Comprehending the State of Cryptocurrency Index

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Understanding the state of crypto from the perspective of capital firms such as Andreessen Horowitz, which has invested heavily in cryptocurrency startups since 2013.

Understanding the state of cryptocurrency provides you, as an individual, with a reason to see the cryptocurrency market as something to invest in.

Demand Are Created by Users

For cryptocurrencies to be useful, they must be used. This is the reason why measuring the value of, for example, bitcoin isn’t as valuable as measuring the users of bitcoin. The essence of cryptocurrency organizations is to link users together and allow them to transact with new forms of value. So, if the value of crypto is increasing while the number of users is reducing, this does not speak more about how useful such crypto is.

Most of the time, people are happy about the price increase, but it doesn’t seem the same when it comes to user growth. And it is glaring that most people do not invest in cryptocurrency projects based on user growth.

Using the State of Cryptocurrency Index as a Measure of Users’ Growth

The cryptocurrency index is aimed at giving observers a broad view of the sector over time.

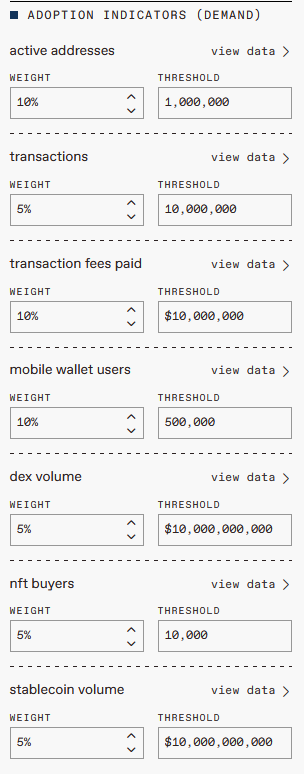

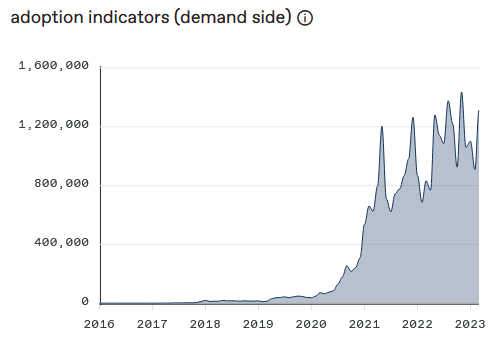

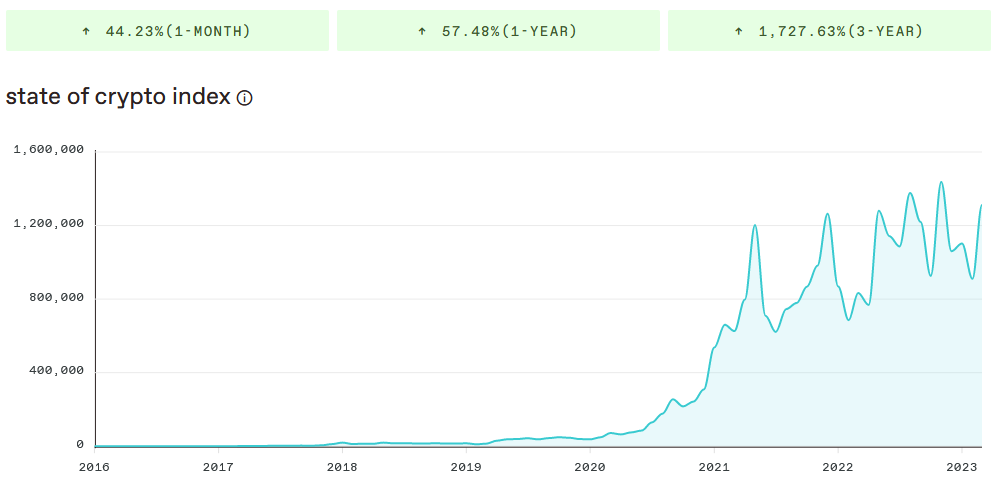

The chart above displays the metrics that make up the state of the crypto chart.

Functional Addresses: This is the number of distinct users on leading blockchains.

Transactions: This is the number of transactions that are occurring across leading blockchains.

Transaction Charges: This is the number of people who are paying for the services of the blockchain.

Mobile Wallet Users: This is the figure that represents the number of distinct users on the leading crypto wallet.

DEX Volume: This stands for the worth of coins exchanged across leading non-centralized cryptocurrency exchanges.

NFT Buyers: This is the number of distinct users that are purchasing Non-Fungible Tokens

Stablecoin Worth: This represents the worth of stablecoins that are being moved across leading blockchains.

The most important thing here isn’t the weighting; rather, it is the total shape of the chart that matters, as the weights are being adjusted. If, as the weights are being adjusted, things are still moving in the direction of growth, then the industry may likely grow.

Nevertheless, indexes can be used for more than just the computing growth of the industry. It also helps measure the growth of developers.

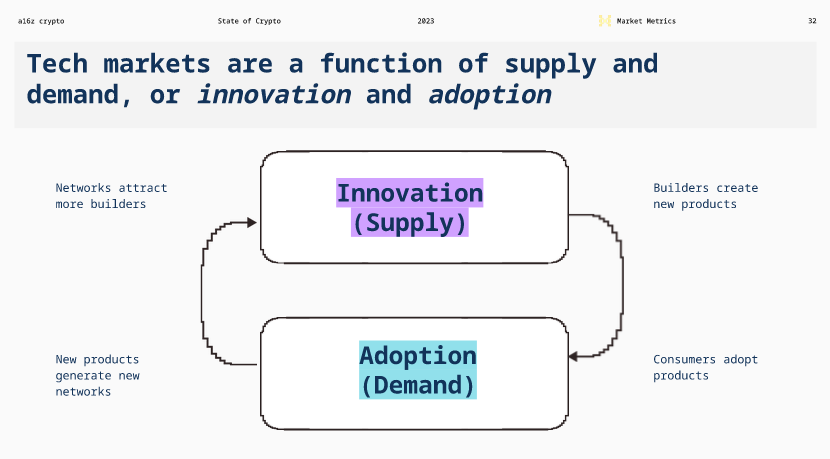

Developers Are the Supply

Let’s take Bitcoin for an instance. As the number of buyers increases, its price skyrockets. Subsequently, this stimulated more developers to start designing more crypto projects. However, this isn’t a linear phenomenon but a wave-like one.

Nevertheless, it has had an upward path over a long period of time, as most leading companies of today took off during downturns.

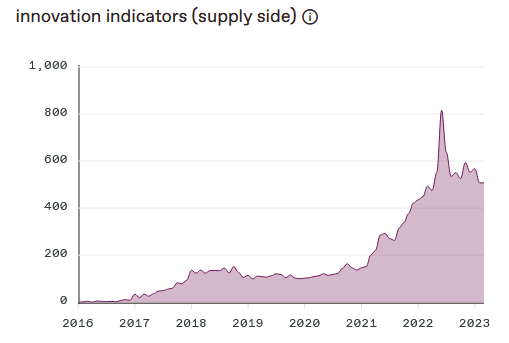

Using the State of Cryptocurrency Index to Measure Developers

In order to measure developers; which is the supply, the parameters below are used.

Functional Developers: These are the developers that are actively designing cryptocurrency projects.

Interested Developers: This is the number of developers that are experimenting with cryptocurrency projects.

Contract Developers: This stands for the number of developers that are supplying new codes on blockchains.

Authenticated Smart Contracts: This is the number of new apps that were launched.

Developer Library Downloads: This is the number of applications that were downloaded to assist developers.

Academic Publications: This represents the number of research publications on cryptocurrency topics.

Job Search Interest: This represents searches on the blockchain and crypto-related employment.

Both active users and active developers can be considered primary metrics for the adoption of cryptocurrency. However, this article emphasizes more active developers. So we have:

This provides a better appearance of the general index when compared to Andreessen Horowitz’s:

The chart above presents remarkable long-term growth. It’s more like investing $1, which grew into $1,727. This is how investing in this general industry appears, while the long-term outcome seems even better as given below.

Why not Measure only Price?

In whatever way this index is manipulated, it is more likely that one will see something similar to the price of the cryptocurrency market, for instance, a Bitcoin price chart:

Price tends to be deceiving. It is just a data point that is controlled by sentiments. So the index is a more efficient tool because it includes lots of data points that reflect the growth of the underlying demand and supply.