Comparing Bitcoin ETFs to BTC: Which Offers Superior Investment Potential?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin ETFs, although correlated with Bitcoin’s market cap, diverge significantly from the primary asset. Both bitcoin and bitcoin ETFs cater to institutional and retail investors alike.

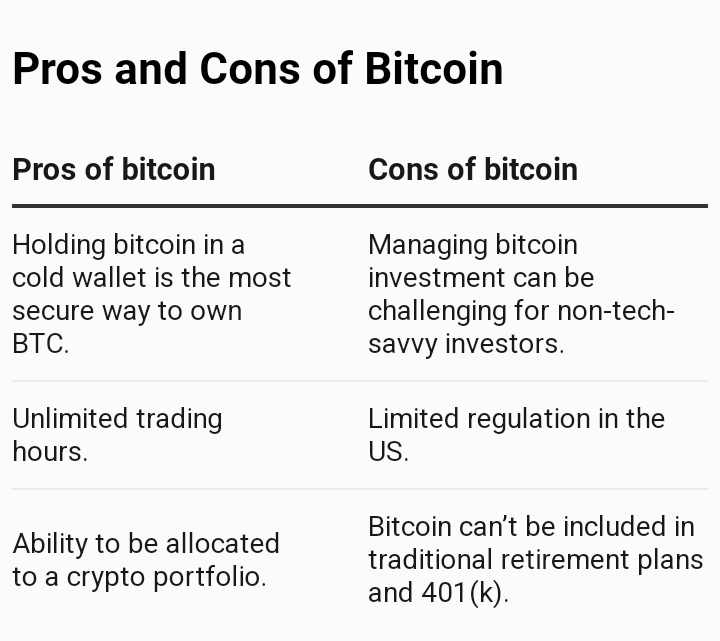

Bitcoin, the pioneering cryptocurrency, boasts a widespread presence across a multitude of cryptocurrency exchanges, including renowned platforms like Coinbase and Binance. Within these vibrant marketplaces, investors enjoy the flexibility of acquiring Bitcoin using both fiat currencies and various digital assets. Upon acquisition, investors retain complete ownership of their Bitcoin holdings, empowering them with the autonomy to manage and utilize their assets as they deem fit.

To safeguard their investment, investors often opt to secure their Bitcoin in digital wallets equipped with private keys, ensuring robust protection against unauthorized access and potential security breaches.

Bitcoin ETFs boast heightened liquidity and accessibility for conventional investors, available through brokers like Schwab and Etrade, who can acquire ETF shares using fiat currency.

While bitcoin operates around the clock, ETF shares are limited to trading during market hours, potentially alienating investors seeking direct engagement.

Assessing the Risk Associated with Bitcoin and Bitcoin ETFs

Engaging in bitcoin investment through esteemed cryptocurrency exchanges or acquiring ETF shares via reputable brokers presents investors with a degree of security. However, it’s essential to acknowledge that investing directly in Bitcoin through crypto exchanges entails a marginally higher level of risk, especially for individuals who may not possess advanced technological proficiency.

While both avenues offer avenues for exposure to the cryptocurrency market, direct bitcoin investment requires users to navigate the complexities of managing digital wallets, executing transactions securely, and safeguarding against potential cyber threats. Conversely, investing in bitcoin ETFs via established brokerage platforms streamlines the process, offering a more accessible and user-friendly approach for investors seeking exposure to the digital asset space without grappling with the intricacies of blockchain technology.

Storing crypto assets in hot wallets poses risks from potential hacking or exchange insolvency, as exemplified by the FTX incident. The safest recourse involves transferring funds to secure hardware wallets, albeit risking permanent loss if the private key is misplaced.

ETF investments generally uphold safety standards through regulation, yet shareholders must entrust the issuing entity.

Performance Metrics

Due to their custodial control over bitcoin assets, ETFs typically generate comparable returns over extended periods, mirroring the performance of the underlying cryptocurrency. However, it’s worth noting that ETFs may intermittently demonstrate heightened volatility, occasionally outperforming the direct performance of BTC. Additionally, it’s essential for short-term traders to recognize that ETFs are subject to trading limitations outside of standard market hours, which can impact their ability to execute transactions during certain time frames. Therefore, investors should carefully consider these factors when evaluating the suitability of ETFs for their investment strategies, especially in the context of short-term trading objectives.

Investment Considerations

Bitcoin ETFs and physical bitcoin react congruently to market stimuli, maintaining a nearly perfect positive correlation and parallel risk profiles.

However, in terms of investment objectives, each option serves distinct purposes.

ETFs prove advantageous for investors seeking portfolio diversification, especially those blending stocks and bonds, as exemplified in our Blockchain Believer’s Portfolio, enabling consolidated management of diverse assets within a single account.

Understanding Bitcoin ETFs

Bitcoin spot ETFs serve as investment instruments that provide investors with direct exposure to the price movements of Bitcoin. These ETFs are listed on prominent stock exchanges such as Nasdaq and NYSE and are subject to regulation by the Securities and Exchange Commission (SEC).

Through custodial arrangements, these ETFs acquire and secure actual holdings of Bitcoin, enabling investors to participate in the cryptocurrency market without directly owning or managing the digital assets themselves. By closely tracking the price fluctuations of bitcoin, these ETFs offer a convenient and regulated means for investors to gain exposure to the burgeoning cryptocurrency space within the familiar framework of traditional financial markets.

What is Bitcoin (BTC)?

Bitcoin operates as a dia financial asset residing on a blockchain network governed by decentralized nodes globally. As the pioneering blockchain application, Bitcoin holds the mantle of the largest cryptocurrency by market capitalization, currently valued at $1.3 trillion.

Initially conceived as a decentralized peer-to-peer currency, Bitcoin has evolved into a store of value, offering investors an inflation-resistant wealth preservation avenue.

Key Considerations for Investors

In summary, for conventional investors seeking bitcoin exposure within standard brokerage frameworks, bitcoin ETFs offer a straightforward solution. By integrating bitcoin ETFs into their conventional portfolios of stocks and bonds, these investors can enhance diversification.

Conversely, direct investment in Bitcoin suits crypto enthusiasts equipped with a deep understanding of blockchain intricacies, digital wallet management, and cryptocurrency dynamics. Additionally, bitcoin holders can engage in decentralized finance (DeFi) initiatives by converting their holdings to Wrapped Bitcoin (WBTC), unlocking various yield-generating avenues.