U.S. Spot Bitcoin ETFs Surge in Trading Volume Amid Market Volatility

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

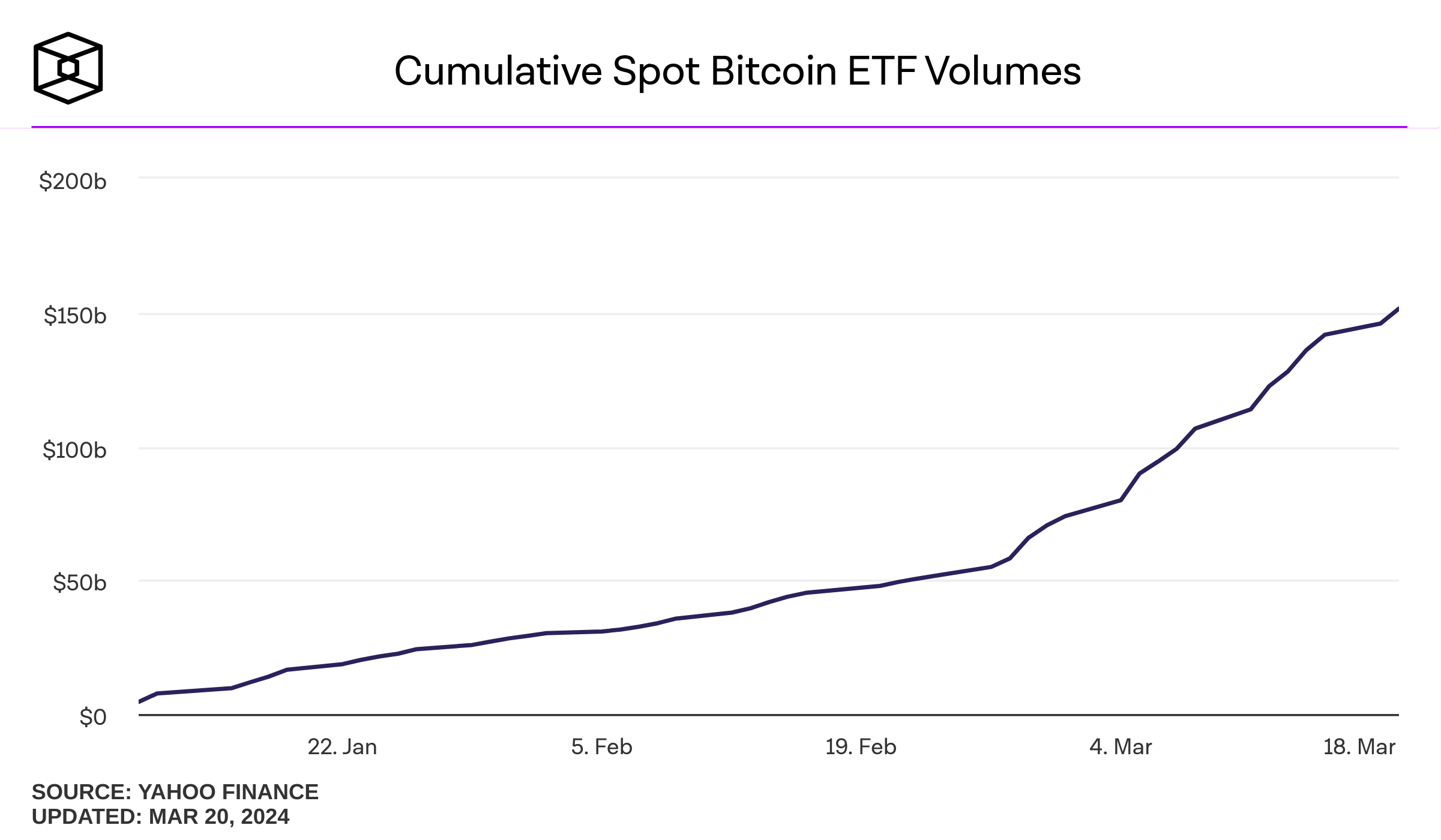

In a dramatic financial development, U.S. spot bitcoin exchange-traded funds (ETFs) have achieved a milestone, surpassing a cumulative trading volume exceeding $150 billion. This surge occurred in less than ten weeks following the Securities and Exchange Commission’s approval of ETFs from industry giants such as BlackRock, Fidelity, and Bitwise.

The trading landscape has undergone a significant transformation, with a $50 billion surge in spot bitcoin ETF cumulative trading volume since March 8, reaching $151.4 billion by the close of trading yesterday. Leading the charge was BlackRock’s IBIT, with a remarkable $2.5 billion in trades, followed by Grayscale’s GBTC and Fidelity’s FBTC, which saw $1.5 billion and $962 million, respectively.

Market dynamics have shifted, with Grayscale’s GBTC experiencing a decline in market share by trading volume, dropping from 50.5% at the launch of spot bitcoin ETFs on January 11 to 26.5%. In contrast, BlackRock’s IBIT has emerged as the primary beneficiary, with its market share soaring from 22.1% to 45.2%. Fidelity’s FBTC maintains its position in third place, commanding a 17.2% market share.

A record-breaking net outflow of $326.2 million from U.S. spot bitcoin ETFs was recorded yesterday, surpassing the previous high of $158.4 million set on January 24. Grayscale’s GBTC alone witnessed outflows of $443.5 million on Tuesday, following Monday’s record outflow of $642.5 million.

Bitcoin ETF Flow – 19 March 2024

All data in. Record net outflow of $326m pic.twitter.com/iBmBiMR74Z

— BitMEX Research (@BitMEXResearch) March 20, 2024

Nate Geraci, President of The ETF Store, highlighted the unprecedented scale of these outflows, comparable to the market conditions seen since the March 2009 stock market low.

Other funds also experienced the impact, with BlackRock’s typically dominant ETF plummeting from $451.5 million on Monday to a mere $75.2 million. Fidelity’s FBTC and Bitwise’s BITB followed suit with $39.6 million and $2.5 million, respectively.

Brian Rudick, a research analyst at GSR, noted that the flows of spot bitcoin ETFs have significantly influenced bitcoin’s price movements since their introduction.

Bitcoin Records Rollercoaster Ride

The market has been particularly volatile, with bitcoin’s price dropping 10% from a peak of $73,797 to $61,507 before briefly dipping to $60,780 earlier today and then recovering. All this within a week.

As of this writing, bitcoin is trading at $63,350, marking an impressive 50% increase year-to-date, demonstrating the cryptocurrency’s resilience amid fluctuating market conditions.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here