Exploring the Avalanche Network: A Deep Dive into its Unique Features

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

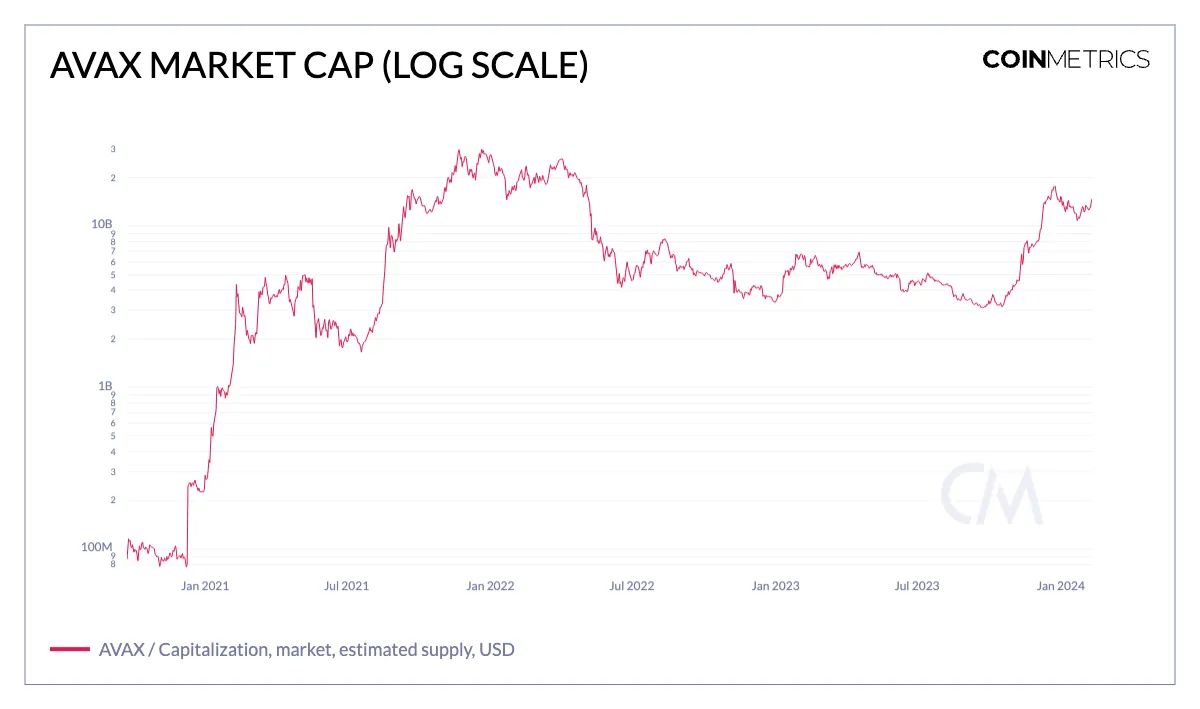

At the forefront of the ever-evolving multi-chain landscape stands Avalanche, a prominent layer-1 network boasting unparalleled customizability, scalability, and rapid execution. Its innovative subnetwork approach caters to a diverse spectrum of applications, spanning from financial services to digital collectibles. Despite market fluctuations, Avalanche’s growth trajectory remains steadfast, drawing developers, retail users, and institutions alike to its tri-chain architecture.

In this edition of Coin Metrics’ State of the Network, we delve into Avalanche’s pivotal role in the digital asset ecosystem. Through a comprehensive examination of metrics, we shed light on adoption trends and usage dynamics, providing insights into the network’s current state.

Avalanche and the AVAX Token: Unraveling the Architecture

Introduced in 2020 by the Ava Labs team, Avalanche operates on a modified proof-of-stake (PoS) mechanism, positioning itself as an open-source platform for decentralized app (dApp) development, compatible with the Ethereum Virtual Machine (EVM). With its proprietary “Avalanche Consensus,” the network is committed to delivering scalable and interoperable infrastructure to the blockchain realm.

Founded in 2018 by Emin Gün Sirer, Ted Yin, and Kevin Sekniqi—esteemed scholars in distributed systems and cryptography—Ava Labs was born from their academic pursuits at Cornell University. Notably, Emin Gün Sirer’s groundbreaking paper on Karma, a peer-to-peer cryptocurrency concept, predates Satoshi’s whitepaper by five years. The AVAX token emerged during the initial seed round in February 2019, securing $6 million for 18 million AVAX tokens at $0.33 each. Subsequent private and public token sales in May and July 2020, respectively, further fortified Avalanche’s financial footing, solidifying AVAX’s position as the network’s native token.

Deciphering Avalanche’s Unique Consensus Mechanism

Ava Labs has pioneered a revolutionary consensus protocol named Avalanche Consensus, marking a significant milestone in the realm of permissionless and scalable blockchain solutions. Unlike the sequential transaction processing of Bitcoin and Ethereum, Avalanche adopts a directed acyclic graph (DAG) architecture, enabling parallel transaction processing and vastly accelerating throughput and speed.

A standout feature of Avalanche Consensus is its permissionless nature, eliminating strict limits on validator numbers—a departure from layer-1 solutions such as Cosmos or BSC, which impose caps on active validators. Scalability is further bolstered through subsampling, a technique that streamlines consensus by reducing required validator votes, facilitating swift transaction finalization in under a second. Unlike Ethereum, where validator communication complexity escalates with increased participation, Avalanche maintains efficiency even as validator numbers grow, promoting permissionless engagement in the validation process.

Moreover, Avalanche employs proof of stake (PoS) to counter Sybil attacks, mandating validators to stake a minimum of 2000 AVAX as collateral—a mechanism akin to a security deposit, ensuring alignment with the network’s integrity. Embracing a leaderless approach, Avalanche fosters decentralization by enabling all staked validators to participate, broadening the validator pool. Additionally, for specific tasks like managing the validator chain and the EVM chain, Avalanche utilizes Snowman Consensus, a variant of its consensus protocol that operates linearly.

Fee Structure and Network Adoption Dynamics

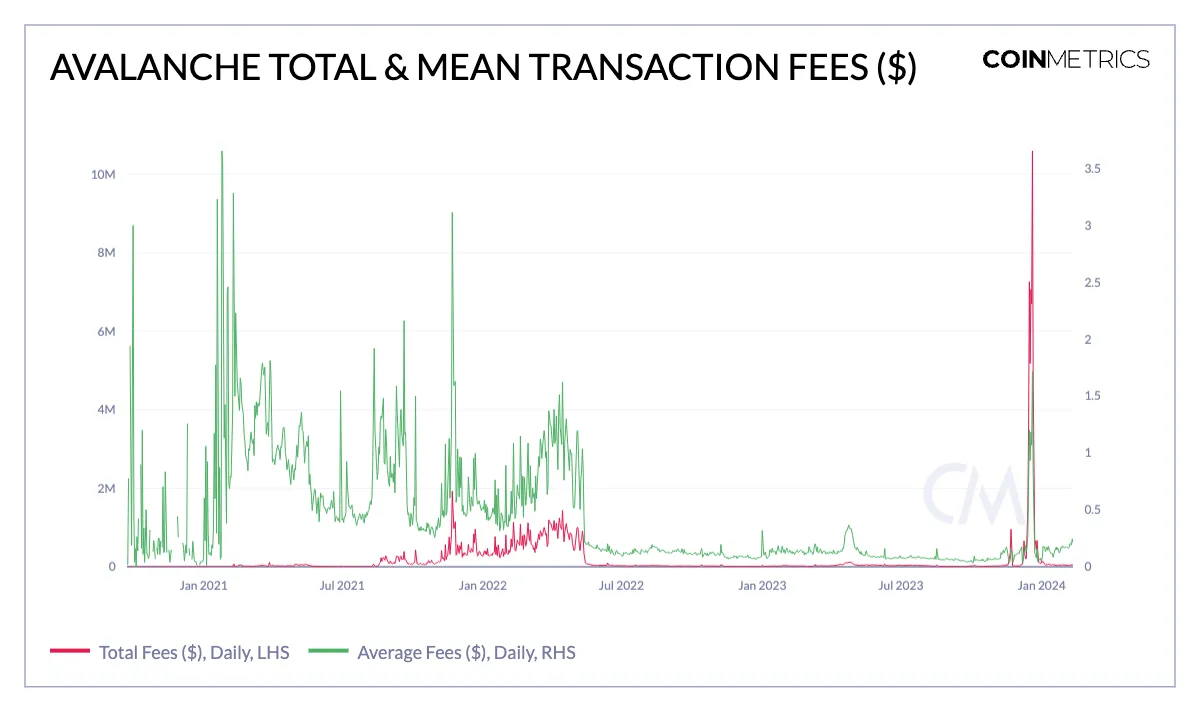

The fee structure on the Avalanche network mirrors Ethereum’s EIP-1559 model, comprising a base fee and a priority fee, known as a ‘tip cap’. Base fees, subject to dynamic adjustments based on blockspace usage, are complemented by priority fees, offering users the option to expedite transaction processing by paying extra. Both fee types, denominated in AVAX, are burned rather than distributed to validators, potentially bolstering AVAX value through increased scarcity.

Avalanche has witnessed fluctuations in average and total fees on the C-Chain, propelled by periods of heightened activity. Since June 2022, mean fees on the C-Chain have stabilized around $0.10, presenting a cost-efficient alternative to chains burdened with higher transaction costs. Nonetheless, the influx of activity drove total fees to a record high of $10.5 million, with average fees peaking at $1.7 in December 2023—underscoring the impact of heightened blockspace demand on transaction costs. Conversely, the X-Chain has maintained mean transaction fees below $0.05, reinforcing its efficacy for token management and transfers.

Fueled by its low-cost, scalable, and adaptable blockchain framework, Avalanche has witnessed notable adoption. In April 2023, daily active addresses and new addresses surpassed 500k, coinciding with heightened interest from prominent financial institutions such as WisdomTree, T. Rowe Price, Wellington Management, and Cumberland.

Conclusion

Avalanche’s unique consensus mechanism and subnet architecture position it distinctly in the layer-1 landscape, effectively addressing scalability and interoperability challenges. Robust usage and adoption metrics underscore the network’s capacity to support diverse applications and cater to a broad user base.

Empowered by innovative subnet utilization, Avalanche has propelled the trend toward asset tokenization, paving the way for digitizing global assets on a unified platform, and fostering more accessible and efficient financial systems. Supported by essential tools like the Core Wallet, Avalanche is poised to expand its reach across various sectors, enriching its ecosystem and broadening its appeal. Positioned amidst the transition towards a multi-chain, interoperable digital asset landscape, Avalanche stands ready to play a pivotal role.