Exploring Crypto Staking in 2023: A Beginner’s Path to Earning Through Cryptocurrency Validation

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

For newcomers, initiating their crypto staking journey in 2023 is made effortless by engaging in online crypto exchanges and platforms. These platforms offer intuitive tools and interfaces to simplify the staking process.

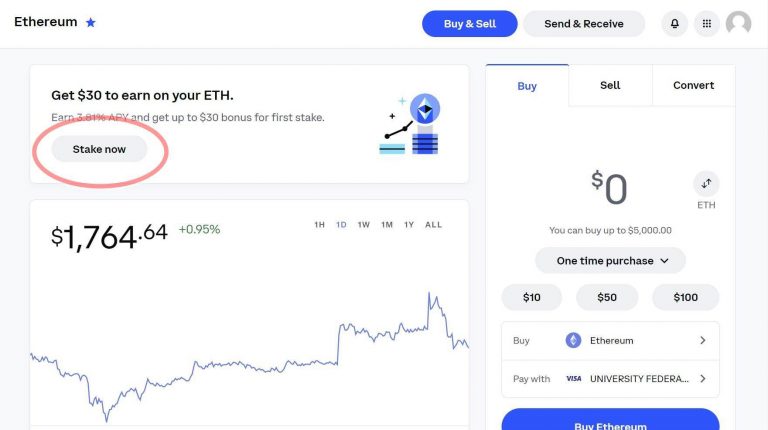

Here’s a step-by-step guide for embarking on your staking adventure with Coinbase:

1. Access Coinbase and swiftly stake ETH directly from your homepage. Just click on the ‘Stake Now’ button to commence.

2. Specify the amount you intend to stake, proceed with the transaction, and then verify your stake.

Understanding the Concept of Staking Crypto

Staking crypto is the art of expanding your cryptocurrency holdings by contributing to validation processes, particularly within “Proof of Stake” blockchains. In PoS blockchains, active participants deposit a portion of their cryptocurrency (referred to as the “stake”) for consideration as block validators. The network then randomly selects a staker to authenticate a block, earning additional crypto in the process.

Staking mirrors the idea of generating “interest,” but instead of traditional interest-bearing options like bonds or savings accounts, you accrue it within the exchange itself.

The standard staking process entails locking your cryptocurrency within a staking wallet for a predetermined period. During this interval, the network utilizes the staked assets to validate transactions and maintain blockchain security. In return, crypto holders receive more cryptocurrency as “staking rewards.”

How Crypto Staking Operates

Staking revolves around the act of holding a specified amount of cryptocurrency within a dedicated digital wallet and securing it for a predefined duration. This undertaking necessitates user resources to bolster the chain’s stability and security, with staking wallets ensuring the longevity of transaction validation.

To partake in cryptocurrency staking, users commit a set quantity of cryptocurrency to the network. For instance, a minimum of 32 ETH is required to stake in the Ethereum network. Validators are then chosen from the staking participants to verify transaction blocks, and the rewards for this validation are typically dispensed in the same cryptocurrency used for staking.

Diverse Approaches to Staking

There are four primary methods for engaging in coin staking:

1. Delegation: This is the simplest approach, favored by smaller investors. Instead of running a validator, smaller users entrust their coins to a third party, such as an exchange or staking platform, which pools funds from multiple investors.

2. Pooled Staking: Similar to delegation, this approach combines multiple validators into a pool for enhanced staking rewards. The larger the pool, the better the chances of receiving rewards.

3. Liquid Staking: An increasingly popular method, liquid staking allows token holders to earn rewards while maintaining access to their tokens, offering flexibility and efficiency.

4. Validator Nodes: The most advanced method involves running your validator node, offering higher rewards and more control in certain blockchains. However, this requires substantial investment and technical expertise.

Mining vs. Staking

For individual investors, staking is a preferable choice over crypto mining, especially due to the environmental concerns linked to mining. Ethereum’s transition to PoS significantly reduced its energy consumption, making staking an eco-friendly alternative.

Common Questions About Crypto Staking

The common questions asked about cryptocurrency staking include the following.

What Are the Benefits of Staking?

Staking provides passive income through rewards, has a lower entry barrier than mining, and is more energy-efficient.

What Are the Risks Involved? Staked coins are not liquid during the staking period, and misbehaving nodes can result in the loss of staked coins. Market volatility can also impact returns.

How do I Unstake?

Unstaking is possible but may involve waiting, with conditions varying based on the cryptocurrency.

Staking vs. Trading: Staking and trading are distinct strategies, with staking being more passive and less risky but potentially offering lower returns.

What Is the Minimum Staking Amount?

The minimum staking amount varies depending on the cryptocurrency, with some allowing small investments and others requiring more substantial sums.