Bitcoin Shatters $65,000 Ceiling Amid Impressive First-Day Performance by BITO

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Newly-launched ProShares Bitcoin Strategy Exchange-Traded Fund (ETF) recorded an impressive performance on its first day, after closing the session at $41.94 per unit. Meanwhile, Bitcoin (BTC) surged dramatically because of the listing yesterday to a new record high at $67,000.

Commenting on the ProShares ETF performance, Bloomberg Intelligence analyst James Seyffart tweeted that: “Looks like the final tally is gonna be right around ~$990 million in trading for BITO on its first-day trading.”

Also, senior ETF analyst at Bloomberg Eric Balchunas shared his thoughts on the development via Twitter, stating that: “BITO just about $1 [billion] in total volume today (curr $993m but trades still trickling in).” Balchunas added that: “Easily the biggest Day One of any ETF in terms of ‘natural’ volume. It also traded more than 99.5% of all ETFs ([including] some big [ones] like DIA, ARKK, SLV). It [definitely] defied our expectations.”

The positive development helped BTC capture a market capitalization above $1.25 trillion, with global trades volume surpassing $42.4 billion on Tuesday.

Balchunas asserted that the first BTC ETF performance in the US “makes life that much harder for the next in line ETFs to succeed.” He added that: “Every day counts [because] once an ETF gets [known] as “the one” and has tons of [liquidity], it’s virtually impossible to steal (see SPY, GLD).”

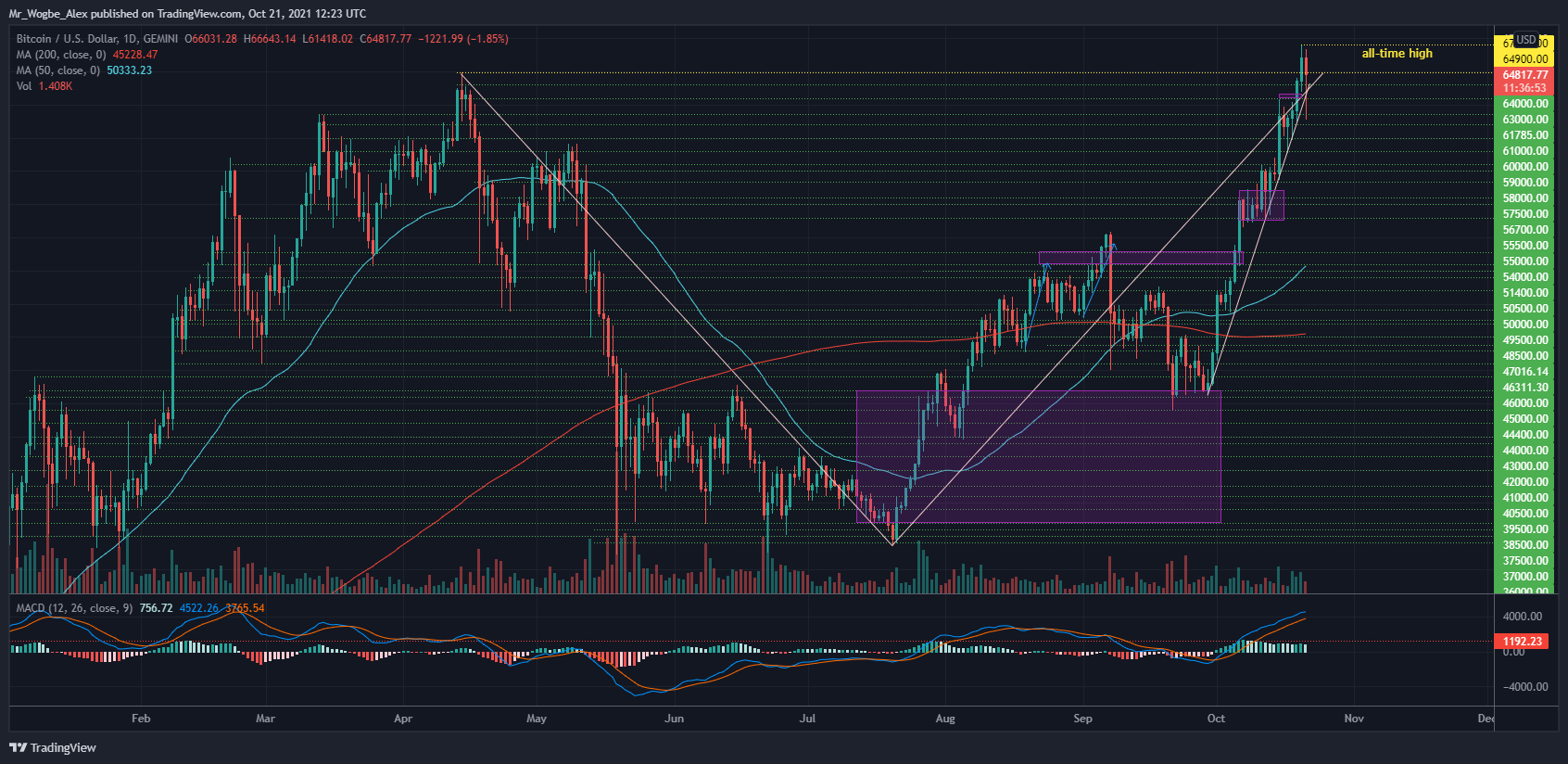

Key Bitcoin Levels to Watch — October 21

Following an aggressive full-bodied candle break above the $65,000 level to the $67,000 new ATH, BTC posted a mild drop to the $65,000 line. Earlier today, the primary cryptocurrency resumed an upward momentum to retest the new ATH but encountered immense bearish pressure near the $67,000 level, forcing a sharp correction to the $61,400 area. This correction found immediate support and bullish push from the 4-hour SMA, which pushed it back above the $65,000 level.

That said, BTC currently trades in overbought conditions and faces the possibility of another sharp correction in the near term.

Meanwhile, our resistance levels are at $66,000, $67,000, and $68,000, and our key support levels are at $64,000, $63,000, and $62,000.

Total Market Capitalization: $2.63 trillion

Bitcoin Market Capitalization: $1.22 trillion

Bitcoin Dominance: 46.4%

Market Rank: #1