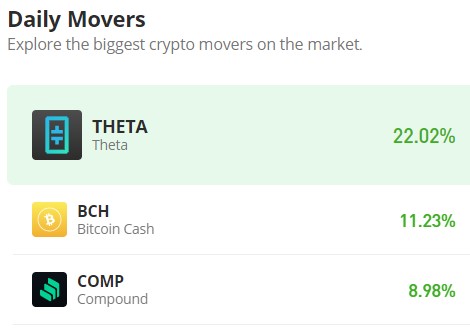

Bitcoin Cash (BCH/USD): Bullish Strength Has Been Confirmed

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

For some time now, there has been a notable observation in the Bitcoin Cash market regarding the almost fixed resistance level. It appears to demonstrate resilience against the ascending lows. This combination of a fixed resistance and an ascending support level typically suggests a bullish price breakout. Bulls have shown a willingness to re-enter the market at higher price levels, thereby exerting additional pressure on the longstanding resistance. Consequently, the resistance level of $274 has finally been breached. The ascending high serves as an indication of bullish momentum accumulation, and today’s substantial bullish performance confirms the buildup that has been observed in the market for some time.

The Bitcoin Cash Market Data

- BCH/USD Price Now: $305

- BCH/USD Market Cap: $6 billion

- BCH/USD Circulating Supply: 19.7 million

- BCH/USD Total Supply: 19.7 million

- BCH/USD CoinMarketCap Ranking: #19

Key Levels

- Resistance: $290.00, $300.00, and $310.00.

- Support: $270.00, $260.00, and $250.00.

Bitcoin Cash Market Analysis: The Indicators’ Point of View

The current bullish momentum has extended over several months, with its inception noted to have commenced in August of the previous year, following a peak in a bull market at the $329 price level. Around August of last year, the bull market demonstrated considerable strength, lasting only a few days, during which the market surged from around $100 to $329. Typically, such hyperbullish markets are followed by equally robust bearish trends. While the subsequent bearish movement was significant, bulls demonstrated persistent interest in establishing long positions, gradually eroding bearish sentiment.

Despite the prevailing bullish sentiment in the Bitcoin Cash market, it’s worth noting that currently, according to the Relative Strength Index, the market has surpassed the threshold into overbought territory. Nonetheless, the bullish trend may persist, with the $329 price level remaining a significant target.

BCH/USD 4-Hour Chart Outlook

Despite the current surge in the price of Bitcoin Cash, investors are advised to exercise caution and await the formation of the next support level. Presently, the Relative Strength Index indicates a significant overbought condition, while the Bollinger Bands suggest high volatility. There exists a possibility of a price reversal, and given the elevated volatility, such a correction could be substantial. Taking this crypto signal into consideration, investors should monitor whether a support level forms around the $300 threshold or slightly below it. The establishment of such a support level would provide assurance of the trend’s continuation.