs, the creator of the TerraUSD stablecoin, has officially filed for Chapter 11 bankruptcy protection in the U.S., according to recently disclosed court documents. The company filed with the U.S. Bankruptcy Court for the District of Delaware on Sunday, January 21, according to the court’s website.

This move comes as the company faces legal challenges from the Securities and Exchange Commission (SEC) and other entities in connection with its alleged involvement in the 2022 cryptocurrency crash.

The filed documents reveal that Terraform Labs disclosed having assets and liabilities ranging between $100 million and $500 million. Despite the financial turbulence, the company has assured stakeholders that it will sustain its operations, ensuring the payment of employees and vendors throughout the bankruptcy process, all without necessitating additional funding.

In a statement, Terraform Labs emphasized its commitment to pursuing its Web3 vision, a strategic initiative aimed at decentralizing the internet and empowering users. The bankruptcy filing, the company contends, will enable it to “execute on its business plan while navigating ongoing legal proceedings.”

Terraform Labs Orchestrated Fraud: SEC

The SEC has accused Terraform Labs and its co-founder, Do Kwon, of orchestrating a $40 billion fraud involving TerraUSD and Luna, two cryptocurrencies touted for their stability and reliability. However, in May 2022, TerraUSD deviated from its $1 peg, precipitating a market-wide sell-off that erased billions of dollars from investor portfolios.

Facing extradition to the U.S., Do Kwon, currently residing in Singapore, had the trial delayed by a federal judge to facilitate the extradition process. Both Terraform Labs and Kwon vehemently deny any wrongdoing, asserting that their actions were executed in good faith with the intent to provide innovative solutions for the crypto industry.

As the legal battle unfolds, the industry watches closely to see how Terraform Labs will navigate these challenging waters and if it can uphold its vision for a decentralized future amidst the regulatory storm.