Revolutionary Shifts in the Crypto Landscape

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a surprising turn of events, the recent triumph for Crypto emerged on August 29th as a U.S. appeals court sided with Grayscale in their legal battle against the SEC following the rejection of their spot Bitcoin ETF application last year. This ruling significantly boosts the likelihood of approval for spot Bitcoin ETF applications from firms such as BlackRock and Fidelity.

While the U.S. has appeared slow in adopting digital assets compared to other regions, several nations have implemented equally stringent measures against crypto. However, the redeeming quality of the U.S. lies in its commitment to procedural fairness within its court system, offering a path for rectification when boundaries are breached.

We have underscored the imperative for trustless systems in our sector, wherein users can depend on blockchain-based frameworks to execute transactions transparently and reliably. The assurance provided by the American judiciary system in upholding procedural fairness could pave the way for a favorable regulatory environment for crypto, fostering further onshore innovation.

Fundamentals-Driven Investment Approach

The investment methodology centered on fundamentals for digital assets mirrors that of traditional equities, which may come as a pleasant revelation and a crucial clarification for investors in conventional asset classes.

The initial step involves rigorous fundamental analysis, addressing pertinent queries akin to those in evaluating public equities. This includes assessing product-market fit, total addressable market (TAM), market structure, competitors, and differentiation.

Subsequently, attention is directed toward business quality, evaluating factors such as competitive advantage, pricing power, customer base, and customer retention.

Unit economics and value retention emerge as pivotal considerations, emphasizing the importance of sustainable profitability and value creation to ensure returns for token holders.

Furthermore, scrutiny extends to the management team, encompassing their background, track record, alignment of incentives, strategic roadmap, go-to-market plan, and partnerships.

Synthesizing this wealth of fundamental information forms the foundation for constructing financial models and investment memos for core positions.

Asset selection and portfolio construction follow suit, leveraging multi-year financial models to gauge event-driven catalysts, risk-reward profiles, and valuations.

Post-investment decisions, ongoing monitoring ensues through a systematic approach to data collection and analysis, tracking key performance indicators to make informed adjustments as necessary. For instance, active monitoring of on-chain data for decentralized exchanges like Uniswap facilitates real-time assessment of trading volumes and market dynamics.

Foundational Investment Strategies in Action: Arbitrum’s Paradigm Shift

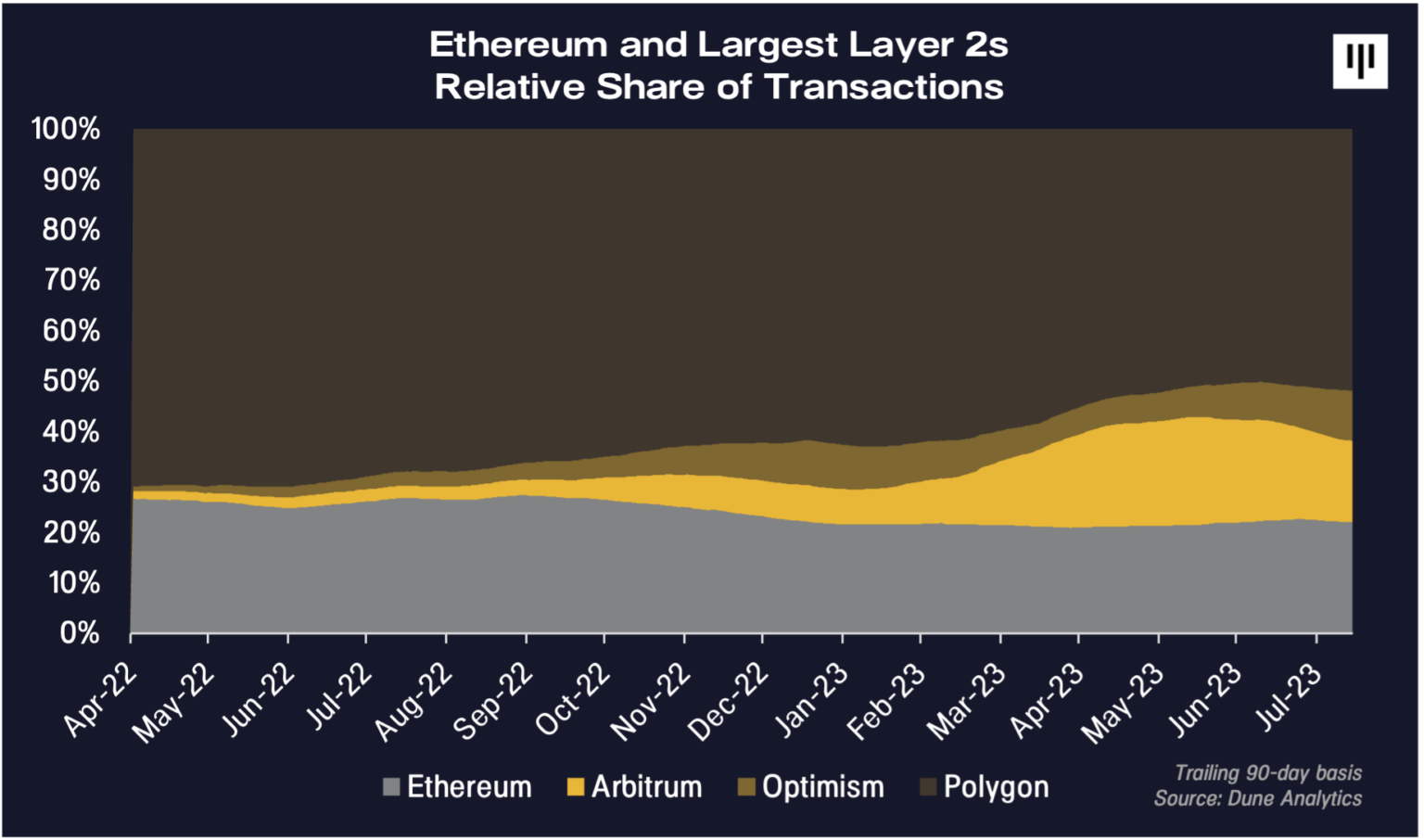

Ethereum has been subject to criticism for its sluggish and costly transactions during peak usage periods. Amidst debates over scalability, layer 2 solutions like Arbitrum are emerging as viable alternatives.

Arbitrum’s value proposition is straightforward: faster and more economical transactions, boasting a 40x speed increase and a 20x cost reduction compared to Ethereum. This compatibility with existing applications and security features has propelled Arbitrum’s rapid growth, both in absolute terms and relative to its peers.

For investors prioritizing fundamental metrics, Arbitrum stands out as a top contender, witnessing robust adoption as one of Ethereum’s fastest-growing layer 2 solutions. Notably, its transaction volume growth amidst a bear market underscores its market dominance within the Ethereum ecosystem.

Arbitrum’s positive network effects are evident, with increasing usage attracting developers, thereby amplifying its user base. However, fundamental investors must scrutinize the monetization aspect to gauge its long-term viability.

Arbitrum’s profitability model, driven by transaction fee collection and efficient batch processing, positions it as a lucrative investment opportunity. Quarter-over-quarter growth metrics and revenue figures validate its financial strength and scalability potential.

With approximately 2.5 million monthly users and impending cost reductions due to Ethereum’s technical upgrades, Arbitrum is poised for substantial revenue and profitability growth. The anticipated reduction in transaction costs could significantly impact its business dynamics, offering multiple avenues for increased adoption and profitability.

As Arbitrum navigates its options regarding cost savings, investors anticipate a significant catalyst for further usage and revenue expansion. Overall, Arbitrum’s transformative potential and solid fundamentals make it an intriguing prospect in the evolving crypto landscape.

Macro Catalysts Unveiled

As regulatory clarity begins to dawn, it remains a significant barrier to market progression, particularly affecting the valuation of lesser-known tokens. The tide seems to be shifting against the SEC’s heavy-handed approach, as evidenced by court rulings challenging their enforcement tactics. The recent favorable outcomes for Grayscale’s spot Bitcoin ETF and Ripple’s case against the SEC highlight a pivotal moment in digital asset regulation, emphasizing the need for a nuanced approach.

Regulatory certainty is not only crucial for consumer protection but also essential for fostering innovation by providing entrepreneurs with the confidence and guidance necessary to pioneer new applications.

Furthermore, crypto is experiencing what we term its “dial-up-to-broadband moment.” Analogous to the internet’s transformation two decades ago, scaling solutions like Arbitrum and Optimism are propelling Ethereum’s capabilities to new heights. The exponential increase in transaction speeds, coupled with reduced costs, heralds a paradigm shift akin to the evolution from dial-up to broadband.

Just as the acceleration of internet speeds paved the way for a multitude of online businesses, we anticipate a similar explosion of new use cases in crypto with the advancement of blockchain infrastructure and speed. In our estimation, the potential for innovation in the crypto space is far from being fully realized, underscoring the vast opportunities that lie ahead.