Layer-2 Blockchains

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

To address the scalability issues of Layer-1 blockchains like Ethereum, layer-2 blockchains were created. Their accomplishments have been crucial to the development of DeFi, NFTs, and other Web3 solutions on Ethereum. However, it is anticipated that the Ethereum Layer-1 blockchain will become faster and more scalable than ever after the successful completion of its ongoing PoS upgrade. What function, if any, will Layer-2 protocols play in Ethereum 2.0’s future? Do they still merit your financial investment?

The first significant blockchain to offer smart contract functionality was Ethereum. Due to its first-mover advantage, it was able to attract users and developers at a rate that other, more recent Layer-1 blockchains found difficult to match.

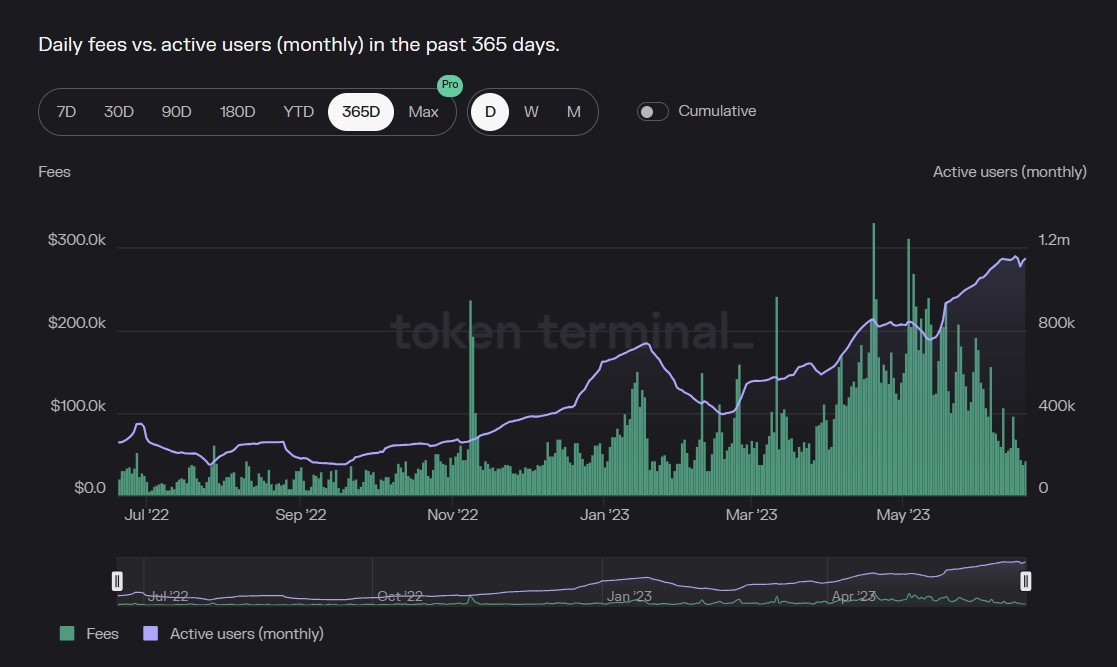

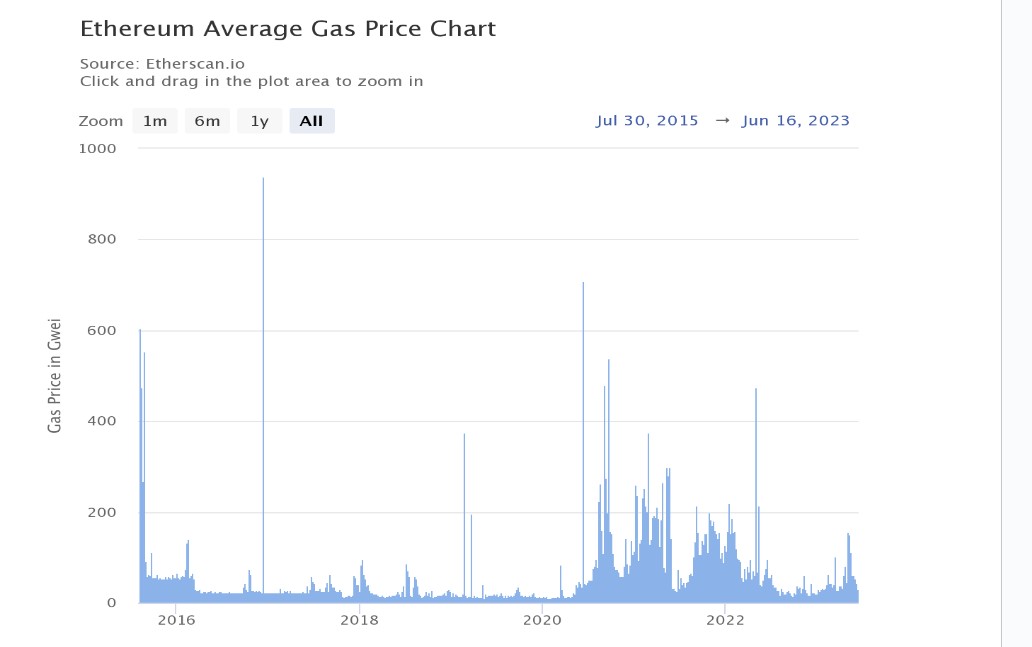

However, when the blockchain’s transaction volume skyrocketed, the network began to experience agonizing delays. Additionally, because the protocol uses a bid system to determine who gets the available block space, this results in absurdly high transaction prices (gas fees).

In extreme cases, the gas costs skyrocketed to 500 million gwei, or around $1600 at the current exchange rate. A single transaction could take longer than 24 hours during certain periods of high congestion.

After 2020, network congestion on Ethereum became a significant problem; therefore, Layer-2 blockchains were developed to speed up transactions and lower gas costs.

Different Layer-2 Blockchain Approaches

To implement Layer-2 solutions, developers have developed several different strategies over time.

Plasma

The Plasma Framework’s Layer-2 protocol establishes several “child chains” linked to the Ethereum mainnet. Although plasma chains have high TPS potential, they are difficult to design. Particular use cases, like decentralized exchanges, games, or token transfers, make them more practical. The Leading Layer-2 blockchain Polygon uses plasma chains.

Optimistic Rollups

A rollup is a Layer-2 method used to carry out a large number of Layer-1 transactions away from the mainnet. Before publishing these transactions back on the mainnet, the solution “rolls up” and compresses them into a single piece of data.

Optimistic rollups drastically speed up transactions by processing transactions in good faith off-chain as soon as they are received. However, because of the mechanism for dispute resolution, there is a minor delay in the confirmation of transactions on the Ethereum mainnet.

Zero-Knowledge Rollups (zk-rollups)

Zk-rollups are typically thought to be more effective in scenarios involving intricate computations or higher levels of security. However, they don’t offer the same level of complete Ethereum Virtual Machine (EVM) compatibility as optimistic rollups. Interoperability is hampered by this, which is detrimental to the blockchain ecosystem’s growing importance. The complexity of developing and deploying zero-knowledge rollups and proof systems has also restricted their use in practical applications.

The Growth of the Layer-2 Industry

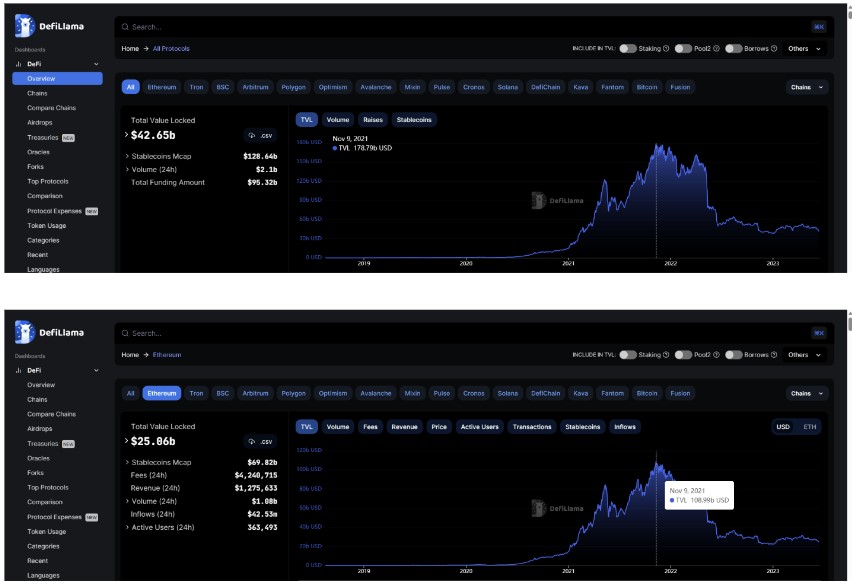

Because of its features and wide adoption, Ethereum continues to be the market leader in DeFi growth. DeFiLlama estimates that the blockchain will be responsible for 58.58% of the ecosystem’s entire value, which will be worth close to $25 billion in Q2 2023.

The value of the entire DeFi ecosystem peaked in Q4 2021 at over $174 billion, with about $110 billion of its value being held on the Ethereum network. Without the assistance of Layer-2 blockchains, this kind of growth would not have been conceivable.

The Best Three Layer-2 Protocols

Polygon (MATIC)

The current version of Polygon contains a software development kit by the same name, the Polygon SDK. It may be used by programmers to create any form of decentralized applications and sidechains that are compatible with Ethereum.

A PoS sidechain serves as the primary Layer-2 blockchain at the center of the Polygon network. MATIC is the name of the native token. The TPS capacity of the Polygon network is 65,000. Furthermore, gas prices are incredibly low.

Arbitrum (ARB)

Arbitrum, in contrast to Polygon, is solely concerned with hopeful rollups. On the Arbitrum sidechain, transactions and smart contracts are resolved before being reported back to the Ethereum mainnet. The Layer-2 protocol promises an insanely low gas cost and a TPS of 40,000.

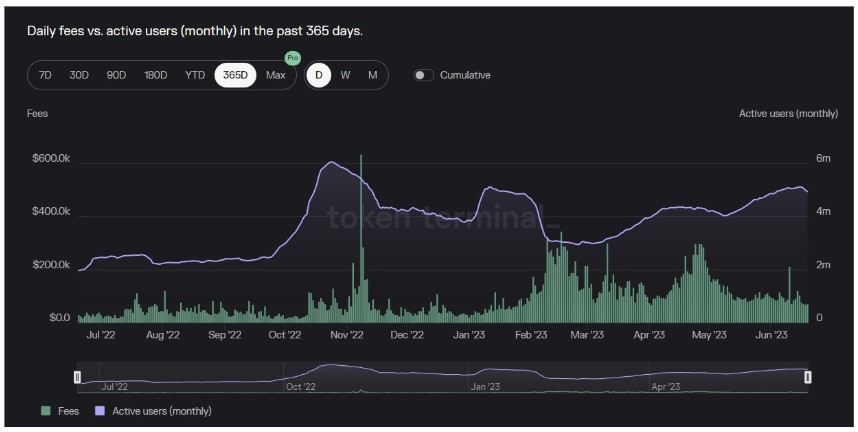

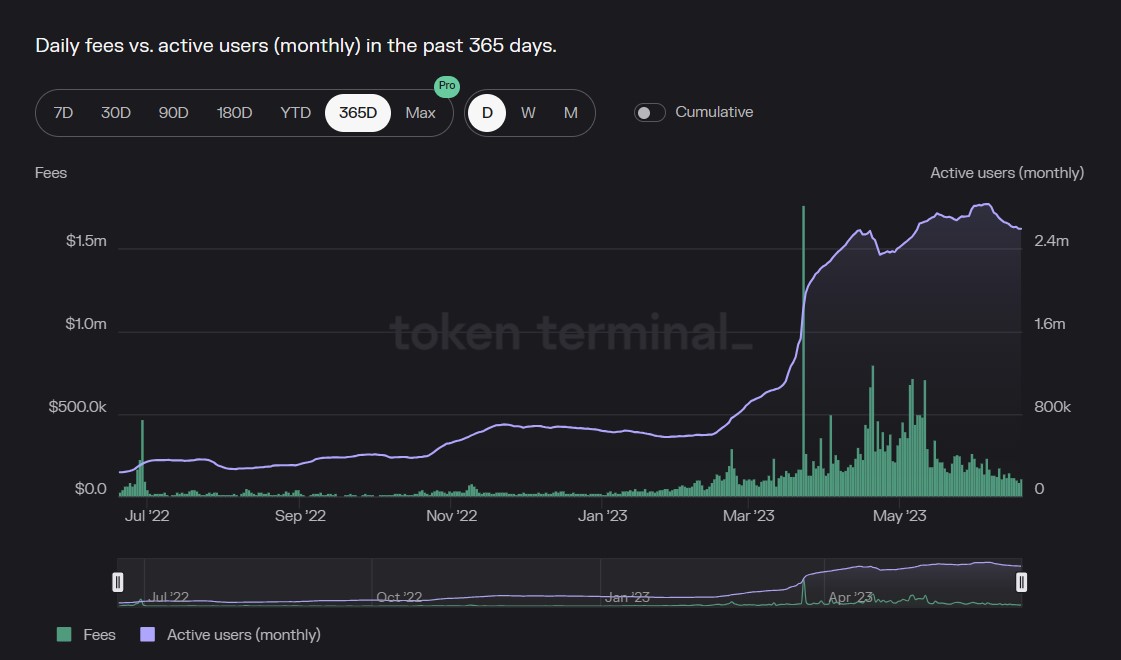

Along with being completely interoperable with all EVM programming languages, Arbitrum. In recent years, the blockchain has made some progress in the DeFi industry. Major DeFi protocols like Curve and SushiSwap have integrations with Arbitrum.

Optimism (OP)

OP is the name of Optimism’s native token. It operates as the blockchain’s governance token and is based on the ERC-777 specification. Additionally, it can be bought and sold on all significant crypto exchanges.

Despite being around for a while, Optimism hasn’t been able to gather as much traction as competitors like Arbitrum. But in rollup chains, it still makes up around 25% of the TVL. It’s still unclear whether it will be able to maintain its market share and expand.

Conclusion

When network congestion and high gas prices first started to affect Ethereum, layer-2 blockchains gave it the essential breathing room it needed. Ethereum 2.0 is anticipated to have transaction speeds of up to 100,000 TPS after the full switch to PoS.

Ethereum is one of the most dependable blockchain assets in terms of endurance and general acceptability, along with Bitcoin. Additionally, well-known Layer-2 protocols like Polygon and Arbitrum still have a place in the Ethereum ecosystem.