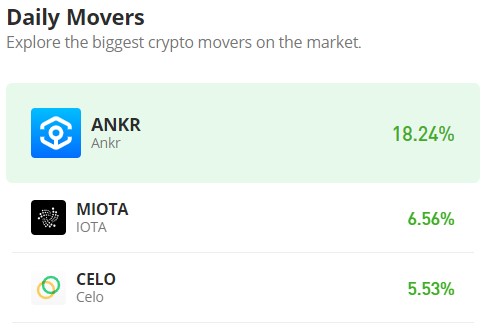

IOTA Market (MIOTA/USD) Bulls Navigate Volatility, Eye Higher Support Levels

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

After the recent bull run propelled the IOTA market steadily above the $0.40 price level from its previous position at $0.286, it faced significant bearish pressure at this threshold. Consequently, the price experienced a sharp decline back below the $0.300 mark. This pronounced bearish movement, breaching the $0.30 price level, has heightened the level of volatility in the market. Given that the zone below $0.30 is considered bullish, bulls have seized upon the prevailing volatility to orchestrate a notable rally in prices.

IOTA Market Data

- MIOTA/USD Price Now: $0.37

- MIOTA/USD Market Cap: $1.2 billion

- MIOTA/USD Circulating Supply: 74 million

- MIOTA/USD Total Supply: 3.2 billion

- MIOTA/USD CoinMarketCap Ranking: #93

Key Levels

- Resistance: $0.40, $0.45, and $0.50.

- Support: $0.35, $0.30, and $0.25.

IOTA Market Analysis: The Indicators’ Point of View

Throughout the day, the IOTA market has been tracking towards the $0.40 price level. However, as the market approaches this threshold, the emergence of bearish sentiment becomes palpable. The presence of a small upper shadow on the candlestick suggests that bears may pose a significant challenge at $0.40, particularly amidst the prevailing market volatility. Despite this crypto signal, bulls currently maintain dominance. Additionally, the Relative Strength Index indicates a momentum measurement of around 60, reflecting the market’s strength. To further bolster their position, bulls may benefit from establishing a support level around $0.35. This strategic move could exert pressure on the $0.40 price level, potentially facilitating a breakthrough.

MIOTA/USD 4-Hour Chart Outlook

From a shorter-term perspective, the $0.35 price level holds significant potential as a support level crucial for the continuation of the bullish trend. Should bulls manage to maintain their stance at this level, it would confirm its support status, potentially propelling the market to surge beyond $0.40 and further. While minor price corrections are typical in the IOTA market, the $0.35 price level stands poised to play a pivotal role as a support threshold.