Forecast: Potential Top-Performing Cryptocurrency Stocks Until 2030

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The cryptocurrency landscape faced a frosty reception amidst high-interest rates in 2022 and 2023, but 2024 has ushered in a warming trend. Bitcoin (BTC -3.77%) has surged nearly 50% year-to-date, buoyed by the approval of the first spot price exchange-traded funds (ETFs) by U.S. regulators and anticipation surrounding the impending halving, poised to curtail Bitcoin’s supply growth. Ethereum (ETH -4.22%) has mirrored this ascent, climbing over 40%, fueled by expectations of regulatory green lights for its spot price ETFs amid ongoing updates to the Ethereum network.

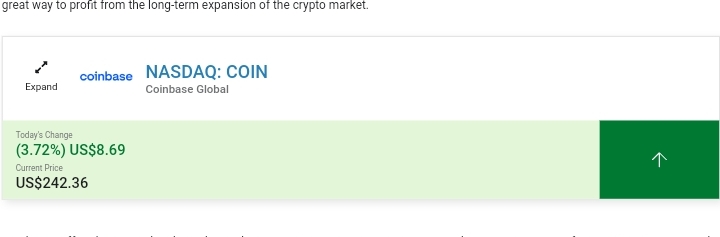

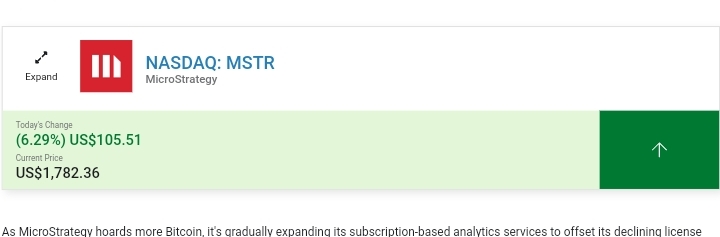

This resurgence has reignited investor interest in cryptocurrency-related equities such as Coinbase Global (COIN 3.72%), Marathon Digital (MARA 5.98%), and MicroStrategy (MSTR 6.29%). Each presents accessible avenues for capitalizing on the crypto market’s expansion and could potentially witness substantial upticks by 2030.

Coinbase Global (Cryptocurrency Stock):

As one of the globe’s largest cryptocurrency exchanges, Coinbase sourced 34% of its trading volume from Bitcoin, 20% from Ethereum, 11% from the Tether (USDT -0.00%) stablecoin, and the remainder from assorted crypto assets in 2023. This diversified revenue stream positions it favorably to leverage the crypto market’s long-term growth trajectory.

While Coinbase weathered a notable slowdown during the past two years amid escalating interest rates deterring investors from cryptocurrencies and speculative ventures, the recent meteoric ascent of Bitcoin and Ethereum suggests a resurgence in retail investor interest, likely rekindling its business momentum.

Analysts foresee a compound annual growth rate (CAGR) of 9% for Coinbase’s revenue and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from 2023 to 2026. At 26 times this year’s adjusted EBITDA, Coinbase’s valuation appears reasonable based on these projections.

However, if one espouses a more bullish outlook for Bitcoin, Ethereum, and other leading cryptocurrencies, Coinbase could feasibly surpass these estimates and deliver market-beating performance well into 2030.

Marathon Digital (Cryptocurrency Stock):

Marathon stands as the premier pure-play Bitcoin miner globally. In 2023, it achieved a milestone by minting 12,852 bitcoins, marking a remarkable 210% surge from the previous year, while witnessing a robust 253% uptick in its energized hash rate, indicative of its augmented mining prowess. While periodically liquidating its mined Bitcoin for additional liquidity, Marathon concluded the year boasting 15,126 bitcoins (currently valued at $947 million) and $357 million in cash reserves.

Positioned to potentially dominate the Bitcoin mining arena in the foreseeable future, Marathon has already expanded its footprint by inaugurating two new facilities, establishing a mining joint venture in Abu Dhabi, and pursuing acquisitions of additional mining sites. Hence, it wouldn’t be out of the realm of possibility for Marathon to contemplate acquiring its closest rival, Riot Platforms (RIOT 6.13%).

The increasing difficulty of mining Bitcoin, exacerbated by halving events occurring every four years, which halve the rewards for mining, poses a challenge. Nevertheless, Marathon could counterbalance this pressure through economies of scale achieved via the expansion of its mining operations and optimization of its cost structure. Analysts project a robust 48% compound annual growth rate (CAGR) for its revenue from 2023 to 2025, with the potential for accelerated growth if Bitcoin’s price surges and Marathon solidifies its dominance over its key competitors throughout the decade.

MicroStrategy (Cryptocurrency Stock):

MicroStrategy, once perceived as a sluggish enterprise software entity, underwent a transformative shift when it embarked on a spree of substantial Bitcoin acquisitions over the past 3 1/2 years. By the conclusion of 2023, the company boasted a staggering 189,150 bitcoins on its balance sheet, valued at approximately $11.9 billion, comprising nearly two-thirds of its enterprise value totaling $18.5 billion. This trajectory signals its commitment to continued Bitcoin acquisitions in the foreseeable future.

As MicroStrategy accumulates more Bitcoin, it simultaneously broadens its subscription-based analytics offerings to offset dwindling license and support revenues. Proponents envision that over the long haul, MicroStrategy’s software segment will stabilize as its Bitcoin investments yield fruitful returns.

Similar to Coinbase and Marathon, MicroStrategy presents a convenient avenue for capitalizing on Bitcoin’s ascending trajectory without directly engaging in cryptocurrency transactions. Additionally, the company could explore the option of divesting a portion of its Bitcoin holdings to alleviate debt burdens and fortify its software ecosystem through substantial investments and strategic acquisitions. With adept maneuvering across these fronts, MicroStrategy stands poised to potentially outshine the broader market by 2030.

Contemplating a $1,000 investment in Coinbase Global at present? Before taking the plunge, mull over this crucial insight:

The esteemed analyst team at Motley Fool Stock Advisor recently unveiled their picks for the top 10 stocks primed for investment… and intriguingly, Coinbase Global failed to secure a spot among them. The selected 10 stocks have the potential to generate substantial returns in the years ahead.

Reflect on the case of Nvidia, which appeared on this list back on April 15, 2005. If you had invested $1,000 following our recommendation, your investment would have ballooned to $538,179!

Stock Advisor offers investors a straightforward roadmap to success, featuring actionable advice on portfolio construction, regular analyst updates, and two fresh stock selections each month. Since its inception in 2002, the Stock Advisor service has outperformed the S&P 500 by more than fourfold.