The Year’s Best Yield Farming Investments

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In just 18 months, yield farming helped the DeFi sector grow to a $150 billion market. How does the sector appear now that the recent prolonged period of price decline in the crypto market has ended?

In this new research, we’ll examine the top yield farming businesses in DeFi. To assist you in locating the best prospects, we’ll also discuss our investment philosophy for a particular industry.

Yield Farming

Yield farming is so essential to the DeFi ecosystem that it is considered to be its lifeblood, a very important aspect of the sector.

Yield farming started in 2020 on the Compound network as an investment strategy. It was ushered in by the advent of liquidity mining. Compound accepted cryptocurrency deposits from investors in exchange for interest, or “yield.” The total value locked (TVL) in DeFi increased by over $2 billion in just two months.

The idea of yield farming provides investors with high returns on their deposits when banks offer extremely low interest rates to depositors.

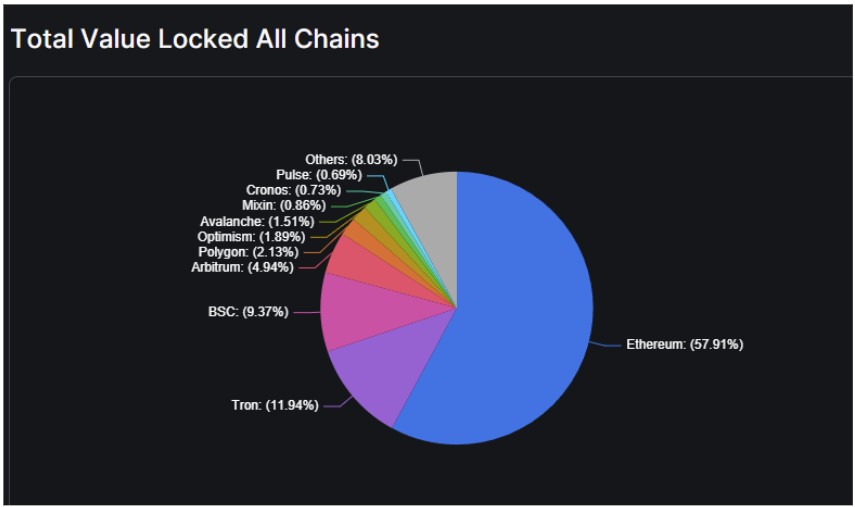

DeFi protocols have decreased by 76% since 2022, yet the market is still worth $47.3 billion in Total Value Locked (TVL). More than 57% of all DeFi yield farming activity is hosted on the Ethereum blockchain, followed by Tron (11.94%) and Binance Smart Chain (9.37%).

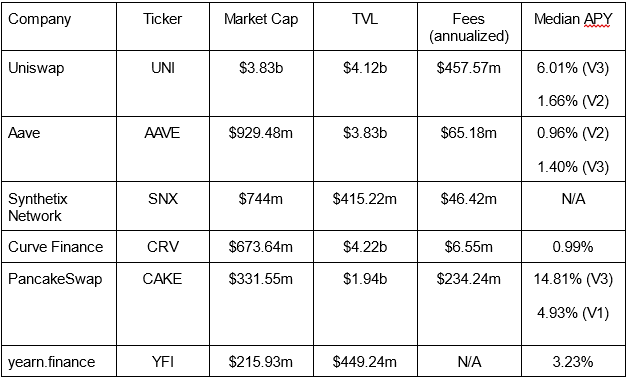

The leading protocols exhibit a wide range of characteristics. The most popular platforms for yield farming are DEXs, with Uniswap and Curve Finance at the forefront. Another hub of effort is DeFi lending, which is mostly focused on protocols like Aave.

The development of DeFi and yield farming continues to be significantly influenced by stablecoins. Coins like USDC and USDT have become well-liked options for farming and staking due to their low volatility.

Many DeFi protocols are now working towards introducing native stablecoins to take advantage of this trend. When crvUSD was released on the Ethereum mainnet by Curve Finance in May 2023, it became the first company to reach this milestone.

Some of the Top Yield Farms

The Investment Idea of Yield Farming

As long as investors hold crypto, there will always be a demand to earn interest on their holdings. This is similar to investing your money in a typical savings account; many investors will wish to put their cryptocurrency to work with companies so that they can earn interest on it at the end of a period.

These yield farming businesses receive funding from liquidity providers (LPs), who supply the funding necessary for their products to function. While there are various ways to profit from yield farming, including becoming an LP, we believe that purchasing and holding the tokens of the best yield farming companies is the most straightforward strategy.

Why Yield Farming?

Below are some of the reasons we are bullish or optimistic about yield farming.

- The Promise of High Annual Percentage Yield (APY)

- The Utilization of Idle Capital.

- You will also enjoy the benefits of diversified investments.

- Yield farming is remarkably resilient against the ongoing crypto winter.

Some Top Yield Farming Platforms:

Uniswap (UNI)

Uniswap is among the most popular decentralized exchanges on the Ethereum network. Uniswap is made for the decentralized lending and trading of ERC-20 tokens. Neither buying nor selling is going on. The UNI token’s owners are in charge of protocol governance. LPs are given shares of the trading fees produced by the platform by Uniswap.

Aave (AAVE)

Aave is a decentralized marketplace for lending and borrowing digital currency. Aave has expanded its presence to other blockchains like Avalanche and Harmony, even though it was initially introduced on the Ethereum blockchain.

Synthetix Network (SNX)

The very innovative DeFi platform Synthetix operates similarly to a derivatives market in conventional finance. Without actually possessing them, users can trade indirectly in a variety of goods, coins, and fiat currency.

Conclusion

Although the 2022 crypto market crisis has diminished the appeal of yield farming, all is not lost. DeFi may become more appealing to investors worldwide as a result of the demise of controlled exchanges like FTX and the current SEC cases against Binance and Coinbase.

Another indication of this model’s robustness is the fact that the main DEX platforms and protocols continue to operate without hiccups. TVL has decreased by two-thirds, but yield farming in DeFi still attracts a lot of investor interest. On Ethereum and other significant blockchains, close to $50 billion is still hidden away in liquidity pools using a variety of different protocols.