2024 Cryptocurrency Outlook: Riding the Wave of Innovation

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

As the cryptocurrency industry rides the momentum gained in 2023, the upcoming year promises to be a thrilling continuation of bullish trends. Anticipate a surge in adoption, revenue growth, and the infusion of cutting-edge technologies shaping the landscape.

Navigating the dynamic crypto realm amid new tokens, regulatory uncertainties, security challenges, and technological breakthroughs can be daunting. Yet, amidst this unpredictability, several emerging trends signal the vibrancy of the crypto space, echoing the excitement of the previous year.

Trend 1: Bitcoin’s Ascendancy

In 2023, Bitcoin witnessed an impressive 150% rally, and as January 2024 unfolds, its value has soared beyond $47,000. Projections suggest an ongoing ascent throughout the year, with the potential to reach an unprecedented high of $80,000 by year’s end.

This optimistic forecast is underpinned by the SEC’s green light for a spot Bitcoin ETF, democratizing access for everyday investors directly through their brokerage accounts.

With Bitcoin spot ETFs trading on stock exchanges, offering exposure without actual ownership, a broader investor base is expected to fuel increased demand, propelling Bitcoin’s price to new heights.

Anticipate a Bitcoin surge in April 2024 with the enigmatic halving event. Occurring every four years, the last was in May 2020, halving reduced mining rewards by 50%, fostering scarcity and historically triggering increased demand and prices. As the countdown to April 2024 begins, another halving event promises to shape Bitcoin’s destiny.

Trend 2: Coinbase’s Phenomenal Rise: Pioneering Cryptocurrency Dominance

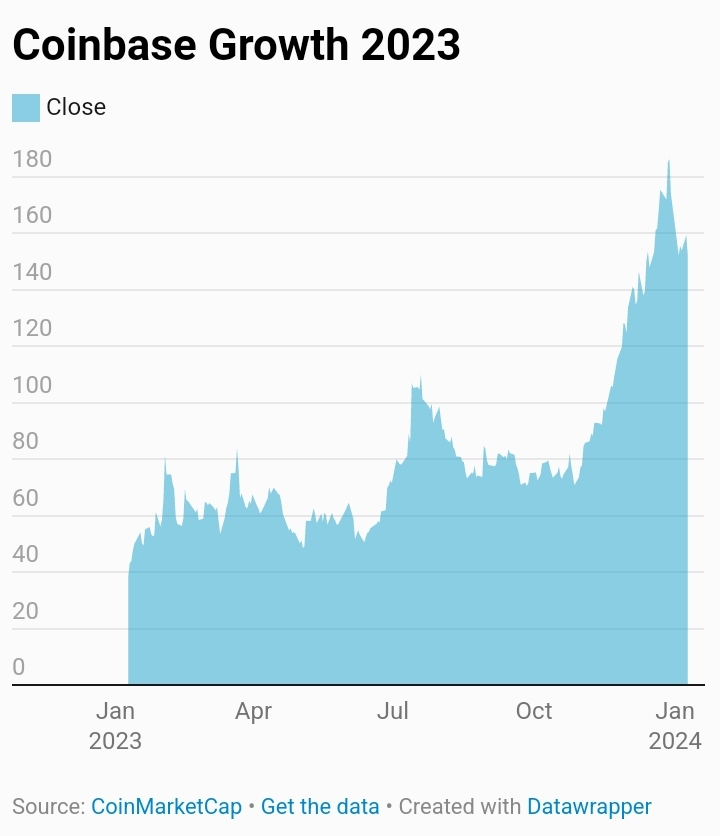

As the premier cryptocurrency exchange in the US, Coinbase has meticulously cultivated brand authority, endowing them with influential pricing power among investors. The stellar performance in 2023, witnessing a 418% surge in stock and a 14% revenue boost, sets the stage for sustained growth into 2024, with the potential to double its revenue.

Foreseen catalysts for Coinbase’s projected expansion include the Bitcoin ETF approval and the impending halving event, both poised to amplify demand for Bitcoin, a cornerstone of the platform’s trading volume.

The green light for Bitcoin ETFs is also anticipated to usher in heightened institutional adoption, attracting traditionally wary investors like insurance companies and pension funds. Coinbase’s unique position as the exclusive custody provider for proposed Bitcoin ETFs positions the platform to reap substantial revenue through custody fees, marking a pivotal role in the evolving cryptocurrency landscape.

Trend 3: Ethereum’s Ascendant Momentum in 2024

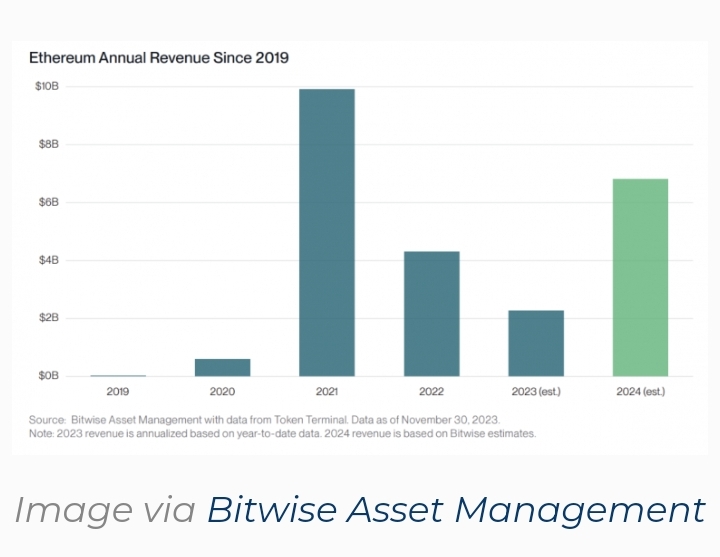

A surge awaits Ethereum in 2024, with analysts foreseeing a potential doubling of its revenue. A pivotal catalyst in this projection is the scheduled EIP-4844 critical upgrade set for the year’s second half. This upgrade promises a significant leap in throughput to 100,000 transactions per second and a remarkable 90% reduction in transaction costs, positioning the network to be more accessible to mainstream users and catalyzing widespread adoption.

Ethereum’s multifaceted role in advancing crypto projects is noteworthy. Beyond offering smart contract functionality, it serves as the primary hub for the DeFi ecosystem, provides a robust framework for tokenizing and trading NFTs, and facilitates the creation and issuance of new tokens. Essentially, Ethereum acts as a cornerstone for the growth of diverse crypto projects, and the anticipated reduction in transaction costs only amplifies its allure for users, further solidifying its position as a linchpin in the evolving cryptocurrency landscape.

Trend 4: Stablecoins Take Center Stage in 2024

While the spotlight leading into 2024 has often been on Bitcoin, astute investors are turning their attention towards stablecoins in the upcoming year. The latter half of 2023 witnessed notable strides, including JP Morgan’s announcement of an enhanced tokenized payment platform, PayPal’s launch of its stablecoin, and Visa’s expansion of stablecoin settlement capabilities. These developments set the stage for a promising outlook in 2024, with Bitwise predicting that stablecoins will outpace Visa in terms of settled volume.

Significant strides in stablecoin regulation also marked 2023, with 25 countries implementing regulatory frameworks, as reported by Cointelegraph. Anticipating this trend, the US is poised to take action on stablecoin regulation in the coming year, providing a mechanism to oversee adoption and solidifying its central role in supervising and regulating stablecoin issuers. This strategic move positions the US as a hub for burgeoning businesses, playing a crucial role in expanding the influence of the USD and other stablecoins on the global economic stage.

In Conclusion

2024 Cryptocurrency Highlights: Bitcoin soaring, Coinbase thriving, Ethereum dominating, and stablecoins rising. As financial institutions explore on-chain innovations, AI gains prominence. If invested, monitor your portfolio for trend impacts. Brace for an exciting crypto journey in 2024.