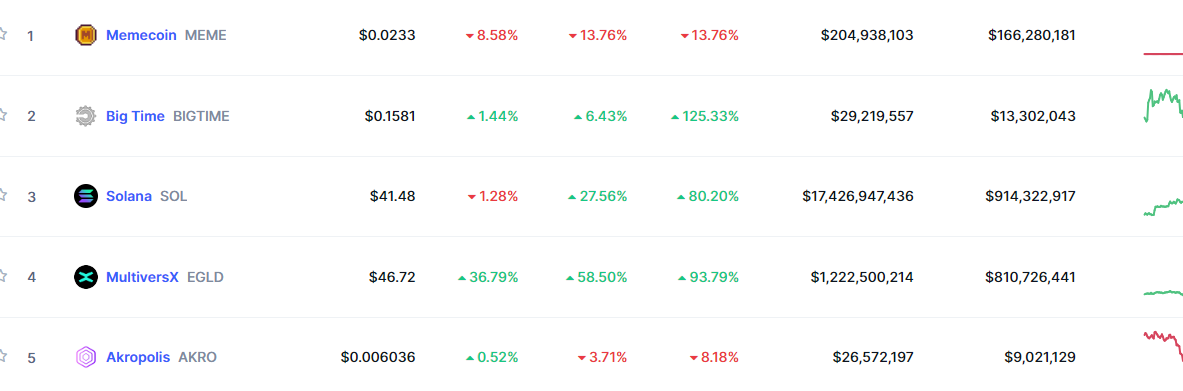

Top Trending Coins for Today, November 5: MEME, BIGTIME, SOL, EGLD, and AKRO

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

When Bitcoin could not surpass its notable $35,000 price threshold, it relinquished its leading position as the most trending cryptocurrency for the past week. This distinction was claimed by a recently introduced coin, which ascended to the top spot due to its recent launch and significant price volatility, eventually stabilizing and securing its position at the forefront of the market.

Memecoin (MEME)

Major Bias: Indecision

The Memecoin market made its debut on the price chart last Friday, commencing at the $0.0008 price point and subsequently experiencing a substantial increase, eventually reaching the $0.100 price threshold. The price exhibited remarkable volatility during the initial hour of trading, with price fluctuations spanning from $0.0008 to $0.100.

Following this notable price action, the market swiftly stabilized around the $0.023 price level. Nevertheless, it subsequently witnessed a decline, reaching the $0.002 price level, resulting in a decrease of approximately 22.57% from its peak at $0.100.

At this particular price level, the Relative Strength Index (RSI) indicates an overbought market condition.

Current Price: $0.0209

Market Capitalization: $183,997,609

Trading Volume: $187,414,067

Big Time (BIGTIME)

Major Bias: Indecision

In the ever-evolving landscape of the cryptocurrency market, the Big Time market has currently secured the second position. At the outset of the week, the market witnessed a substantial price increase, surging in a bullish direction toward the $0.200 price level. As the week draws to a close, the volatile market has transitioned into a consolidation phase, maintaining a narrow price range around $0.1556.

According to various indicators, the price is currently hovering around the equilibrium level. The Relative Strength Index (RSI) indicates a market momentum of 50.15 at the current price point. However, the tightening Bollinger Bands suggest the potential for an impending price breakout.

Current Price: $0.157

Market Capitalization: $28,575,493

Trading Volume: $13,070,678

Solana (SOL)

Major Bias: Bullish

The Solana market has been experiencing a noteworthy uptrend since the second half of October. Although it had previously tested the $30 price level in mid-July, there were initial speculations that the bull market might encounter significant resistance around this level. Contrary to these expectations, the bull market swiftly transformed the resistance level into a support level, indicating its robust momentum.

Starting from the $32 price level, Solana’s market has continued to exhibit strong upward momentum, resulting in a notable increase in volatility. According to the Moving Average Convergence and Divergence (MACD) indicator, the market appears to be overbought, and a correction phase is currently unfolding, accompanied by a reduction in bullish momentum as reflected in the histogram.

It appears that the prevailing bullish sentiment will likely continue to influence the market. In the past week, Solana has recorded a gain of 27.56%, although during the correction from an overbought condition, it experienced a minor 1.28% loss.

Current Price: $41.48

Market Capitalization: $17,426,947,436

Trading Volume: $914,322,917

MultiversX (EGLD)

Major Bias: Bullish

In the past week, the MultiversX market demonstrated an exceptionally impressive bullish performance, registering a remarkable gain of 36.79% within the last 24 hours. This gain over the last 24 hours constitutes a substantial portion of the market’s overall 7-day gain, which stands at 58.50%.

The market’s hyper-bullish movement during the initial and subsequent 4-hour sessions on November 5 was particularly noteworthy. However, it is important to note that such hyper-bullish periods are often followed by significant bearish corrections. Nonetheless, the market has been successful in maintaining the price above the $45.97 support level, indicating resilience.

Currently, the trade volume indicator shows a decline in market activity, suggesting the potential for price consolidation above this level. This consolidation phase could prove advantageous for the bulls as it may strengthen the level as a reliable support.

Current Price: $47.23

Market Capitalization: $1,222,500,200

Trading Volume: $810,726,441

Akropolis (AKRO)

Major Bias: Indecision

The Akropolis market has been on an upward trend for the past two weeks, initiating from the $0.0058 price level. Despite notable market volatility, the bullish sentiment prevailed as it steadily drove the market’s value higher, eventually reaching the $0.0064 price point. However, from this juncture, a bearish market phase commenced.

The bear market gained momentum as selling pressure caused the bulls to lose ground rapidly. They ultimately regrouped at $0.0058, successfully fending off the bearish pressure and reestablishing control, thus pushing the price back to an equilibrium level.

The formation of this equilibrium level may serve to strengthen the $0.006 price level as a robust support, facilitating further upward price movements.

Current Price: $0.11198

Market Capitalization: $136,700,062

Trading Volume: $221,105,812