A Complete Guide to the Top 10 Arbitrum Protocols

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Barely starting within a year, Arbitrum has proven itself as the most successful Ethereum scaling solution, judging by its Total Value Locked (TVL), which is $2 billion. The platform’s quick speed, low cost, and security have attracted many of the most well-known decentralized applications (dapps) to it. Currently, the platform has over 300 protocols on it. The combination of the number of protocols it has and its TVL qualifies it as the largest Ethereum Layer 2 solution. In addition to that, its token, ARB is gaining more recognition in the crypto market.

What is Arbitrum?

Ethereum is a truly amazing invention, but it is pricey and slow. This need prompted programmers to come up with a Layer-2 project called Arbitrum. This Arbitrum is sitting on top of Ethereum (Layer 1), and it is improving it.

This new layering ensures that security is not sacrificed in order to attain quicker speed by allowing Layer 2 to inherit the security of Layer 1. Since they take on Ethereum’s proof of stake, Layer 2 alternatives like Arbitrum and Optimism don’t have their own consensus processes. This is the major difference between Layer 2 protocols and sidechain platforms such as Polygon Proof-of-Stake.

The mainnet for Arbitrum was launched in late 2021 and got going right away. Within a year, Arbitrum defeated Polygon to overtake it as TVL’s preferred scaling option for Ethereum. Arbitrum is now ranked fourth overall with more than $2.15 billion in TVL, more than doubling what Polygon has achieved in the same amount of time.

How Does Arbitrum Function?

Arbitrum uses a special technique to reduce congestion on the Ethereum network. It rolls up transactions into batches, carries out the validation processes on Arbitrum, and then returns the finished product to Ethereum as one transaction. Therefore, rather than validating each transaction individually, Ethereum processes the batch as a single transaction.

Arbitrum employs “optimistic rollups” in the processing of transactions. This new technique does not require the provision of the respective proofs on the chain.

Rather, optimistic rollups use dispute security methods that provide time periods for challengers to rollup transaction results. In the event that a dispute arises concerning the result and proof of fraud is submitted (within the space of at least seven days), the party responsible for the fault faces a penalty and the transaction will be re-executed.

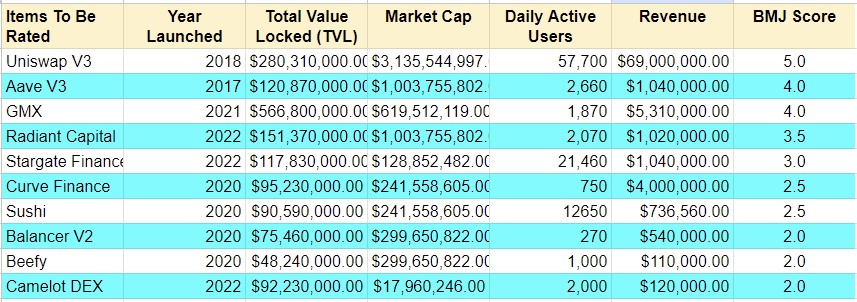

Top 10 Arbitrum Protocols by Total Value Locked

Uniswap (version 3)

Uniswap was deployed in 2018 as a decentralized exchange platform (DEX). It was mainly designed to facilitate ERC-20 tokens. It became one of the first solutions in the decentralized finance sector to experience considerable growth. Additionally, it marked the beginning of the automated market maker (AMM) DEX era, which offers incentives for users to act as liquidity providers. Uniswap released the second version two years later, then the third version on Arbitrum in August 2022. Since then, it has been among the most popular dApps on Layer 2. The latest version of Uniswap has added new features that allow users to specify a price range on the platforms where they provide liquidity.

Aave (version 3)

The Aave platform was deployed in 2017, and it has become a significant player in the DeFi industry. It was developed to enable users to lend and borrow cryptocurrency directly from one another. In March 2022, Aave version 3 was released on Arbitrum, with the new modifications concentrating on security, increased user yield, and cross-chain support. The platform’s native token, $AAVE, is a governance token that enables users to cast ballots on important choices and receive fee reductions.

GMX

GMX’s first launch was on Arbitrum in 2021, before expanding to Avalanche a few months later. In addition to offering perpetual futures trading with up to 50X leverage, GMX also lets customers trade ETH, BTC, and other well-known cryptocurrencies. The platform’s utility and governance tokens are GMX, and GLP, respectively. The GLP is distributed to liquidity providers, and these two tokens run the platform. The GLP holders are entitled to 70% of the platform fees, while the GMX stakeholders receive the remaining 30%. On Arbitrum, GMX is the most widely used protocol, contributing more than 25% of its TVL.

Radiant Capital

This is a lending platform that focuses on cross-chain borrowing and lending. It helps facilitate the movement of assets across various chains; the project is driven by LayerZero technology. The native token is RDNT, and each holder of this token is able to vote on platform proposals. They also receive a share of the interest that borrowers pay. Holders of the RDNT token can stake their holdings to gain more incentives and a share of the fees.

Stargate Finance

Stargate Finance was designed to eradicate the need for wrapped tokens and allow users to send native tokens or assets to different blockchain networks without the use of wrapped tokens. The native token of Stargate is STG. It can be staked and utilized for liquidity as well as governance. The protocol has been successful since it launched over a year ago, with over $430 million in total TVL and $124 million locked in Arbitrum.

Curve Finance

This platform started in 2020 and has risen to become a giant among popular decentralized financial platforms. Rather than adopting the Automated Market Marker (AMM), it facilitates swapping between tokens with identical pegs, such as stablecoins or wrapped tokens (e.g., wBTC). The implication of this is that it has lower fees, slippage, and impermanent losses. The swap fee for curves is set at 0.04%. Every income generated on the platform is shared among the liquidity providers. This platform came onto the Arbitrum network in 2021, and it is currently responsible for its $95 million in Total Value Locked.

Sushi

SushiSwap was launched as a fork of Uniswap. It was one of the most effective “vampire attacks” in the market—when a protocol encourages users to move liquidity from one protocol to another. It made an attempt to outdo UniSwap by developing the SUSHI token on top of the Automated Market Maker (AMM) to reward holders for making token deposits and supplying liquidity, as this was done before UniSwap developed the UNI token. Since then, Sushi has developed into one of the leading decentralized exchange platforms and is now used on 25 chains, including Arbitrum.

Buy ARB on eToro