Crypto Market Sees Unprecedented Inflows Amidst Volatile Week

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a week marked by significant activity in digital assets, crypto investment products have experienced a surge in inflows, setting a new record of $2.9 billion, according to data from CoinShares.

The latest report indicates that this figure surpasses the previous week’s peak, driving year-to-date inflows to an impressive $13.2 billion, a substantial increase from the entire year of 2021, which saw $10.6 billion.

Maintaining its momentum, trading volume reached a steady $43 billion, representing nearly half of global bitcoin volumes. Notably, global exchange-traded products (ETPs) surpassed the $100 billion threshold, though a late-week price correction brought the figure down to $97 billion.

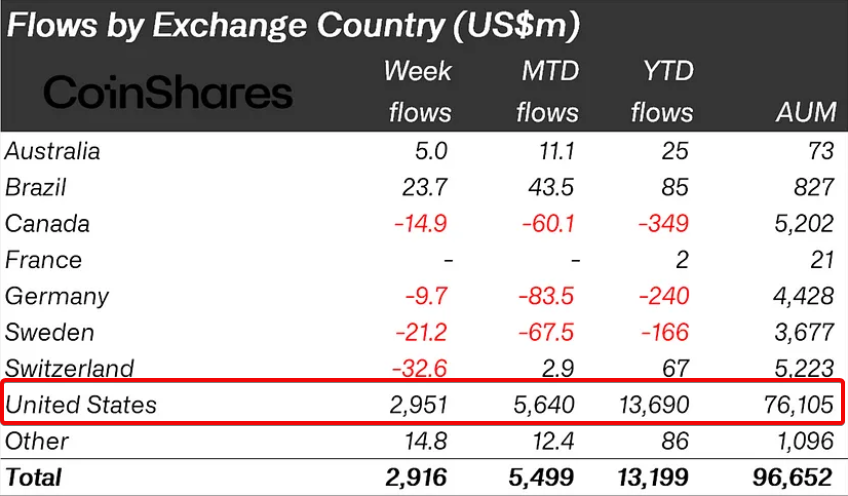

US Dominates in Global Crypto Inflows this Week with $2.951 Billion

Leading the charge, the United States saw inflows of $2.95 billion, with more modest amounts contributed by Australia, Brazil, and Hong Kong. Conversely, Canada, Germany, Sweden, and Switzerland experienced combined outflows totaling $78 million, contributing to a challenging start to the year with $685 million in outflows thus far.

Bitcoin continued to dominate these inflows, attracting $2.86 billion last week alone, accounting for 97% of the total inflows for the year. Meanwhile, ‘short bitcoin’ positions saw a notable increase in interest, marking the largest inflows of the year at $26 million.

This occurred as the price of Bitcoin plunged to a low of $62,320 for the first time since March 5.

In contrast, smart contract platforms such as Ethereum, Solana, and Polygon faced outflows, signaling a shift in investor sentiment within the crypto ecosystem.

MicroStrategy Acquires Even More Bitcoin

In related news, MicroStrategy, a software firm focused on Bitcoin investment, made a significant purchase of 9,245 bitcoins at an average price of approximately $67,400 per coin. This acquisition, led by Executive Chairman Michael Saylor, was funded through a combination of a convertible debt offering and excess cash.

With this latest addition, MicroStrategy’s bitcoin holdings now total over 214,000 BTC, valued at around $13.5 billion. This represents a substantial 1% of the finite supply of Bitcoin, with the company’s average purchase price standing at $35,160 per coin.

MicroStrategy has acquired an additional 9,245 BTC for ~$623.0M using proceeds from convertible notes & excess cash for ~$67,382 per #bitcoin. As of 3/18/24, $MSTR hodls 214,246 $BTC acquired for ~$7.53B at average price of $35,160 per bitcoin. https://t.co/oeYJGgiuy0

— Michael Saylor⚡️ (@saylor) March 19, 2024

As the crypto market experiences fluctuations, with bitcoin’s price dipping to $63,000, MicroStrategy’s stock has also seen a downturn, reflecting the interconnected nature of the cryptocurrency and traditional financial markets.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here