Bitcoin Reserves on Exchanges Hit Multi-Week Low as Investors HODL

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a clear sign of long-term bullish sentiment, Bitcoin investors are swiftly transferring their holdings from exchanges to cold storage, significantly reducing the supply pressure on the market.

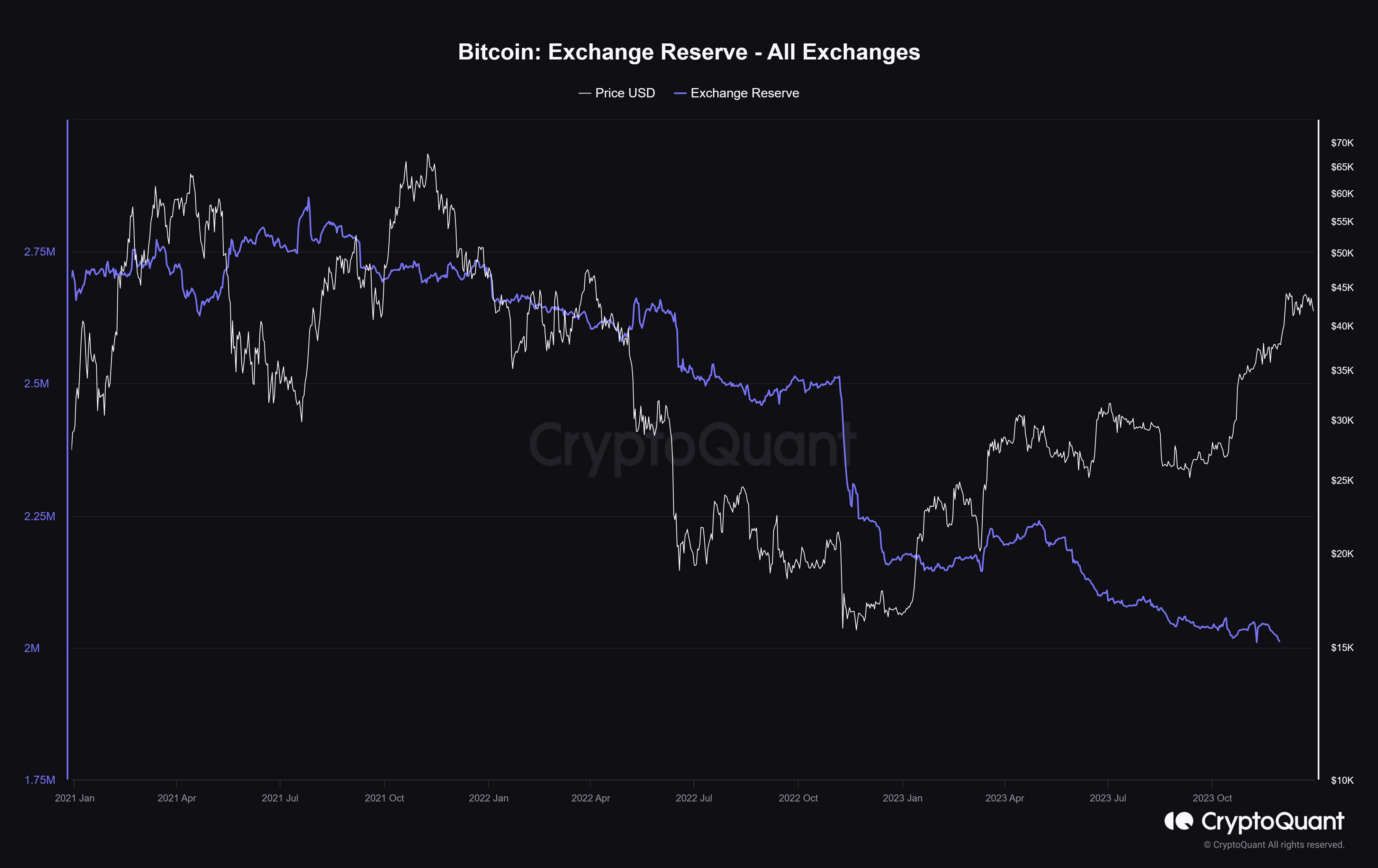

Recent data from CryptoQuant, a leading blockchain analytics platform, reveals that the total amount of Bitcoin on major centralized exchanges has plummeted to just over 2 million coins, marking the lowest level in several weeks.

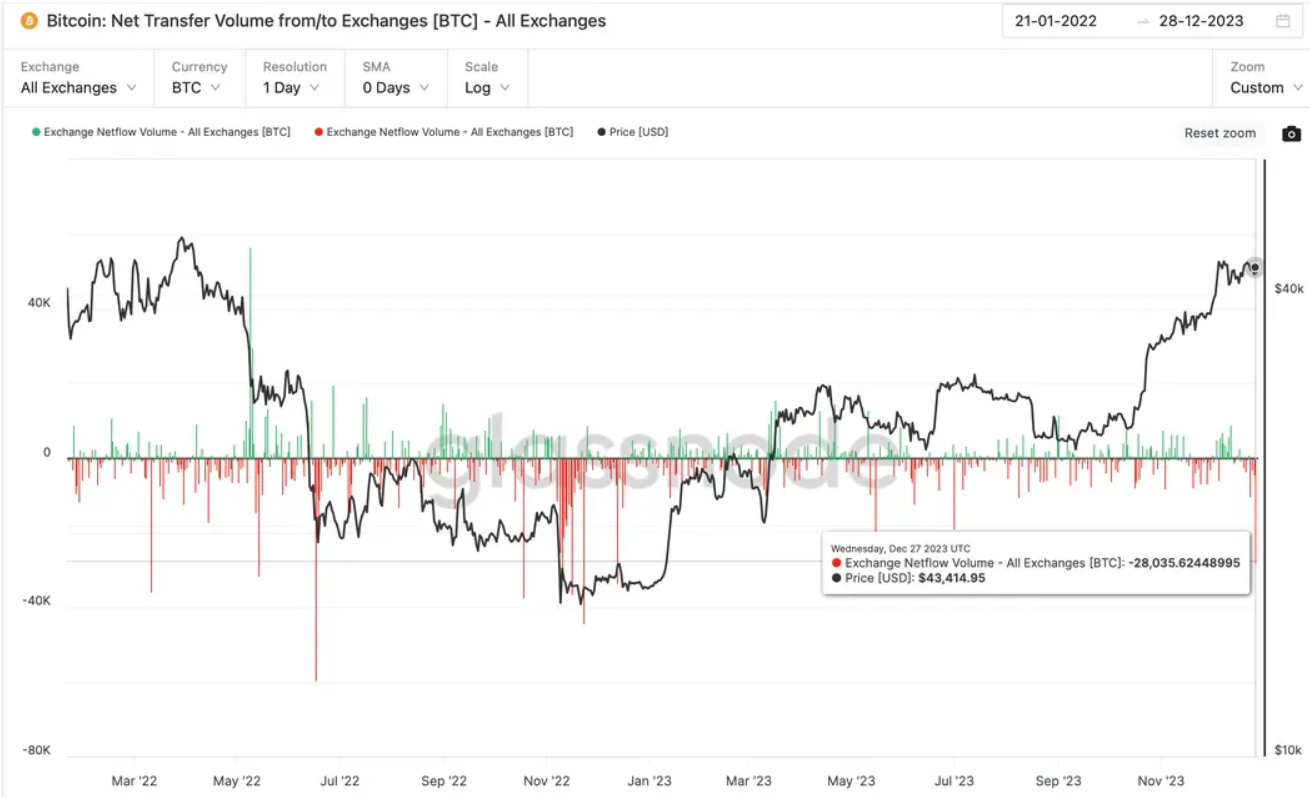

The notable decline in exchange reserves is attributed to a substantial outflow of over 33,000 bitcoins within the past 24 hours. Coinbase, a prominent exchange platform, alone witnessed a staggering loss of over 19,000 bitcoins from its wallets.

According to CryptoQuant, this marks the largest single-day outflow from Coinbase since January 2023.

Bitcoin HODLing Recorded All Through 2023

This trend of shifting bitcoins from exchanges to cold storage has been a consistent theme throughout the year, reflecting investors’ growing confidence in the digital asset’s long-term value.

The surge in Bitcoin’s price, boasting a remarkable 151% year-to-date increase, coupled with the mounting anticipation of the imminent approval of spot Bitcoin ETFs in early January, has further fueled this movement.

CryptoQuant’s data indicates a reduction of approximately 200,000 coins in Bitcoin exchange reserves since the beginning of the year, when levels hovered around 2.3 million coins. This shift underscores the increasing inclination among investors to hold their coins for the long term rather than engage in short-term trading on exchanges.

With fewer coins available on exchanges, the market experiences diminished supply pressure, paving the way for potential price appreciation.

Despite Bitcoin’s current trading value of $41,800, which is 7% lower than its recent local high of $44,800 earlier this month, the overall trend suggests a positive outlook as investors gear up for the new year.