Bitcoin Returns to Extreme Greed Levels as Bulls Reclaim Dominance

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

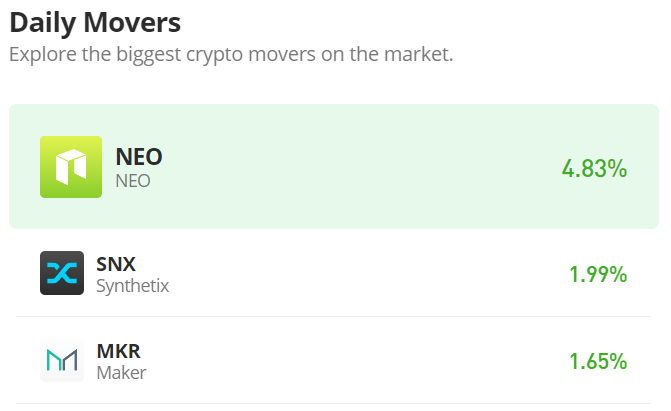

Due to the recent positive developments in the cryptocurrency industry, Bitcoin (BTC) has recorded double-digit gains over the past few weeks, flipping the general market sentiment. However, for the first time in about three months, the Bitcoin Fear and Greed Index has entered “extreme Greed” conditions.

The Bitcoin Fear and Greed Index monitors the overall investor sentiment towards Bitcoin by measuring key market metrics, including surveys, volatility, trading volume, social media trends/comments, amongst others.

That said, the Fear and Greed Index provides results ranging from 0 – 100, with 0 standing for extreme Fear and 100 for Extreme Greed. Nonetheless, the biggest driver of this metric is the price of the asset. Notably, this Index remained in extreme Fear territory, around10, for most of the bear market since mid-May.

However, market conditions returned to neutral when BTC consolidated around the $35k region. With the recent market boom to the $48k area, the Index now enters extreme Greed territory with a Reading of 76.

Despite this indication that a sharp correction could be around the corner, on-chain analysis begs to differ.

Santiment revealed that the supply of BTC on crypto exchanges recorded a substantial decrease in the past two weeks. The in-chain analytics company noted that this is an “encouraging sign” for bulls. Santiment added that BTC still shows signs that it could approach its ATH levels again, as long as exchange inflows remain dormant.

Key Bitcoin Levels to Watch — August 15

Despite the recent $2,250 correction from the $48,180 high, BTC still maintains a bullish outlook as we begin week three of August. According to our daily chart, the primary cryptocurrency receives support from our trendline, $46k – $45k axis, and the 200 SMA, making a bearish descent believe the $45k technical level a challenge to beat.

That said, we expect a rebound in the ensuing hours towards the $48k area, or consolidation between $46k and $45k at worst.

Meanwhile, our resistance levels are at $47,000, $48,300, and $49,500, and our key support levels are at $45,000, $44,000, and $43,000.

Total Market Capitalization: $1.96 trillion

Bitcoin Market Capitalization: $865.3 billion

Bitcoin Dominance: 44.1%

Market Rank: #1