Bitcoin Miners in a Pickle as Operating Costs Surge Amid Low BTC Prices

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Numerous miners have encountered enormous difficulties in the past few months trying to maintain revenues and keep mining Bitcoin (BTC). Miners keep running into problems due to the rising hashrate and rising electricity costs. And Core Scientific is one of these miners.

Core Scientific, one of the biggest blockchain miners, hinted in a statement that it would have to consider bankruptcy. The mining company predicted that its current financial reserves would run out by the end of the year, if not earlier. This may be a sign that the bear market’s repercussions are beginning to affect the major publicly traded Bitcoin miners.

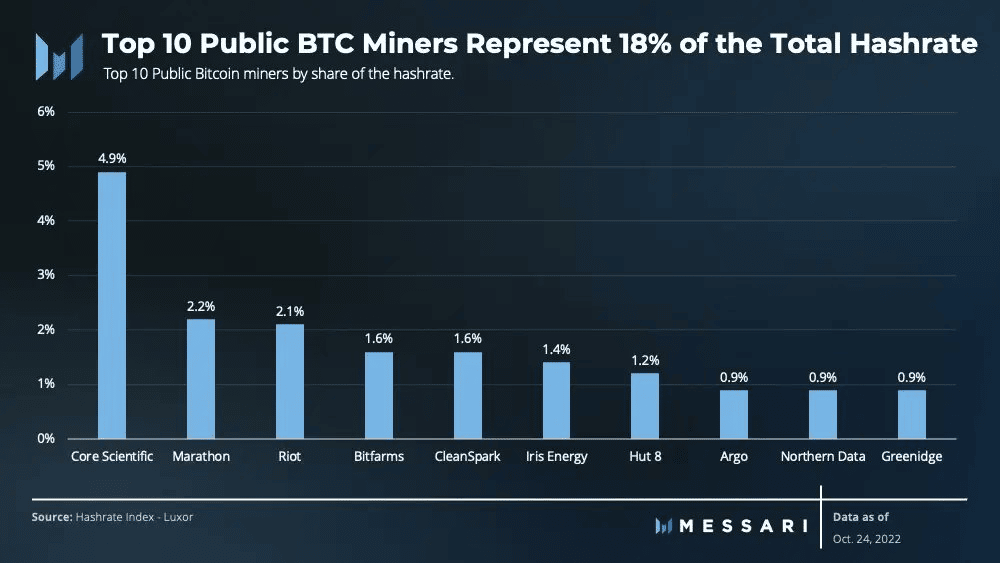

The top 10 public bitcoin miners account for 18% of the total hashrate of the entire Bitcoin network. Miners would be forced to sell their BTC in order to make money due to rising energy costs and hash rates. This increased selling pressure for Bitcoin could have a detrimental effect on BTC.

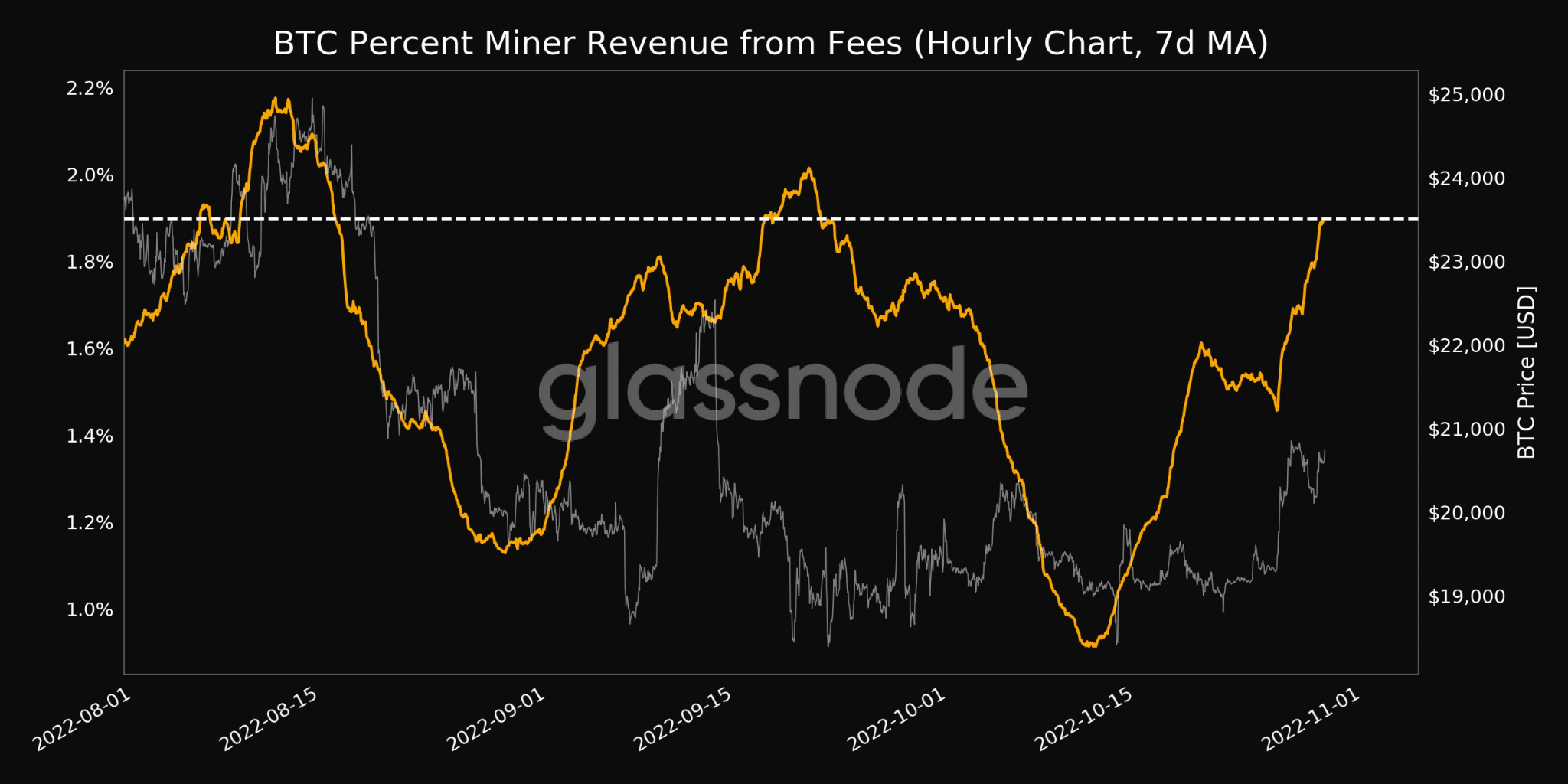

Nevertheless, despite the ongoing sell pressure that miners must contend with, miner revenue from fees has been increasing recently. Data from the on-chain data intelligence platform Glassnode shows that on October 29, miner revenue from fees collected hit a one-month high. The selling pressure on miners may lessen if the revenue generated keeps increasing.

Returning Bullish Sentiment in Bitcoin Could Serve as Breather for Miners

The income of Bitcoin miners was similarly reliant on Bitcoin’s expansion. Messari data show that Bitcoin’s realized volatility has significantly decreased in recent years. Additionally, since July, this number has dropped by 67%, making BTC less risky for investors during that time.

The fact that there has been some growth in the overall Bitcoin supply in profit may be another encouraging sign of Bitcoin’s prospective expansion. On October 29, it also touched a one-month high.

You can purchase Lucky Block here. Buy LBLOCK