Bancor (BNTUSD) Resumes Downtrend Along Descending Channel

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

BNTUSD Analysis: Resumes Its Downtrend Along The Descending Channel

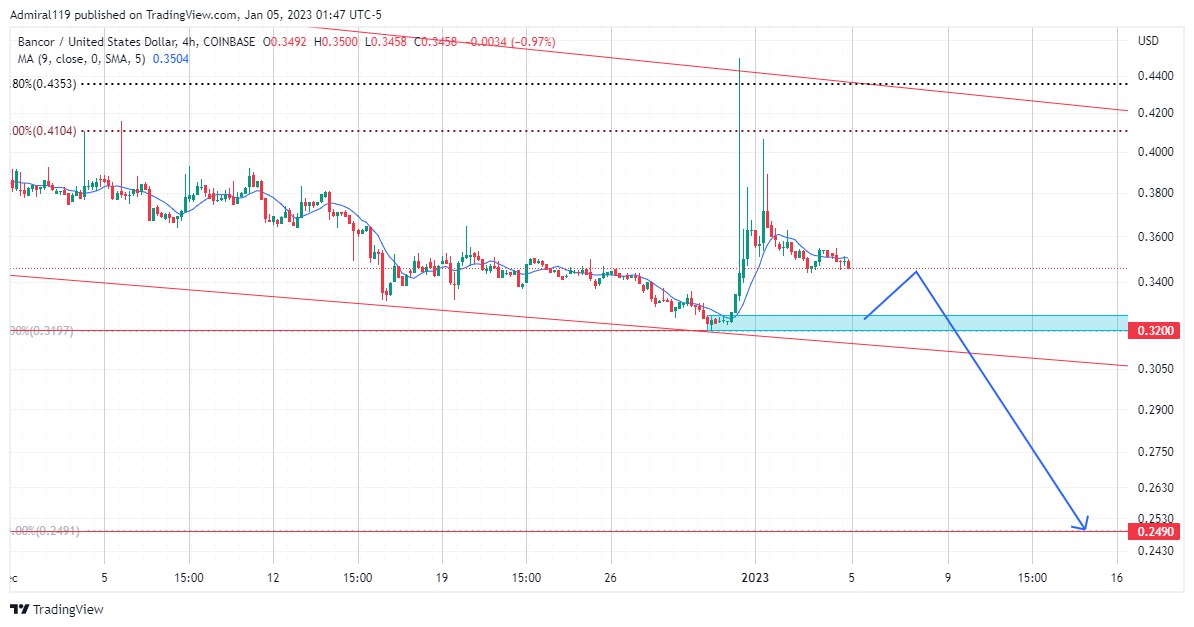

BNTUSD resumes its downtrend along the descending channel. Since the emergence of the descending channel, the market has perfectly fit into the trendlines as price expands downward and retraces upward. Until there is a breakout from the channel to the upside, the market’s order flow should remain bearish.

BNTUSD Significant Zones

Demand Zones: $0.3200, $0.2490

Supply Zones: $0.5270, $0.6360

The upper and lower limits defining the current trading range are the $0.5270 and $0.3200 price levels. BNTUSD has entered the premium at 61.80% to execute sell orders. Right now, the market seems to be aligned with its downtrend, probably heading to break the $0.3200 support. The selling pressure at the mitigation block in the premium must have been so strong for the bullish marubozu candlestick to get more than half of its body consumed. The emergence of the market’s bearishness could be traced back to last August when prices reacted toward the Fair Value Gap.

The downtrend began on August 8, 2022, though a Stop Hunt was created before the sell-side model emerged. The Fair Value Gap was created during a massive crash at the end of the second quarter of the year. The Fair Value Gap happened to be created at the $0.6360 supply zone, thereby causing the presence of huge sell pressure at the zone. The effect of the confluence at the zone could be seen as BNTUSD tends to close below the zone daily.

Market Expectation

The market is now trending downward on the four-hour chart as a result of the liquidity grab into the premium. However, a four-hour bullish order block exists below the current price level. BNTUSD is expected to mitigate this order block and resume its downtrend.

You can purchase Lucky Block here. Buy LBLOCK

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.