Bitcoin Celebrates Genesis Day Amid Quiet Market Tone

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The Hong Kong Bitcoin (BTC) association led the rest of the world to celebrate Genesis Day, as the Asian market awoke to a quiet first week in 2022.

The organization noted that now would be a good time to ensure that your BTC is in a wallet controlled by you, be it public or private keys. Genesis Day is also known as the “Proof of Keys celebration,” an event marked by Bitcoiner pioneer Trace Mayer. The Proof of Keys website marks this day by encouraging BTC HODLers to assume control of their assets.

On Genesis Day, the day the first BTC block got mined, pseudonymous Bitcoin creator Satoshi Nakamoto mined the block with the first 50 BTC reward onto Sourceforge. Satoshi also left a message on the blockchain quoting a headline m from UK’s Times newspaper, which noted that:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Satoshi began working on the BTC whitepaper in 2008 and published it in October of the same year. The idea behind the benchmark cryptocurrency, an anonymous, trustless, and decentralized currency, came following the 2008 financial crisis, which banks receive blame for.

Satoshi has always resented the traditional banking system and also disliked fractional-reserve banking, where a financial institution uses deposits to make loans or investments and does not hold enough backing assets.

Satoshi aimed at cutting out the corrupt practices of banks and “shady middlemen” from the financial industry and might have achieved this with Bitcoin.

Key Bitcoin Levels to Watch — January 4

The benchmark cryptocurrency celebrated Genesis Day on a bearish tone, as BTC retested the $46K support yesterday. However, bears could not manage a close below the support line as the cryptocurrency bounced back to the mid-$46K region, where it currently trades.

That said, I foresee a sustained recovery over the coming few days to the $48.5K resistance, where the sideways bias will get challenged. A sustained break above the $48.5K level could mark the end of the consolidation pattern, while rejection should prolong the pattern.

Meanwhile, my resistance levels are at $48,000, $48,500, and $49,500, and my key support levels are at $47,000, $46,000, and $45,000.

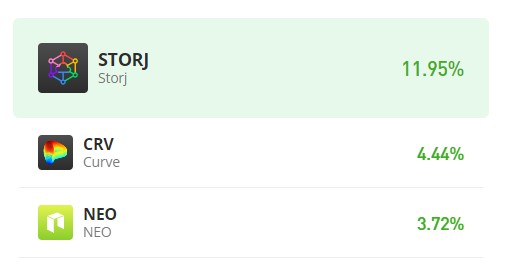

Total Market Capitalization: $2.22 trillion

Bitcoin Market Capitalization: $877.5 trillion

Bitcoin Dominance: 39.4%

Market Rank: #1