Rising to New Heights: Unveiling the Unstoppable Growth of Tether

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Stablecoins such as Tether are pivotal in merging traditional finance with the digital asset world, notably dollar-backed ones experiencing a surge. They provide stability, enabling smooth value transfer and serving as safe havens in volatile markets, which is crucial for economies facing financial instability.

Tether (USDT) leads the stablecoin market with a significant share but faces scrutiny over reserve transparency. Despite recent assurances, its dominance warrants closer scrutiny.

In this issue of Coin Metrics’ State of the Network, we delve into Tether’s rapid ascent. Using advanced on-chain data analysis, we explore its growth, adoption, usage, and reserve strategies to provide a detailed understanding of this stablecoin giant.

The Expansion of Tether: Scaling New Peaks

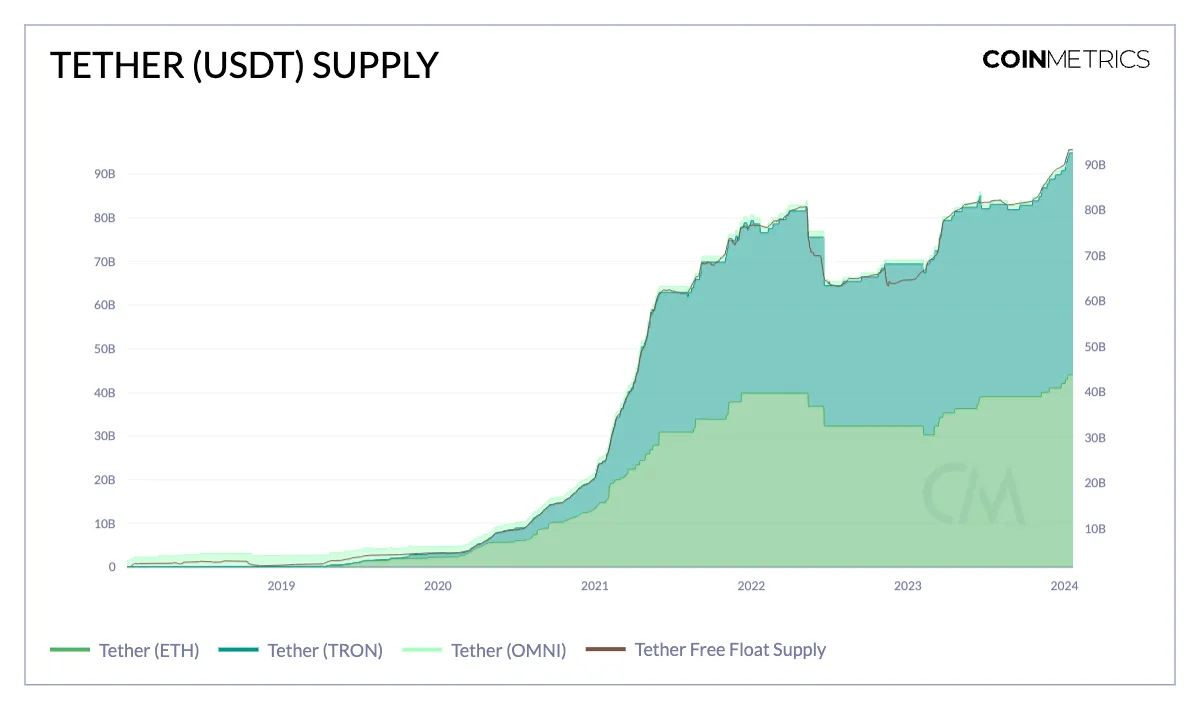

While attention momentarily veers towards Bitcoin ETFs, Tether continues its remarkable climb, surpassing $95 billion in total supply with a notable 35% year-over-year increase. Ethereum and Tron serve as primary platforms for USDT issuance, with significant supply shares. Tether’s expansion into alternative layer-1 networks like Solana and Avalanche broadens its reach, reinforcing its role as the premier stablecoin for the digital era.

Navigating the Seas of Adoption: Unraveling the Offshore Stablecoin Surge

Following recent disruptions, including the SVB collapse and the Operation Choke Point 2.0 fallout, offshore stablecoins witnessed a notable resurgence. A closer look reveals USDT’s remarkable surge within smart contracts, traditionally dominated by USDC. The SVB fallout appears to boost USDT’s confidence in smart contracts, with its footprint growing from $4 billion to nearly $6.9 billion since March 2023. USDT’s dominance extends to key DeFi markets like Aave v2 and Compound, consolidating its position in the DeFi space.

USDT’s growing presence in DeFi, spanning lending protocols and decentralized exchanges, highlights its crucial role in facilitating secure dollar transactions and enhancing access to financial services. While Tether’s integration into smart contracts expands, its primary holdings remain in externally owned accounts (EOAs), reaching $37 billion in supply on Ethereum. This trend mirrors the rising adoption of digital dollars for transactions beyond just store of value or volatility hedging, including trading and payments.

Unveiling Usage Trends: Charting Tether’s Global Footprint

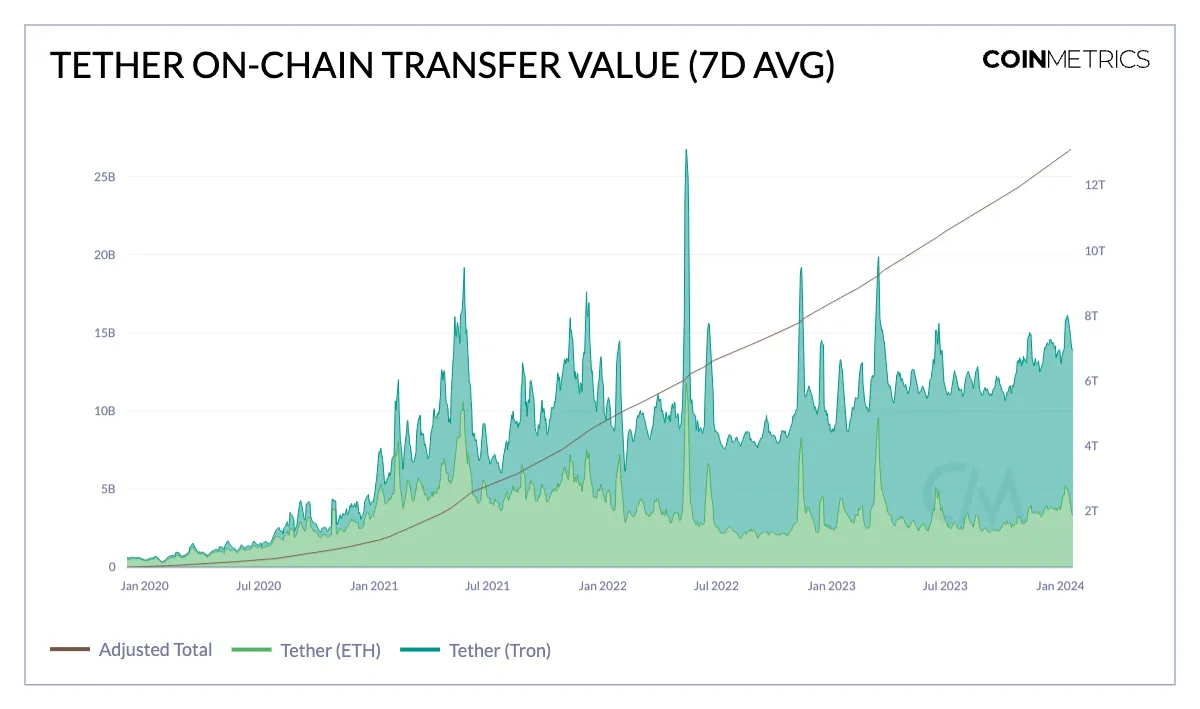

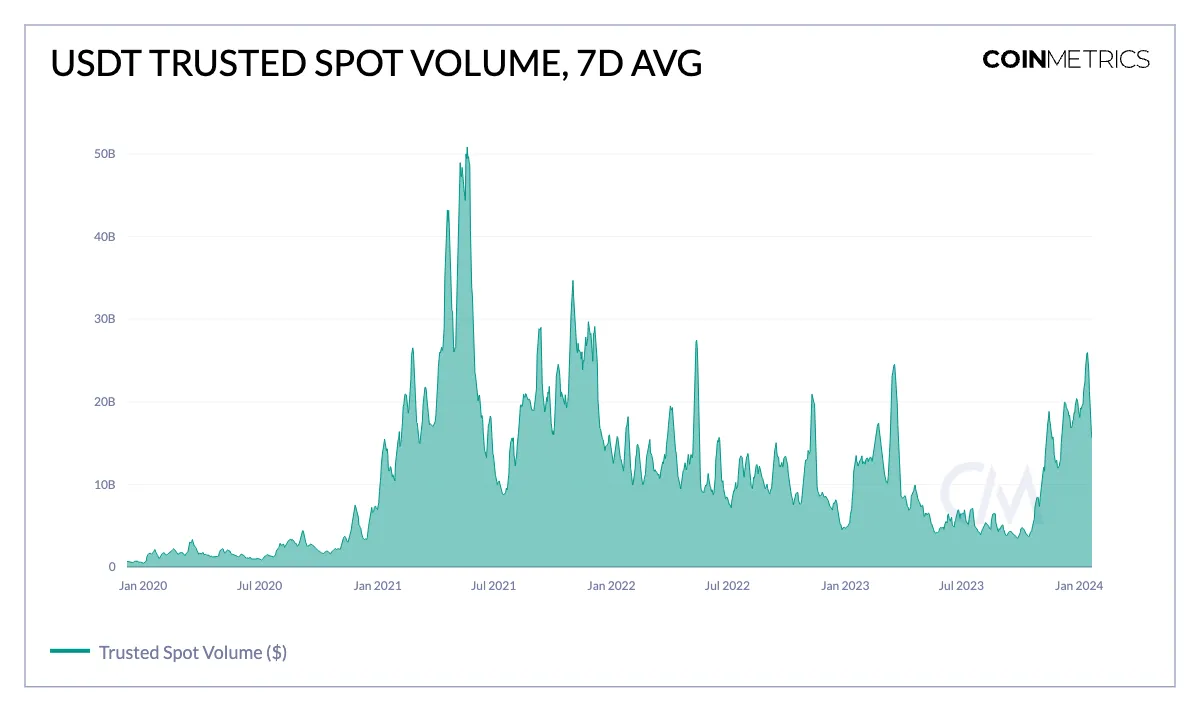

Tether, the leading stablecoin, is widely utilized across networks. This month, on-chain transfer values on Ethereum and Tron exceeded $5 billion and $11 billion, respectively. Since 2014, Tether has facilitated over $13 trillion in transfers, especially in emerging markets where it acts as a reliable dollar substitute. Despite smaller average transfer sizes compared to USDC, Tether’s widespread adoption underscores its pivotal role in facilitating peer-to-peer transactions and economic resilience.

In contrast, USDT transactions on the Ethereum network manifest a different pattern, with an average transfer size of approximately $35,000. This signifies substantial involvement in financial activities within the DeFi landscape, likely influenced by Ethereum’s higher transaction fees. Conversely, USDT transactions on the Tron network paint a distinct picture. With Tron’s negligible transaction fees, the average transfer size for USDT hovers around $7,000, facilitating frequent, lower-value transactions, thereby rendering it a practical choice for everyday payments and remittances.

Unraveling Tether’s Reserve Dynamics

The constitution and transparency of Tether’s reserves have been subjects of intense debate, often sparking conjecture regarding the adequacy of its financial backing. However, Howard Lutnick’s resolute declaration at the World Economic Forum in Davos, asserting that “They have the money,” has assuaged some of these apprehensions, lending credence to discussions surrounding Tether’s reserves. Presently, the sole means of validation lies in independent auditor attestation reports, furnishing a quarterly breakdown of assets stashed in their reserves.

Over the years, Tether’s reserve makeup has undergone notable transformations. While commercial paper once formed a substantial chunk of reserves in 2021, their latest attestation indicates a predominant reliance on US Treasury bills, mirroring the prevailing interest rate environment. In a strategic move unveiled in May 2023, Tether announced a plan to allocate up to 15% of realized profits exclusively into BTC to bolster USDT’s surplus reserves. This initiative materialized into the acquisition of 57.5K BTC, valued at $1.6 billion, aligning with their Q3 2023 attestation. Notably, recent revelations hint at the potential addition of another 8.9K BTC to Tether’s coffers, with credits to this account seemingly linked to Bitfinex, a platform closely intertwined with Tether.

Finally: The Road Ahead

Tether’s meteoric rise underscores its tangible utility, particularly in volatile economies where access to a stable, dependable currency is a luxury. Despite legitimate concerns regarding centralization and transparency, the multifaceted advantages offered by Tether demand acknowledgment.

As a pivotal conduit for broader digital asset adoption, Tether has propelled the entire stablecoin market forward. While it currently reigns as the foremost stablecoin, the evolving landscape poses intriguing questions about its continued dominance. With Circle’s plans for public listing and the emergence of crypto-collateralized and interest-bearing stablecoins, the dynamic realm of stablecoins promises an enthralling journey ahead.