Bitcoin Options Signal Market Optimism Amidst Record Highs

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The world of cryptocurrency is buzzing with excitement over the latest trends in Bitcoin options, which are currently indicating a bullish sentiment among traders. This optimism stems from the strategic positioning of options strikes and the revealing put-call ratio as March comes to a close.

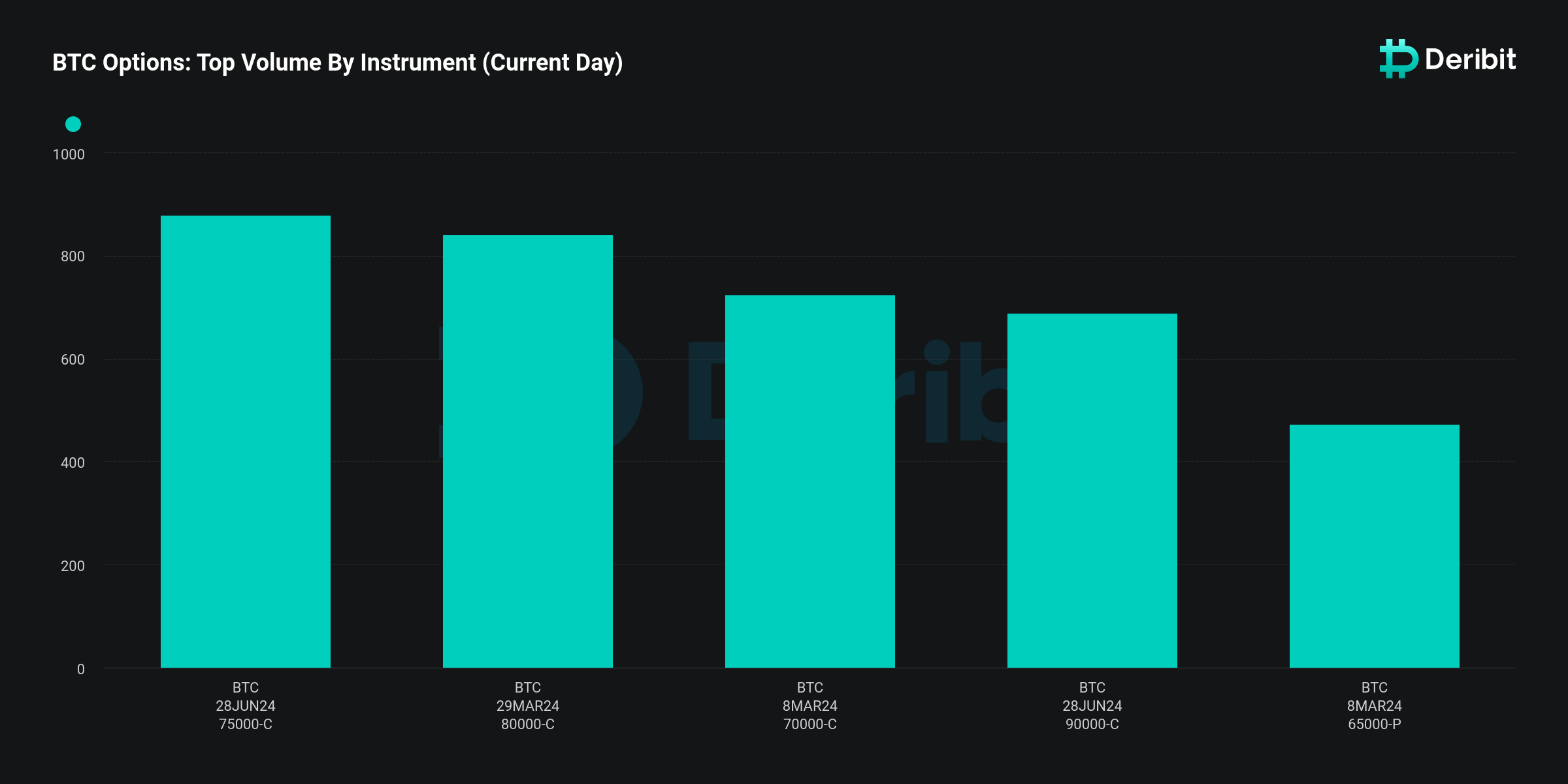

Jag Kooner, the Head of Derivatives at Bitfinex, has noted a significant increase in trading volume for call options with a strike price of $70,000. This surge in trading activity aligns with Bitcoin’s recent climb to a new all-time high, indicating a strong belief in the cryptocurrency’s continued growth.

The concentration of these calls is particularly evident on Deribit, the world’s largest Bitcoin options platform, for both weekly and monthly expiries.

The put-call ratio, a reliable indicator of market sentiment, has consistently remained below 0.6 for the first time in six months, with an even more bullish 24-hour ratio at 0.47. A ratio below 1 suggests that traders are more inclined to bet on Bitcoin’s potential rise rather than its fall.

Additionally, the recent decrease in implied volatility in the options market indicates a calmer outlook among traders. This shift has led to a decline in option premiums across all strike prices, making it more cost-effective for traders to establish positions. The implied volatility index for Bitcoin on Deribit has notably decreased from 77% to 72% within 24 hours, according to The Block.

What Are Bitcoin Options?

Options are financial derivatives that grant traders the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin at a set price before a specified date. The current trend toward call options suggests that traders are optimistic about the market’s future performance.

As of the time of this writing, Bitcoin was trading around the $68,000 mark as traders braced for a return to the $69,200 peak in the near term.

Interested in learning how to day trade crypto? Get all the information you need here