Uniswap Proposes Governance and Fee Upgrades; UNI Price Surges

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The Uniswap Foundation, the team behind the renowned decentralized exchange (DEX) Uniswap, has unveiled a proposal aimed at enhancing its governance and fee framework.

This proposal is geared towards encouraging more active and informed participation from UNI token holders, who possess the authority to vote on the project’s future trajectory.

Under the proposal, UNI holders who delegate their tokens to a voting representative will be entitled to a share of the protocol fees generated by the DEX. This is envisioned to incentivize UNI holders to select delegates who are aligned with the best interests of the protocol and its users.

Moreover, the proposal suggests reducing the quorum and proposal thresholds, which would streamline the process for the community to initiate and pass governance votes. These changes, as stated in the proposal, are intended to “invigorate governance” and foster a more engaged and diverse ecosystem.

Scheduled for a snapshot vote on March 1, followed by an on-chain vote on March 8, the proposal, if approved, will be integrated into the next version of the Uniswap protocol, v4, anticipated to launch in the third quarter of 2024.

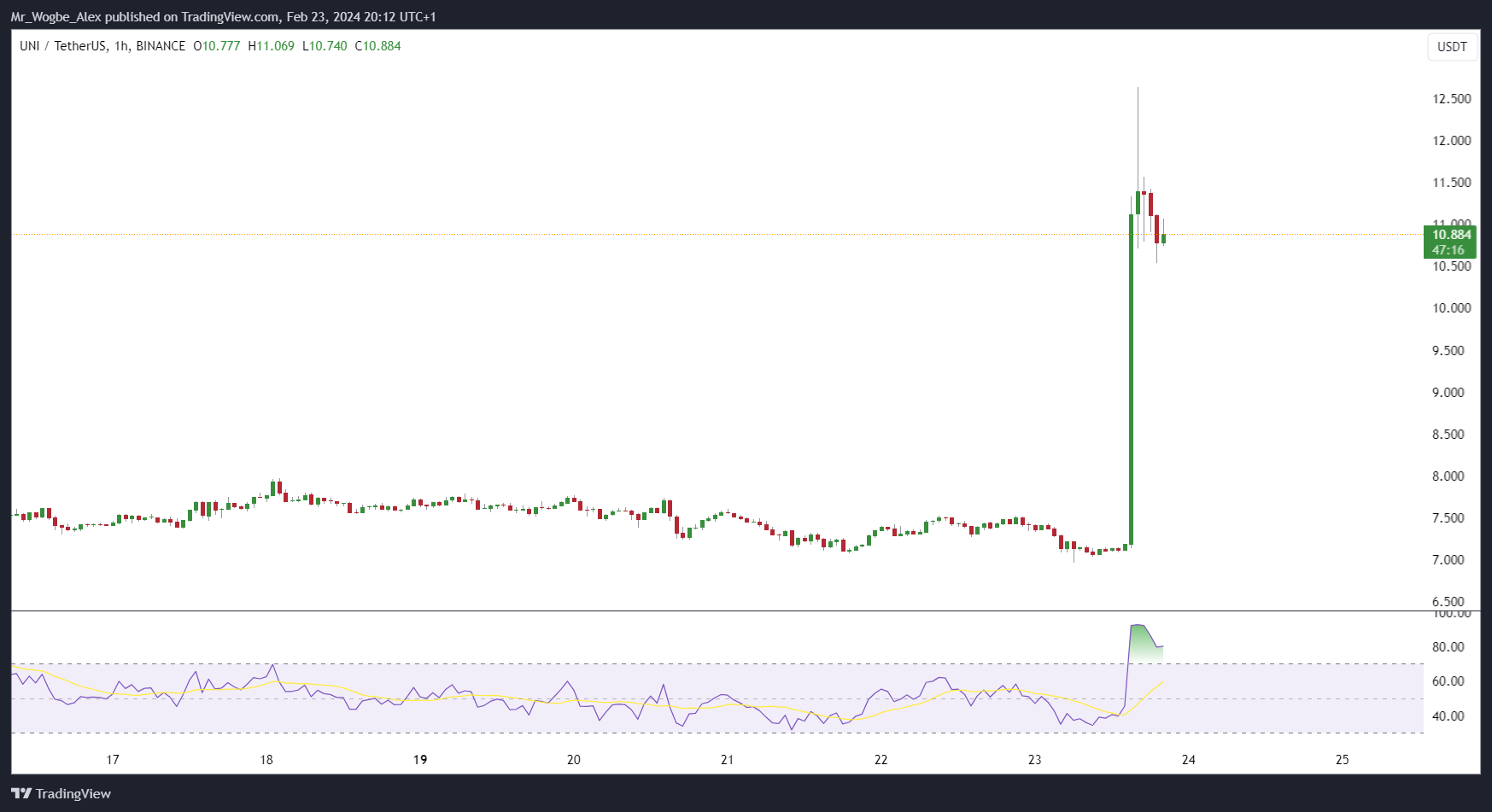

Uniswap Jumps By 70%, Records New Local High

Coinciding with the proposal’s announcement was a notable price surge for UNI, the native token of Uniswap, which surged by over 70% from $7.35 to $12.63 on February 23, marking its highest point since January 2022.

Despite a subsequent mild decline, with the cryptocurrency trading up by 50% over the past 24 hours at the time of this report, UNI has outperformed most of its counterparts.

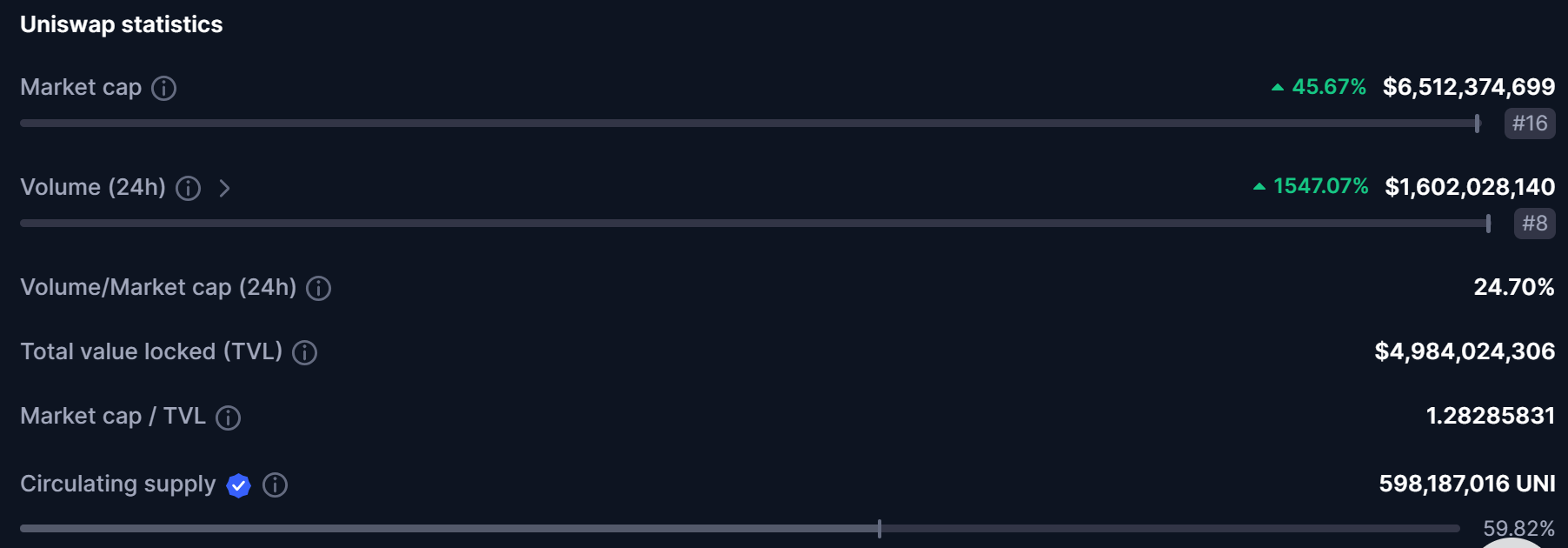

Uniswap stands as the leading DEX in the crypto domain, boasting over $4.9 billion in total value locked (TVL) and over $1.5 billion in daily trading volume. The platform enables users to swap any ERC-20 token without intermediaries, leveraging liquidity pools funded by users themselves.

Uniswap v3, the current iteration of the protocol, introduced the concept of concentrated liquidity, allowing liquidity providers to earn higher fees by specifying price ranges for their pools.

The forthcoming Uniswap v4 hinges on the successful implementation of Ethereum’s Dencun hard fork, slated for March. Dencun is set to introduce several enhancements to the Ethereum network, including lower gas fees, faster transactions, and enhanced security.

Now that the launch of Dencun on Mainnet has been scheduled for March 2024, we're excited to provide an update to the community! 🎉

Uniswap v4's launch is tentatively set for Q3 2024.

From community-built Hooks (https://t.co/WyaGr1Ti1t), to events, to Twitter Spaces, the…

— Uniswap Foundation (@UniswapFND) February 15, 2024

Ahead of its launch, Uniswap v4 will undergo a comprehensive security audit, ensuring the protocol’s safety and reliability.

Interested in learning how to day trade crypto? Get all the information you need here