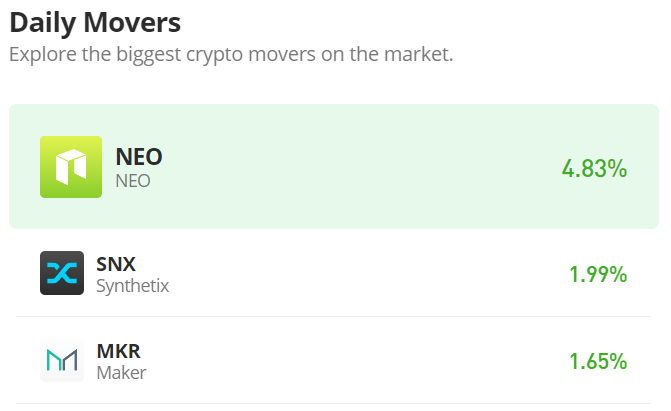

The Indecision in the Synthetix (SNXUSD) Market Tightens Up

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

At the $2.619 price level on January 20, the Synthetix market began to consolidate. And this has continued until today. Initially, in the trading session of today, the bull market attempted the February 8 resistance price level, which is $2.9, but the sellers are still very strong, and it seems like the market is going to close at the point at which it had opened. The market is not ready to move in a clear direction yet.

SNX/USD Price Statistic

- SNX/USD price now: $ 2.71

- SNX/USD market cap: $686,433,892

- SNX/USD circulating supply: 252,906,900 SNX

- SNX/USD total supply: 314,857,962

- SNX/USD coin market cap rank: #72

Key Levels

- Resistance: $3.00, $3.50, $4.00

- Support: $2.00, $1.50, $1.00

Price Prediction Synthetix: the Indicators’ Point of View – The Indecision Intensifies

The appearance of the spinning top candlestick, which represents today’s Synthetix trading session, shows that the price consolidation is about to reach a new level. And because of this, we see the bands beginning to converge. At the climax of the consolidation trend, the market will have a breakout for a clear direction. The market moves between $2.350 and $2.935, and it does not seem like it will begin to move in favor of either the bulls or the bears yet. In the Bollinger Bands indicator, we can expect to see the bands contract as the struggle intensifies.

SNX/USD 4-Hour Chart Outlook

From the smaller timeframe perspective, we notice frequent exhaustion in both the bull market and the bear market. From the recent market performance on the chart, when you look at the volume of trade in the 16th-hour session, you will discover that the volume of trade was very high, but the actual representation of that same session on the chart was not a momentum candle, and this ultimately led to the abortion of the bear run. This has been the case in the market for some time. Traders are showing signs of lacking interest in the market for now.