Best-Managed Bitcoin IRAs

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Many investors will agree that the best time to start investing is now. However, a lot of investors aren’t aware that cryptocurrencies, such as Bitcoin and others, can be their retirement investment accounts.

What is an IRA?

This is a famous retirement investment method that has some tax benefits. IRAs are of four major types: Traditional, ROTH, STEP, and SIMPLE provide slightly varied ways of investing towards one’s retirement to elude unnecessary taxes. IRAs initially revolved around stocks and mutual funds but have been extended to crypto, gold, and real estate.

Oftentimes, people can invest up to $6,500 of their earnings into their IRA investors below the age of 50, while investors above the age of 50 can invest $7,500 in a year into their IRA. Nevertheless, IRAs aren’t very flexible because they have age-based rules governing withdrawals from them. Should an investor choose to withdraw from the IRA before the age of 59.5, such an investor will have to pay 10% of the withdrawal. Consequently, most of the IRAs work based on a “set it and forget it” orientation.

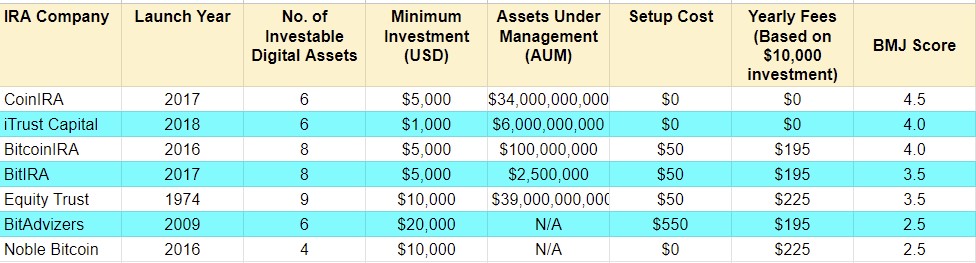

Below are some of the IRA accounts that investors can choose from.

CoinIRA

CoinIRA started in 2017, and it gives users the chance to buy and sell eighteen different types of crypto. In addition, their “flex metal” users can invest in silver, platinum, or gold. CoinIRA does not charge users any monthly storage fees; nevertheless, one needs at least $5,000 to open an account. Users are also required to pay 1.25% in trade charges. All digital assets under the care of CoinIRA are secured by Equity Trust. Equity Trust is a controlled IRS-authorized custodian.

iTrustCapital

Established in 2018, iTrustCapital allows users to trade cryptocurrency using IRA retirement accounts. iTrustCapital provides about twenty-five cryptocurrencies and access to solid silver and gold. Users arent asked to pay management or setup fees, although transaction charges are pegged at 1%. Users also need a minimum of $1,000 to open an account with iTrustCapital.

BitcoinIRA

Established in 2015, BitcoinIRA functions as a retirement asset company. The assets offered by this company include precious metals and cryptocurrency. It is quite easy to set up this account, and it provides users with the chance to buy and sell up to 60 different cryptocurrencies with up to $700 million of their property insured at Lloyds of London. The minimum amount of funds with which investors can invest with BitcoinIRA is $5,000, and they’ll have to pay $195 as annual maintenance charges. This company also charges users 2% as a transaction fee and 0.08% as a security fee.

Equity Trust

This company was established in 1974 by Richard Desich, sir. Equity Trust operates as a self-directed custodian IRA and allows users to invest in various things, such as stocks, bonds, real estate, mutual funds, and cryptocurrency. Equity Trust also has a feature that integrates other providers, such as CoinIRA and BitIRA, with its platform. Individuals who intend to set up an account with this company will have to pay $50 and $75 for both online and paper registrations. Equity Trust also charges users a yearly maintenance fee of between $225 and $2,250 based on their account balance.

Why Should I Invest in an IRA?

IRAs have tax advantages, and they help people, especially Americans, save towards their retirement. The bedrock for financial security usually starts with baseline accounts such as IRAs. Nevertheless, IRAs should not be the only source of income for retirement.

The yearly return on an IRA investment is 710%; nevertheless, this can be increased by including highly productive assets like Bitcoin and blue-chip cryptocurrencies. As a result of limitations on earned income, contribution limitations, and contribution restrictions, it is best to leave an IRA investment untouched until the age of approximately 60.

Should Include Bitcoin in my Retirement Investment Funds?

It is widely known that electronic assets have more risks than mutual funds, stocks, and bonds. Taking on, for example, a Bitcoin IRA usually comes with more risks than the usual IRA. However, this is done to generate more returns. Consequently, it is required that an investor do a great deal of research before taking on a Bitcoin IRA as his or her only retirement fund. How profitable or successful a Bitcoin IRA depends on how well cryptocurrency is adopted in the future.

To Investors

Although bitcoin IRAs are still a relatively new financial product, there are some ways shrewd cryptocurrency investors might benefit from them. To do this they’ll have to Consider utilizing capable service providers, paying attention to costs, setting aside a maximum of 10% of their IRA investment for cryptocurrency, and buying reputable cryptocurrency assets