Bitcoin Rallies as MicroStrategy Plans to Purchase More BTC with Share Sales Proceeds

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Free Crypto Signals Channel

MicroStrategy, which currently holds the record as the largest publicly listed institutional investor of Bitcoin, plans to sell $500 million worth of its Class A shares to the mentioned investment firms. The prospectus forwarded to the US Security and Exchange Commission (SEC) suggests the company could use the proceeds to purchase more Bitcoins.

Acknowledging the recent slump below the $20K mark, MicroStrategy noted that it had measures in place to deal with the volatility. The company noted:

“Future fluctuations in Bitcoin trading prices may result in our converting Bitcoin purchased with the net proceeds from this offering into cash with a value substantially below the net proceeds from this offering.”

The prospectus sent to the SEC revealed that the company does not plan to use its BTC holdings for trading or derivatives contracts. Its plan is simply to buy and hold the crypto asset for an unspecified long-term period. However, it noted that it might sell portions of its holdings if the liquidity is required for essential purposes. With its holding pattern in recent months, such a situation likely has to be significantly dire.

Finally, MicroStrategy noted that there was no target BTC holding amount in its plans, as it plans to monitor the markets “in determining whether to conduct debt or equity financings to purchase additional Bitcoin.”

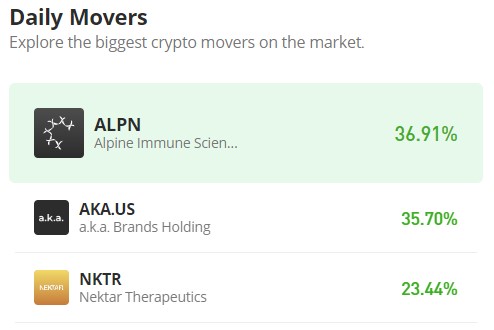

Key Bitcoin Levels to Watch — September 11

Following an aggressive 16% rally over the past four days, Bitcoin stands on the brink of scaling the long-resistant $21.7K pivot top on Sunday.

The benchmark cryptocurrency graciously picked itself after suffering a sharp plunge to the $18.5K axis, posting a parabolic rally since September 7. With the excitement over the upcoming Ethereum Merge upgrade fueling bullish sentiment in the market, BTC stands the chance of rebounding near the highly-elusive $25K mark.

Meanwhile, my resistance levels are at $21,700, $22,000, and $23,000, and my key support levels are at $21,000, $20,500, and $20,000.

Total Market Capitalization: $1.06 trillion

Bitcoin Market Capitalization: $415.2 billion

Bitcoin Dominance: 39%

Market Rank: #1

You can purchase Lucky Block here. Buy LBlock